PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910716

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910716

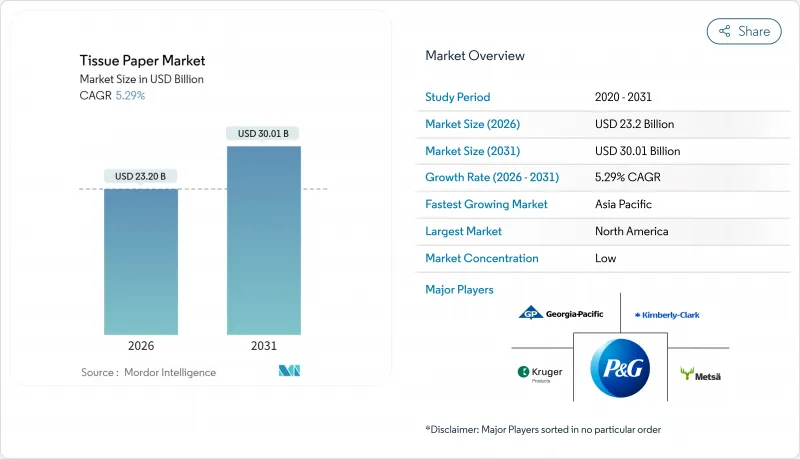

Tissue Paper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global tissue paper market was valued at USD 22.03 billion in 2025 and estimated to grow from USD 23.2 billion in 2026 to reach USD 30.01 billion by 2031, at a CAGR of 5.29% during the forecast period (2026-2031).

This expansion shows the tissue paper market's ability to absorb elevated fiber and energy costs while sustaining consumer demand. Large integrated mills have committed more than USD 3 billion to new capacity and acquisitions since 2024, underscoring confidence in steady long-term consumption. North American producers are modernizing lines with through-air-dried (TAD) technology that cuts manual operations by 85%, whereas Asia-Pacific converters scale recycled-fiber grades to meet urban hygiene needs. Regulatory pressure- from the EU Packaging and Packaging Waste Regulation (PPWR) to the EU Deforestation Regulation (EUDR)- is reshaping sourcing and packaging strategies but simultaneously creating niches for certified, traceable products. On the demand side, the commercial reopening of offices, schools, and HoReCa outlets is lifting the away-from-home channel and shifting the mix toward higher-margin towel and napkin formats.

Global Tissue Paper Market Trends and Insights

Growing Hygiene and Sanitation Expenditure

Escalating public-health awareness is translating into sustained tissue usage. National programs such as India's Swachh Bharat Mission have delivered toilet access to 100 million rural households, changing hygiene habits and adding new volume to the tissue paper market. Institutional buyers likewise raise specifications: randomized trials in schools prove disposable wipes reduce contamination more effectively than traditional solutions, reinforcing demand for wet-strength toweling. Healthcare facilities champion antibacterial seat covers, a subcategory projected to reach USD 602.5 million by 2028, while commercial cleaning services valued at USD 117 billion in 2025, embed daily paper-based protocols. As hygiene budgets expand, producers with FSC and Green Seal portfolios capture procurement preference across hospitals, airports, and universities.

Rapid Away-from-Home Reopening Post-COVID

Return-to-office mandates and restored HoReCa footfall are reviving away-from-home consumption. In the United States, federal agencies reported toilet-paper stock-outs during the first quarter of 2025, exposing deferred procurement and triggering expedited contracts. European converters such as Lucart generated EUR 765 million (USD 817 million) in 2024 on the strength of AfH towels and napkins produced from recycled fibers, illustrating the channel's rebound. Food-service operators, responsible for 27.5% of total food waste, are adopting premium napkins to support cleaner presentation, thereby nudging overall value per kilogram higher. Manufacturers are collaborating with facility managers to install smart dispensers that cut overuse and provide real-time refill alerts, turning hygiene into a data-driven service offering.

Volatile Virgin Pulp Prices

Sharp swings in Northern Bleached Softwood Kraft and eucalyptus pulp have tightened tissue producer margins, forcing some mills to accelerate fiber-substitution trials. The closure of older fluff-pulp lines in the United States adds further supply uncertainty, encouraging converters to hedge inventories or lock multiyear contracts. Hardwood's shorter fiber length enhances softness, yet the widened price spread versus softwood raises cost-mix questions for premium bath tissue. Producers are experimenting with bamboo and wheat straw to diversify inputs, but large-scale availability remains nascent. Mill downtime planning and procurement analytics thus become critical disciplines in safeguarding profitability.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Additions of Large Integrated Paper Mills

- E-Commerce-Led Private-Label Tissue Boom

- ESG Backlash Over Deforestation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bleached Softwood Kraft Pulp accounts for nearly half of the tissue paper market size in 2025, sustaining premium strength and absorbency levels demanded by luxury bathroom and facial grades. Yet recycled fiber is posting the fastest climb, growing at a 6.34% CAGR as converters respond to EUDR scrutiny and brand owners' circular-economy pledges. Several European lines now integrate through-air-dried technology that elevates recycled sheets to near-virgin softness, blurring historical quality gaps. The tissue paper market share for alternative fibers such as bamboo remains in single digits but garners interest from niche eco-labels seeking deforestation-free claims. Hardwood kraft pulp supplements softwood in layered ply structures to improve hand-feel without spiking furnish cost, while high-yield chemithermo-mechanical pulp caters to value-tier napkins and away-from-home rolls.

Recycled fiber's rise also dovetails with brand-owner packaging shifts. As consumer-goods companies pivot toward paper-based wraps to satisfy plastic-free targets, collection rates of post-consumer corrugated and folding boxboard increase, enhancing furnish availability for tissue furnish. Mills that bolt on de-inking units target these streams, capturing cost savings and lowering scope-3 carbon footprints. Over the forecast horizon, recycled furnish penetration is set to temper virgin pulp exposure, giving risk-diversified suppliers a stronger negotiating hand.

Bathroom rolls held 57.90% of the tissue paper market share in 2025, owing to entrenched household habits and pandemic-era pantry stocking. Even so, paper towels exhibit the highest trajectory at a 6.73% CAGR, buoyed by commercial facilities' elevated surface-wiping standards and household substitution away from textile dishcloths. The tissue paper market size for towels receives an added lift from TAD capacity that delivers plush, cloth-like textures prized in premium kitchen segments. Facial tissues cling to relevancy through lotion-infused and antiviral variants, while paper napkins benefit from HoReCa refurbishment, where operators upgrade to thicker emboss patterns for upscale presentation. Specialty tissue, wrapping, interleaving, and MG paper remain a boutique but profitable corner, serving confectionery, apparel, and fresh-produce niches.

Within bathroom tissue, brands are layering odor-neutralizing cores and biodegradable wet-wipe companions to differentiate beyond sheet count. Smart dispensers in airports and stadiums optimize roll changeovers and feed digital dashboards, fusing product with service. Towels, meanwhile, are migrating to sustainable packaging: plastic film overwraps are being replaced by molded-fiber belly bands that double as shelf signage, reinforcing the hygiene-and-eco dual value proposition.

The Tissue Paper Market Report is Segmented by Raw Material (Bleached Softwood Kraft Pulp, Birch Hardwood Kraft Pulp, High-Yield Pulp, and More), Product Type (Bathroom Tissue, Paper Towels, Facial Tissues, and More), End-User Industry (Residential, Horeca, Healthcare Facilities, and More), Distribution Channel (Online Sales, and Offline Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributes 37.95% of global revenue, reflecting high per-capita usage and consolidation benefits among integrated players. Recent headline investments, such as Kimberly-Clark's USD 2 billion expansion and Georgia-Pacific's fully automated Green Bay line, signal a renewed commitment to domestic capacity that tempers import reliance. The region's institutional segment should regain pre-pandemic throughput by 2026 as federal and private employers ratchet up office attendance targets. Through-air-dried towel grades continue to outperform, capturing share from two-ply kitchen rolls as consumers equate a cloth-like feel with superior absorbency and hygiene.

Asia-Pacific delivers the steepest growth, clocking an 7.66% CAGR toward 2031. India aims to consume 30 million tons of paper by March 2027 on the back of e-commerce packaging and FMCG expansion. Chinese converters chase efficiency gains through 70% digitalization targets by 2025, with intelligent process controls trimming waste in sheet caliper and basis-weight variation. Investments in hardwood pulp capacity across Latin America disproportionately favor Asian buyers, cementing intercontinental supply linkages. Rising urban disposable incomes propel premium bathroom and facial grades, while rural programs offer vouchers for basic hygiene products, broadening the consumption base.

Europe faces a twin challenge: stringent environmental statutes and stagnant demographic growth. PPWR and EUDR compliance compels mills to overhaul traceability systems and recycle streams. Companies with vertically integrated forestry assets gain structural advantage, whereas mid-size converters must forge closer ties with certified plantation partners. Still, away-from-home recovery across tourism-heavy southern economies should revive towel and napkin demand. Latin America, meanwhile, leverages cost-competitive eucalyptus plantations to solidify its role as the world's net pulp supplier, exporting surplus to North America and Asia.

In the Middle East and Africa, currency volatility and lower disposable incomes temper uptake, yet national drives, such as Kenya's circular-economy initiatives that recycle 22 million trees' worth of waste paper, create localized momentum. Premium hotel construction in Gulf states opens niche demand for luxury bathroom rolls embroidered with gold-leaf branding, illustrating the region's bifurcated consumption profile.

- Essity AB

- Kimberly-Clark Corporation

- Georgia-Pacific LLC

- Procter & Gamble Company

- Cascades Inc.

- Sofidel S.p.A.

- Asia Pulp & Paper (APP) Sinar Mas

- Hengan International Group Co., Ltd.

- Metsa Tissue Corporation

- WEPA Hygieneprodukte GmbH

- April (Asia Pacific Resources International Holdings Ltd.)

- CMPC Tissue S.A.

- Suzano S.A.

- Vinda International Holdings Ltd.

- Kruger Products L.P.

- Clearwater Paper Corporation

- Orchids Paper Products Company

- ST Paper LLC

- Wausau Paper Corporation

- Irving Consumer Products Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing hygiene and sanitation expenditure

- 4.2.2 Rapid away-from-home (AfH) reopening post-COVID

- 4.2.3 Capacity additions of large integrated paper mills

- 4.2.4 E-commerce-led private-label tissue boom

- 4.2.5 Plastic-free packaging mandates pushing tissue substitutes

- 4.3 Market Restraints

- 4.3.1 Volatile virgin pulp prices

- 4.3.2 ESG backlash over deforestation

- 4.3.3 Freight container imbalance post-pandemic

- 4.3.4 Soft demand in low-income economies due to affordability

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Bleached Softwood Kraft Pulp (BSK)

- 5.1.2 Birch Hardwood Kraft Pulp (BHK)

- 5.1.3 High-Yield Pulp (HYP)

- 5.1.4 Recycled Fibre Pulp

- 5.1.5 Other Raw Materials

- 5.2 By Product Type

- 5.2.1 Bathroom Tissue

- 5.2.2 Paper Towels

- 5.2.3 Facial Tissues

- 5.2.4 Paper Napkins

- 5.2.5 Specialty and Wrapping Tissue

- 5.3 By End-User Industry

- 5.3.1 Residential

- 5.3.2 HoReCa (Hotels/Restaurants/Cafes)

- 5.3.3 Healthcare Facilities

- 5.3.4 Offices and Educational Institutions

- 5.3.5 Other End-User Industries

- 5.4 By Distribution Channel

- 5.4.1 Online Sales

- 5.4.2 Offline Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Essity AB

- 6.4.2 Kimberly-Clark Corporation

- 6.4.3 Georgia-Pacific LLC

- 6.4.4 Procter & Gamble Company

- 6.4.5 Cascades Inc.

- 6.4.6 Sofidel S.p.A.

- 6.4.7 Asia Pulp & Paper (APP) Sinar Mas

- 6.4.8 Hengan International Group Co., Ltd.

- 6.4.9 Metsa Tissue Corporation

- 6.4.10 WEPA Hygieneprodukte GmbH

- 6.4.11 April (Asia Pacific Resources International Holdings Ltd.)

- 6.4.12 CMPC Tissue S.A.

- 6.4.13 Suzano S.A.

- 6.4.14 Vinda International Holdings Ltd.

- 6.4.15 Kruger Products L.P.

- 6.4.16 Clearwater Paper Corporation

- 6.4.17 Orchids Paper Products Company

- 6.4.18 ST Paper LLC

- 6.4.19 Wausau Paper Corporation

- 6.4.20 Irving Consumer Products Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment