PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644892

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644892

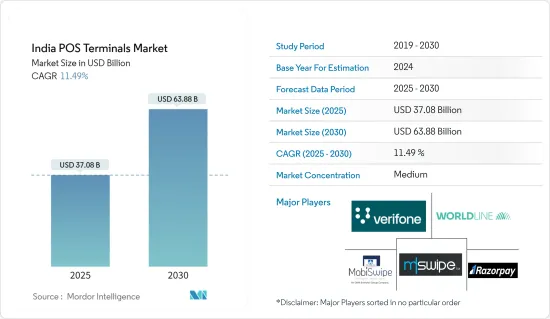

India POS Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India POS Terminals Market size is estimated at USD 37.08 billion in 2025, and is expected to reach USD 63.88 billion by 2030, at a CAGR of 11.49% during the forecast period (2025-2030).

Several factors are propelling India's POS terminal market, such as the surging demand for mobile POS terminals, increasing adoption of mobile wallets, supportive regulations, the growth of e-commerce, the influx of new enterprises, urbanization, and technological advancements.

Key Highlights

- The world of payments is undergoing dramatic changes, driven by evolving consumer preferences, technological advancements, and regulatory shifts. India, propelled by the surge in digital transactions, is witnessing remarkable growth, reshaping its payment landscape.

- The Indian retail sector is witnessing a surge, driven by a proliferation of retail outlets and heightened consumer spending. Consequently, there is a growing demand for payment processing machines. With a rising preference for digital transactions over cash among Indian consumers, these machines have become an essential element for retailers.

- India boasts a robust market for point-of-sale (POS) terminals. These devices facilitate cashless transactions, allowing consumers to make payments via their phones or cards. The Indian market for these machines is expanding due to the extended adoption of digital payments over cash. With this shift, there's a growing demand from businesses and stores for specialized POS terminals. Over the last few years, India has witnessed a significant surge in the adoption of card payment machines, enabling businesses to accept digital payments.

- The Reserve Bank of India (RBI), in addition to the government and other ministries, has diligently spearheaded efforts that have led to a significant surge in digital payments. Several of these initiatives have garnered international recognition. Card payments, alongside the Aadhaar-enabled Payment System (AePS), Unified Payments Interface (UPI), Immediate Payment Service (IMPS), QR-based payments, and National Electronic Toll Collection (NETC), have played pivotal roles in the gradual shift from a cash-centric economy to one that is increasingly reliant on digital transactions.

- In October 2023, Paytm, a player in the fintech industry, unveiled its latest innovation: the Paytm Card Soundbox. This advanced device not only offers audio alerts for UPI transactions but also facilitates 'tap-and-pay' card transactions, covering major networks like Visa, Mastercard, Amex, and RuPay. Pine Labs also introduced a cost-effective iteration of its traditional point-of-sale (PoS) terminal, dubbed 'Mini'. The 'Mini' terminal is equipped to process UPI transactions and 'tap-and-pay' card payments across a wide array of networks.

- However, the industry's growth is hampered by a scarcity of PoS terminals. The market faces challenges such as steep installation and maintenance costs, security concerns, and related expenses, all hindering its expansion.

India POS Terminals Market Trends

Retail Segment Expected to Hold Significant Market Share

- Several key factors in India's retail sector are propelling the growth of the POS terminals market. The expansion of organized retail chains and a rising number of independent stores are boosting the demand for efficient transaction processing systems in India. As retailers aim to elevate customer experiences and operational efficiency, the adoption of POS terminals is becoming essential.

- Moreover, the government's initiatives, such as Digital India, are propelling retailers toward digital payment solutions. This momentum is reinforced by both demonetization and the GST implementation, which have spurred businesses to embrace formalized digital transactions.

- As per the Telecom Regulatory Authority of India, as of December 2023, Reliance Jio Infocomm Limited held the most significant service provider of internet subscribers, boasting more than 470 million subscribers, equating to a dominant market share exceeding 50%.

- Furthermore, the surge in e-commerce and omnichannel retailing is driving demand for unified POS systems capable of managing both online and offline transactions effortlessly. Retailers are now prioritizing sophisticated POS solutions, emphasizing features like inventory management, customer relationship management (CRM), and data analytics to maintain their competitive edge.

- The expanding middle class, bolstered by rising disposable incomes, is fuelling the rising consumer spending. This surge is directly translating into a spike in retail sales, underscoring the necessity for streamlined payment systems.

- In February 2024, Zoho Corporation unveiled its latest venture in India, introducing the Zakya brand. Zakya's primary focus is on providing modern Point of Sale (POS) solutions tailored for retail establishments. These solutions aim to simplify daily operations and offer centralized monitoring capabilities. Notably, Zakya's POS system, operating on the cloud, boasts a swift implementation process and a user-friendly interface. This feature set is designed to enable small- and medium-sized retailers to swiftly transition, go live, and initiate billing within an hour of setup.

Mobile Point-of-Sale Anticipated to Register Significant Growth

- Card and mobile payments are surpassing ATM withdrawals in popularity. The shift is driven by a growing preference for digital payment methods. The impetus for this change was the COVID-19 pandemic, which heightened concerns about cash handling, prompting a pivot toward digital transactions. This trajectory is poised to persist, which is evident in the rising adoption of store card payments.

- In India, the trend of utilizing the Unified Payment Interface (UPI) for in-store purchases via smartphones is gaining momentum. To further streamline this process, there is a push toward integrating near-field communication technology with UPI. This advancement not only minimizes physical contact during transactions but also encourages wider UPI adoption among merchants. Additionally, it enhances the digital payment landscape for retailers, an area where UPI has historically seen limited penetration.

- In April 2024, BharatPe, a player in India's fintech sector, unveiled 'BharatPe One,' marking India's all-in-one payment solution. This innovative product combines POS, QR, and speaker functionalities into a single device. This innovative product aims to simplify merchant transactions. It provides a variety of payment acceptance options, such as dynamic and static QR codes, tap-and-pay, and traditional card payments. These options cater to a vast spectrum of debit and credit cards.

- Moreover, India's mPOS landscape is evolving, spurred by initiatives from POS companies. RapiPay stands out, offering hybrid micro-ATMs that function as mobile point-of-sale (mPOS) machines. This innovation enables customers to use credit cards alongside debit cards at RapiPay stations. Unlike conventional ATMs, RapiPay's Micro ATMs offer enhanced convenience, allowing users to not only withdraw cash but also conduct a range of banking operations at any RapiPay Direct Business Outlet.

India POS Terminals Industry Overview

The Indian POS terminal market is moderately competitive, with a considerable number of regional players. Some of the major players in the market are VeriFone Inc., Worldline, Ezetap (Razorpay), MobiSwipe Technologies Private Limited, and Mswipe Technologies Pvt Ltd. Companies are strategically collaborating and acquiring businesses to boost their market share and profitability.

- June 2024: QueueBuster and Otipy entered a strategic partnership. The alliance merges QueueBuster's advanced POS technology with Otipy's pioneering use of Electric Carts in fresh produce retailing. QueueBuster's advanced POS technology would be seamlessly integrated into Otipy's recently introduced physical electric carts, bolstering operational efficiency and elevating customer satisfaction.

- February 2024: CSB Bank, headquartered in India, unveiled a strategic collaboration with fintech firm Bijlipay. This partnership is designed to bolster the bank's payment ecosystem by offering comprehensive POS solutions. Beyond this, the alliance is set to enhance customer satisfaction and streamline service delivery, leveraging Bijlipay's seamlessly integrated solutions across the bank's network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Digitization Drives the Growth of POS Terminals in India

- 5.1.2 Implementation of Various Government Initiatives to Improve Market Growth

- 5.1.3 Growing Demand for Mobile Point-of-Sale Systems

- 5.2 Market Restraints

- 5.2.1 Concerns Over Data Security Might Restrict Economic Growth

- 5.2.2 High Compliance Costs per Device and Certification Renewal Costs

- 5.3 Market Opportunities

- 5.3.1 Rise in Contactless Payment Adoption

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the Rising Use of Contactless Payment and its Impact on the Industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Mode of Payment Acceptance

- 6.1.1 Contact-based

- 6.1.2 Contactless

- 6.2 By Type

- 6.2.1 Fixed Point-of-sale Systems

- 6.2.2 Mobile/Portable Point-of-sale Systems

- 6.3 By End-User Industry

- 6.3.1 Retail

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 VeriFone Inc.

- 7.1.2 Worldline

- 7.1.3 Ezetap (Razorpay)

- 7.1.4 MobiSwipe Technologies Private Limited

- 7.1.5 Mswipe Technologies Pvt Ltd

- 7.1.6 ePaisa

- 7.1.7 NGX Technologies

- 7.1.8 PayU

- 7.1.9 Payswiff

- 7.1.10 PAX Technologies Pvt. Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET