PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693701

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693701

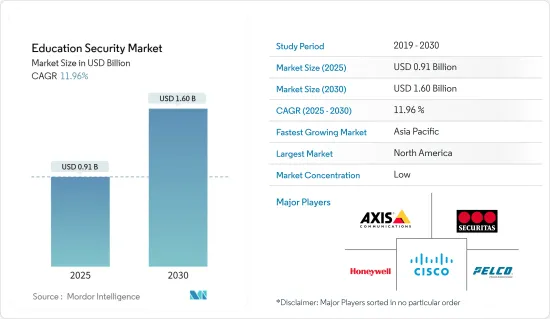

Education Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Education Security Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.60 billion by 2030, at a CAGR of 11.96% during the forecast period (2025-2030).

Security systems are designed to protect students and teachers from diseases, fires, harassment, theft, aggression, and attacks from internal and external forces. More security spending is needed to develop technology innovation in education facilities. Video surveillance systems are affordable and provide real-time information. In case of significant security incidents, these solutions alert the nearer law enforcement offices to protect students and staff and handle routine discipline issues.

Significant differences in the structure of educational establishments in different countries affect the approach and support for violence prevention and intervention. Substantial differences also exist in the level of student and teacher learning standards, quality of teaching, support for teachers, and infrastructure across countries with development, poverty, or underdeveloped status. Moreover, the increase in the market for education safety is driven by a variety of security systems and services.

Moreover, the education sector has witnessed a significant transformation in recent years, driven by the increased awareness of the need for robust security measures in schools, colleges, and universities. With safety becoming a top priority, educational institutions increasingly use advanced security solutions to protect students, staff, and property. In addition, the growing government aid to boost education security growth and the increasing expansion of infrastructure are set to strengthen the security systems and significantly contribute to the market's growth during the forecast period.

For instance, in February 2024, the University of Georgia announced new campus security measures worth USD 7.3 million. The package includes a 20% budget increase for the police department to increase officer recruitment and retention through more competitive salaries. The package also includes additional security cameras and lighting, additional license plate readers, and the implementation of a Blue Light Call System.

Procurement costs and privacy concerns related to public surveillance significantly restrain the growth of the Education Security Market. The market is expected to overcome these challenges only by implementing a well-balanced approach.

The pandemic had a negative impact on the market, with several education institutions shut down globally. However, in the recovery, education security served additional purposes, and in the post-COVID-19 environment, the demand for automated solutions in education security has risen. The growing construction of education facilities globally to recover from the impact of COVID-19 is analyzed to positively impact the market growth rate during the forecast period.

Education Security Market Trends

Higher Education Facilities are Expected to Witness Major Growth

The need for identity access management and visitor management systems, among others, is gaining traction in higher education campuses, creating market growth opportunities.

Market vendors, such as Identisys, Honeywell, and Pelco Products Inc., provide customized solutions to universities and colleges designed for their unique needs, driving the market adoption of education security solutions. For instance, IdentiSys, an education security solution provider, offers customized security systems, streamlined identification processes, advanced access control, integrated visitor management, and mobile credentials for university campuses.

Additionally, market vendors are introducing advanced technologies, such as mobile credential solutions to allow students and staff to use their smartphones for virtual ID cards and access keys, eliminating the need for physical cards and enhancing security through multi-factor authentication, driving the market growth of educational security solutions in higher educational institutions due to its ease in providing digital access control system.

For instance, Amity University implemented security solutions through smart cards, biometric readers, IP cameras, and fire warning systems, which shows the need for education security solutions on campuses. Additionally, students carry a chip-enabled smart card to access the campus, which can be used as an e-wallet in the cafeteria, book shops, etc., easing the security needs of the campus, students, and staff and fueling the market growth.

System integration and management services are driving the educational security market in higher education departments due to the need for integrated security solutions and an open-source platform to simultaneously manage all the IoTs installed on university premises for better management. This service offers a single dashboard solution to the user to control, monitor, and manage their security needs, which can be customer-managed and vendor-managed.

The higher education sector's market for education security solutions has been registering significant technological advancement and integrating artificial intelligence (AI)-enabled solutions to manage and detect security risks, supporting market growth.

North America is Expected to Hold Significant Market Share

The education security market in North America is primarily driven by the increased demand for security owing to the increased shooting attacks in schools in the past few years, construction of new primary and higher education facilities, growth in the education budget coupled with innovative solutions launches by the market vendors operating in the region. Additionally, the region is home to some of the major players, such as Cisco Systems Inc. and Honeywell Security Group, which further expand the education security market in the region.

The United States and Canada have experienced the highest growth in the region's campus and school security market, primarily because of rising education security spending caused by high construction costs for educational facilities and increased demand for surveillance cameras. Various schools and higher education institutions in the country are upgrading their security measures by investing substantial funding. This, in turn, drives the growth of the education security market in the region.

For instance, in January 2024, Pennsylvania schools were entitled to USD 155 million in safety and security funds - USD 90 million of which is earmarked for new investments in mental health counselors and resources. School safety funding is a top priority for Governor Josh Shapiro and was included in the state budget for the 23-24 school year. The School Safety and Security funding is made available through the Pennsylvania Commission (PCCD) through the School Safety and Security (SS&S) Committee. PCCD has approved a funding framework that allows schools to leverage over USD 155 million dollars in federal and state funding for a variety of investments.

Furthermore, the region's ongoing infrastructure development and construction activities are expected to create growth opportunities for adopting security solutions for the security of newly constructed educational facilities. For instance, in February 2024, AUCSO announced a partnership with ISARR, A Customized Risk, Resilience and Security Management Solution, to collect critical benchmarking data for its members. This partnership builds on the existing relationship between ISARR and AUCSO (ISARR has been a major supporter of AUCSO over the past four years).

Further, with a greater focus on physical security systems, it's becoming vital that educational facilities implement school and college campus security solutions that can allow authorized individuals onto their sites and keep unauthorized individuals out. Education authorities in the country are investing heavily to expand educational institutions' video surveillance systems, access control systems, and door-locking systems.

Therefore, the North American market is analyzed to hold a significant share in the education security market owing to the growing product launches, increasing school security funding by the government and educational authorities, and growth in educational facilities construction across the region.

Education Security Market Overview

The Education Security market features key players such as Cisco Systems Inc., Honeywell International Inc., Axis Communications AB, and Genetec Inc. These market leaders have successfully set themselves apart by implementing various strategies to enhance functionality. These strategies include remote access, wireless capabilities, strategic partnerships (offering additional services, benefits, product bundling, and distribution), and providing deeper discounts. As a result, these vendors have significantly differentiated their offerings in the market.

The strength of their brand identity is closely tied to their influence in the market. Established brands are synonymous with high performance, so long-standing players are anticipated to maintain a competitive advantage. Due to their extensive market reach and capacity to offer advanced products, the competitive rivalry in this sector is expected to remain intense.

February 2024: OmnilERT launched its 3rd generation AI Visual Gun Detection System. This state-of-the-art system is packed with cutting-edge innovations designed to take the industry to the next level with Omnilert's visual gun detection solution. As the only solution to deliver the combination of Detection, Verification, Activation and Notification Omnilert Gun Detect now secures hundreds of thousands of school, college, and hospital campuses, as well as retail and commercial properties and other organizational facilities and campuses.

April 2024: Bosch's gun detection system combines video and audio AI with a multi-tiered approach to detect guns at school entrances. When someone brandishing a gun walks into a school's entrance, the system's two Flexidome cameras, equipped with IVA PRO visual gun detection, immediately notify school staff. If a gun isn't visible, the second layer, the Flexidome panorama 5100i camera, with intelligent audio analytics, detects and classifies the shot while accurately predicting the direction from which it came. The near-infrared camera-based system enhances safety while providing a smooth flow and welcoming environment to support learning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Real-time Surveillance

- 5.1.2 Growing Demand for Cost-effective security solutions and significant Infrastructure Developments

- 5.2 Market Restraints

- 5.2.1 The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Guarding

- 6.1.2 Pre-Employment Screening

- 6.1.3 Security Consulting

- 6.1.4 Systems Integration & Management

- 6.1.5 Alarm Monitoring Services

- 6.1.6 Other Private Security Services

- 6.2 By Facilities

- 6.2.1 Primary & Secondary Facilities

- 6.2.2 Higher Education Facilities

- 6.2.3 Other Educational Facilities

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Honeywell International Inc

- 7.1.3 Pelco Inc. (Motorola Solutions Inc.)

- 7.1.4 Securitas Technology (Securitas AB)

- 7.1.5 Axis Communications AB

- 7.1.6 Genetec Inc.

- 7.1.7 Verkada Inc.

- 7.1.8 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.9 Silverseal Corporation

- 7.1.10 Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- 7.1.11 SEICO Inc.

- 7.1.12 AV Costar

- 7.1.13 Kisi Incorporated

- 7.1.14 Siemens AG

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET