PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549577

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549577

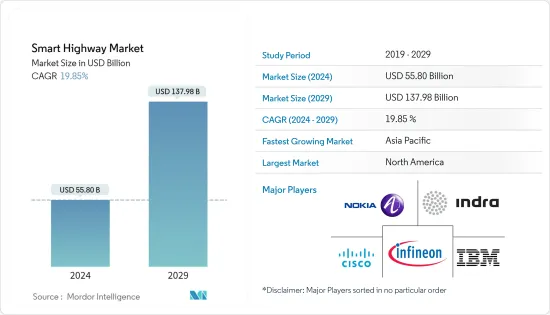

Smart Highway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Smart Highway Market size is estimated at USD 55.80 billion in 2024, and is expected to reach USD 137.98 billion by 2029, growing at a CAGR of 19.85% during the forecast period (2024-2029).

The growing investment in smart cities, along with the benefits associated with smart technologies, such as improved traffic safety and data-driven traffic control to reduce infrastructure damage, drives the growth of the smart highway market.

Key Highlights

- With rapid urbanization, an increase in greenhouse gas (GHG) emissions contributes to an expanding carbon footprint and forcing the adoption of clean and sustainable technology for intelligent transportation. For instance, according to the United States Environmental Protection Agency, greenhouse gas (GHG) emissions from transportation account for about 28% of the total greenhouse gas emissions in the United States.

- Smart transport management systems use digital sensors that can acquire and record data during landslides, poor weather conditions, and traffic congestion. They can also display forecasts and alerts on LED screens on state and national highways.

- The market is driven by many factors, such as reducing the number of accidents occurring on highways, providing safe and efficient transportation systems, and reducing the transportation time on highways connecting the major cities of a country. All of these can be done by implementing smart technologies, which efficiently monitor traffic and help properly functioning highways while providing real-time information to the authorities.

- The lack of infrastructural support in developing countries can significantly restrain the smart highway market. Implementing smart highways necessitates substantial investment in technology, sensors, communication networks, and a skilled workforce. Developing countries often face budget constraints, and governments may prioritize other essential sectors over advanced transportation infrastructure.

Smart Highway Market Trends

Smart Transport Management Systems Product Technology is Expected to Hold Significant Market Share

- Smart transport management systems (STMS) play a vital role in the smart highway market, as they are a key technology that enables the integration of advanced transportation solutions to improve efficiency, safety, and sustainability. SMTS encompasses a range of products and technologies that facilitate real-time monitoring, control, and management of various elements within the transportation system.

- ITMS includes a network of sensors, cameras, and a traffic control system that monitors real-time traffic conditions. These systems collect traffic flow, density, and congestion data, enabling traffic operators to optimize traffic signal timing, manage lane control, and respond to incidents efficiently.

- ETC systems are an essential part of smart highways. They use various technologies like RFID, ANPR, DSRC, or GNSS to automate toll collection, reducing congestion and improving traffic flow at toll plazas. For instance, in April 2024, the Delhi transport department planned to set up 5,000 CCTV cameras at various junctions in the national capital as part of the ITSMS integration project. Under the new tender document, the chosen agency will be required to set up CCTV cameras with an ANPR system for 16 road traffic violations, along with the ICCC infrastructure, within three years. The selected agency will also be required to arrange for a storage capacity to store all the CCTV footage and data for five years.

- Traffic information and navigation systems (TINS) provide real-time traffic information to drive through variable message signs, mobile apps, or navigation devices. This helps drivers make informed decisions, avoid congested routes, and improve traffic distribution.

- Environmental monitoring systems monitor air quality and other environmental parameters along highways to assess pollution levels and make data-driven decisions to reduce emissions and improve air quality.

North America is Expected to Hold Significant Market Share

- The North American smart highway market experienced steady growth and advancements in intelligent transportation systems (ITS) and smart infrastructure. Government agencies in North America have been actively promoting the adoption of smart transportation solutions to address traffic congestion, reduce accidents, and enhance overall transportation efficiency.

- The region's strong technological infrastructure and high smartphone penetration have facilitated the implementation of ITS technologies, such as electronic toll collection systems, traffic management systems, and real-time traffic information.

- There has been a significant emphasis on deploying smart highway technologies to enhance road safety through incident detection, management systems, and vehicle-to-infrastructure communication.

- The region has seen increasing interest in autonomous and connected vehicle technologies. These technologies have the potential to revolutionize the transportation landscape and require smart highway infrastructure to support their deployment.

- North America is a global technological leader. The increased spending on construction and road infrastructure is expected to offer more opportunities for the region to expand. Moreover, the public construction spending on highway and street projects in the United States is very high. For instance, in March 2024, NoTraffic, the developer of the leading AI Mobility Platform, announced that it received approval from the Florida Department of Transportation (FDOT) to operate in the state, accompanied by substantial successful implementations of NoTraffic's systems in various locations including Collier County, Pasco County, Orlando, and more. This significant milestone underscores NoTraffic's unwavering commitment to the highest safety and future-ready standards.

Smart Highway Industry Overview

The smart highway market is highly fragmented, with the presence of major players like Alcatel-Lucent Enterprise (Nokia Corporation), Cisco Systems Inc., IBM Corporation, Indra Sistemas SA, and Infineon Technologies AG. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Applied Information Inc. and Curruix Vision LLC announced a strategic partnership to provide new, enhanced traffic insights and proactive safety solutions to increasingly complex traffic management environments. The strategic partnership will combine their technical strengths by integrating Curruix Vision's smart city ITS intersection AI technology into Applied Information's intelligent city supervisory platform, Applied Information Glance.

- February 2024: Actelis Networks Inc., a cyber-secure, fast-deployment networking solution for Internet of Things (IoT) applications, deployed a hybrid fiber-to-the-premises (H2P) connectivity solution at several of Napa's busiest traffic junctions. Actelis' local partner, Econolite, ordered and installed the solution. Econolite and Actelis completed an ATMS upgrade project at the city's busiest intersections.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Highway and Infrastructure Projects

- 5.1.2 Rising Need for Safe and Efficient Transportation

- 5.2 Market Challenges

- 5.2.1 Capital-intensive Projects

- 5.2.2 Lack of Infrastructural Support in Developing Countries

- 5.3 Market Opportunities

- 5.4 Key Recent Case Studies

- 5.5 Evolution of Smart Highway Technology

6 MARKET SEGMENTATION

- 6.1 By Product Technology

- 6.1.1 Smart Traffic Management Systems

- 6.1.2 Smart Transport Management Systems

- 6.1.3 Monitoring Systems

- 6.1.4 Services

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alcatel-Lucent Enterprise (Nokia Corporation)

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Indra Sistemas SA

- 7.1.5 Infineon Technologies AG

- 7.1.6 Huawei Technlogies Co. Ltd

- 7.1.7 Kapsch AG

- 7.1.8 LG CNS Co. Ltd (LG Electronics Inc.)

- 7.1.9 Schneider Electric SE

- 7.1.10 Siemens AG

- 7.1.11 Xerox Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS