PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549797

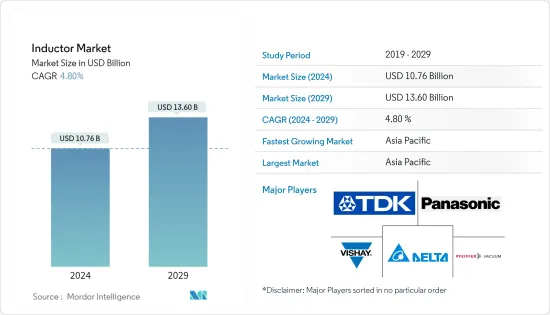

Inductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Inductor Market size is estimated at USD 10.76 billion in 2024, and is expected to reach USD 13.60 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

The inductor market has seen a significant rise in importance, driven by technological advancements and increasing applications across various industries. Inductors, which are crucial components in electrical circuits, primarily serve the purpose of energy storage within a magnetic field. Their extensive use in sectors such as automotive, aerospace, communications, and consumer electronics highlights their indispensable role. The market's evolution has been shaped by innovations in inductor technology, especially in response to the growing demand for energy-efficient systems and miniaturized electronic devices. Several factors, including supply chain complexities, material costs, and rapid technological advancements, influence the dynamics of this market.

Innovation Surge in Consumer Electronics

Key Highlights

- Rapid Technological Advancements: The swift pace of innovation in consumer electronics is a pivotal factor shaping the inductor market. As devices become more compact and sophisticated, the demand for smaller, more efficient inductors has escalated. This trend is particularly evident in the proliferation of smartphones, tablets, wearables, and other portable devices, all of which require high-performance components for optimal functionality. Furthermore, the rise of smart home devices and IoT (Internet of Things) applications has significantly increased the need for advanced inductors. The integration of these components into consumer electronics ensures improved energy efficiency, better power management, and enhanced overall performance.

- Miniaturization and Efficiency: The push towards smaller, more powerful devices has driven substantial advancements in inductor design and manufacturing processes. High-frequency inductors are now being developed to meet the specific needs of modern electronics, allowing for more compact circuit designs without compromising performance. This trend underscores the market's focus on delivering compact, efficient components that align with the industry's demand for miniaturization.

- IoT and Smart Devices: The increasing adoption of IoT devices presents new opportunities for inductor manufacturers. These devices, which often operate on low power, require components that manage power efficiently, making inductors a critical part of their design. The expanding IoT ecosystem continues to drive the demand for energy-efficient inductors that can support the low-power requirements of these devices.

- Energy Efficiency: As consumers and regulators alike demand more energy-efficient products, manufacturers are focusing on developing inductors that contribute to lower power consumption. This is especially important in battery-powered devices, where efficient power management is crucial. The emphasis on energy efficiency in inductor design is a key trend that aligns with broader industry movements towards sustainability and reduced energy usage.

Growing Demand for Energy-Efficient Systems

Key Highlights

- Automotive Sector: The automotive industry's shift towards electric vehicles (EVs) has significantly increased the demand for high-efficiency inductors. These components are essential in various power electronic systems within EVs, including onboard chargers, DC-DC converters, and inverters. Inductors play a crucial role in optimizing power conversion and managing energy more effectively, which is vital for extending battery life and enhancing vehicle performance. The growing adoption of EVs continues to drive demand for advanced inductors that can meet the stringent efficiency requirements of automotive applications.

- Renewable Energy Systems: The expansion of renewable energy systems, such as solar and wind power, also propels the demand for efficient inductors. These systems rely heavily on power electronics to convert and manage energy, with inductors serving as key components in ensuring efficient energy transfer and minimizing losses. The push towards renewable energy aligns with the industry's focus on sustainability and the development of energy-efficient technologies.

- Industrial Automation: The move towards automation and smart manufacturing processes in industrial settings has led to an increased need for inductors capable of handling higher power levels while maintaining efficiency. As industries adopt more sophisticated automation technologies, the role of inductors in ensuring reliable and efficient operation becomes increasingly critical. The demand for high-performance inductors in industrial applications reflects the broader trend of automation and digital transformation across various sectors.

Inductor Market Trends

Automotive Industry Segment is Expected to Register Significant Growth

- High-Frequency Inductors Poised for Rapid Expansion: The global inductor market is poised for substantial growth, particularly in the high-frequency inductor segment. As industries such as telecommunications, automotive, and consumer electronics increasingly adopt advanced technologies like 5G, electric vehicles (EVs), and advanced driver-assistance systems (ADAS), the demand for high-frequency inductors is expected to surge. These components are essential for ensuring optimal performance in high-speed, high-efficiency electronic devices, making them a critical focus area for industry players.

- Technological Advancements Driving Growth: The growth in the high-frequency inductor market is significantly driven by ongoing advancements in manufacturing processes and materials. These innovations enhance the performance, durability, and reliability of inductors, making them more suitable for demanding applications. The power inductor segment, which includes high-frequency inductors, is particularly crucial in power management applications across various sectors, further driving market growth.

- Innovations in Inductor Design: As demand for compact and efficient components rises, suppliers are increasingly focused on developing innovative inductor designs. These advancements are reshaping the competitive landscape, with key players investing heavily in research and development to maintain a competitive edge. The trend towards miniaturization, particularly for applications in small communication devices like smartphones and wireless modules, is also driving this innovation, contributing to the overall growth of the market.

- Price Trends and Market Dynamics: The rising demand for high-frequency inductors is influencing price trends, with fluctuations in raw material costs and manufacturing processes potentially impacting the market. However, economies of scale and improvements in manufacturing technologies are expected to help stabilize prices, making these inductors more accessible across various industries. The overall market outlook for high-frequency inductors remains positive, with significant growth opportunities driven by technological advancements and increasing demand.

Asia-Pacific Region is Expected to Dominate the Market

- Booming Electronics Industry: The Asia-Pacific region is expected to dominate the global inductor market, registering the highest growth rate due to its thriving electronics industry. Countries such as China, Japan, and South Korea are leading this growth, driven by substantial investments in semiconductor manufacturing, consumer electronics, and the automotive sector. The region's strong manufacturing base and the presence of key inductor suppliers provide a competitive advantage, enabling it to meet growing global demand efficiently.

- Adoption of Advanced Technologies: The rapid adoption of advanced technologies such as 5G, IoT, and electric vehicles is fueling demand for inductors in the Asia-Pacific region. Industry data indicates that the market size for inductors in this region is expanding rapidly, with power and high-frequency inductors playing a critical role in supporting the region's extensive telecommunications infrastructure and automotive industry. The growth of electric and hybrid vehicles in the region is particularly driving the demand for these components.

- Focus on Innovation and Sustainability: Increased investment in research and development is a key factor driving the inductor market in Asia-Pacific. Local companies are at the forefront of developing new inductor types and applications, enhancing the region's market share. The focus on sustainable manufacturing practices and the development of energy-efficient inductors aligns with global trends towards sustainability, further boosting the market outlook.

- Strong Market Forecast: The Asia-Pacific region's strong market forecast is supported by its leadership in electronics manufacturing and technological innovation. As the region continues to innovate and integrate advanced technologies, the demand for inductors is expected to rise, driving market growth and solidifying Asia-Pacific's position as a global leader in the inductor market. The region's focus on smart city initiatives and the growing automotive sector further contribute to this positive market trajectory.

Inductor Industry Overview

Highly Fragmented Market: The inductor market is highly fragmented, with numerous global and regional players contributing to a competitive landscape. The market lacks clear dominance by any single company, with competition spread across multiple firms, both large and small. The presence of conglomerates such as Panasonic Corporation and Murata Manufacturing Co., Ltd., alongside specialized companies like Coilcraft Inc. and Sumida Corporation, illustrates the diverse nature of the market. This fragmentation suggests that no single company holds a substantial market share, leading to intense competition and opportunities for differentiation.

Market Leaders with Diverse Offerings: Leading companies like TDK Corporation, Vishay Intertechnology Inc., and Pulse Electronics (a subsidiary of YAGEO Company) play pivotal roles in shaping the global inductor market. These firms have established themselves through extensive product portfolios, innovation, and strategic acquisitions. TDK Corporation and Murata Manufacturing Co. Ltd. are known for their significant R&D investments, allowing them to maintain a competitive edge. Meanwhile, companies like Delta Electronics and Taiyo Yuden Co., Ltd. leverage their technological expertise and global presence to cater to a broad range of industries, including automotive, consumer electronics, and telecommunications.

Strategies for Future Success: In the highly competitive inductor market, companies are focusing on innovation, quality enhancement, and strategic partnerships to stay ahead. Trends such as miniaturization, increased efficiency, and the integration of inductors into complex electronic systems are crucial for maintaining relevance. Companies that can continuously innovate, adapt to new industry standards, and meet the growing demand for compact, high-performance inductors are likely to thrive. Additionally, expanding into emerging markets and industries with growing inductor demand will be a key strategy for sustaining growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Innovations in Consumer Electronics Products

- 5.1.2 Growing Demand for Energy Efficient Electrical and Electronic Systems

- 5.2 Market Restraints

- 5.2.1 Rising Cost of Raw Materials, Especially Copper

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Power

- 6.1.2 Frequency

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace and Defense

- 6.2.3 Communications

- 6.2.4 Consumer Electronics and Computing

- 6.2.5 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TDK Corporation

- 7.1.2 Vishay Intertechnology Inc.

- 7.1.3 Panasonic Corporation

- 7.1.4 Delta Electronics

- 7.1.5 Pulse Electronics (YAGEO Company)

- 7.1.6 Sagami Elec Co. Ltd

- 7.1.7 Taiyo Yuden Co. Ltd

- 7.1.8 TE Connectivity Limited

- 7.1.9 Murata Manufacturing Co. Ltd

- 7.1.10 Sumida Corporation

- 7.1.11 Coilcraft Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET