PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851151

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851151

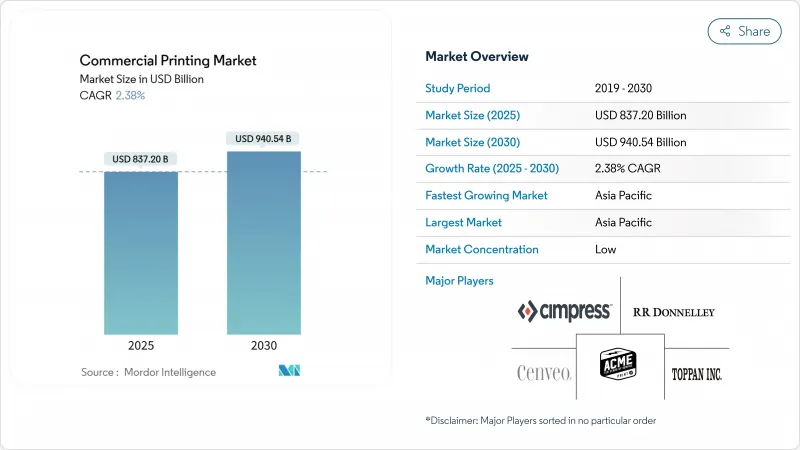

Commercial Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The commercial printing market size is valued at USD 837.20 billion in 2025 and is forecast to reach USD 940.54 billion by 2030, advancing at a 2.38% CAGR.

This performance indicates that the commercial printing market is adapting to digital disruption while capitalizing on growth in packaging, variable-data services, and sustainable substrates. Ongoing demand for printed packaging in e-commerce, a steady shift toward vegetable-based inks, and wider use of on-demand digital workflows are cushioning revenue pressures that still affect traditional publishing work. Investments in artificial intelligence for print workflow automation, together with micro-factory concepts located near consumer hubs, are expected to raise throughput and improve profitability for many participants in the commercial printing market. At the same time, larger firms are pursuing alliances with software vendors to integrate real-time data analytics, while regional specialists are carving out niche positions in direct-to-object and short-run promotional applications.

Global Commercial Printing Market Trends and Insights

Explosive Growth in On-Demand Packaging Print Runs

E-commerce brands increasingly favor shorter, more frequent packaging runs to support fast product launches and regional promotions. A 2024 installation of a Domino N610i digital label press by Multi-Label Tech-Print in Ahmedabad underscores the migration toward high-throughput digital lines able to process hundreds of SKUs with minimal changeover time.The trend is advancing most rapidly in Asia-Pacific, where localized fulfillment centers require packaging that is printed close to consumers, limiting inventory costs and reducing obsolescence.

Rising Adoption of Variable-Data Printing for Personalized Marketing

Advertisers in North America and Europe are demanding individualized mailers and packaging tied to first-party data. Dai Nippon Printing introduced its "Persona Insight" AI tool in 2025, combining government demographic statistics with print workflows that generate unique design variants in one production pass. Printers that integrate data analytics and digital presses are securing premium, service-rich contracts that offset slower run lengths in traditional commercial jobs.

Ongoing Shift of Advertising Spend to Digital Media Channels

Brand owners allocate budget toward online video and social media, curbing growth in magazine and newspaper print orders. Printers offset the decline by emphasizing packaging and direct mail formats that integrate QR codes for seamless offline-to-online engagement.

Other drivers and restraints analyzed in the detailed report include:

- Sustained Demand for Promotional Print from Retail and CPG Brands

- Transition Toward Eco-Friendly Substrates and Vegetable-Based Inks

- Volatile Prices of Paper, Ink and Energy Inputs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexographic platforms retained 41.07% revenue in 2024, underpinned by favorable economics for long runs on flexible packaging. The commercial printing market size for digital inkjet solutions is projected to widen by 3.45% CAGR to 2030 as brands demand quicker artwork changes and individualized campaigns. Regional converters increasingly deploy hybrid lines, marrying flexo white layers with variable inkjet color to cut setup times and waste. Digital cost parity at mid-length runs is expected before 2028, eroding flexo's historical edge in SKU-rich sectors such as beverage labels.

Advances in AI-guided registration and automated job changeovers are shrinking labor input and maximizing uptime. Investments like Multi-Label Tech-Print's Domino N610i show how medium-sized converters leverage six-color, 600 dpi engines to print metallics and high-opacity whites in one pass. Environmental compliance is another driver: water-borne inkjet fluids emit lower VOCs than solvent-based flexo blends, helping printers satisfy tightening air-quality rules.

Packaging held 44.08% of commercial printing market share in 2024 and will rise at a 3.07% CAGR on the back of e-commerce parcel volumes and brand premiumization. Folding cartons and flexible pouches serve cosmetics, nutraceuticals, and ready-to-eat meals, sectors that rely on vivid shelf appeal. Publishing work-newspapers, magazines, softcover books-experiences ongoing volume erosion, especially in North America and Western Europe. Yet manga and small-batch literary titles printed on recycled paper are registering niche growth among environmentally conscious consumers.

Commercial printing industry vendors diversify by offering "campaign kits" that bundle corrugated shipper boxes, point-of-sale displays, and personalized insert cards. Printed electronics embedded in packages enable temperature monitoring and anti-counterfeiting, features valued by pharmaceutical and luxury brands in Asia-Pacific. Packaging's resilience gives printers an anchor revenue stream, offsetting cyclical ad-spend patterns in other segments.

The Commercial Printing Market Report is Segmented by Printing Type (Offset Lithography, Digital Inkjet, Flexographic, Screen, and More), Application (Packaging, Advertising, Publishing, and More), Print Material (Paper and Cardboard, Fabric and Textiles, and More), Format (Large-Format Printing, and More) and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific dominated revenue with 45.64% in 2024 and is projected to post a 3.28% CAGR through 2030 as consumer packaged goods output, domestic e-commerce volumes, and government stimulus for infrastructure projects expand print demand. China alone adds hundreds of corrugated converting lines annually, while India's label sector benefits from GST roll-out mandating standardized barcode identification across logistics channels. Regional brands actively specify QR-code smart packaging to build loyalty among mobile-first consumers.

North America maintains a sizeable slice of global output, although growth is modest. The commercial printing market size in the United States is steady as demand migrates toward data-driven direct mail, pharmaceutical inserts, and luxury packaging. Canada's printers focus on short-run book production fueled by educational publishing mandates favoring domestically printed content.

Europe shows flat volume in general commercial work but accelerating investment in C2C recyclable substrates and vegetable-oil inks. Germany is piloting deposit-return systems for paper-based coffee cups, spurring converters to test barrier-coated boards certified for compostability. EU regulations on single-use plastic pack formats will likely channel incremental volume to fiberboard over the medium term.

Latin America and the Middle East & Africa together account for a smaller proportion of the commercial printing market but represent meaningful upside. Brazil's PET recycling rate reached 56.4% in 2025, allowing food brands to switch to PCR-rich labels and flexible pouches, which in turn creates print volume. Gulf Cooperation Council states are building new industrial zones that house packaging plants serving dairy, beverage, and personal-care clusters, underpinning near-term demand for offset and gravure equipment.

- Toppan Inc.

- Dai Nippon Printing Co., Ltd.

- R.R. Donnelley & Sons Company

- Quad/Graphics Inc.

- Transcontinental Inc.

- Cenveo Worldwide Limited

- Cimpress plc

- Deluxe Corporation

- Shutterfly LLC

- LSC Communications LLC

- Mondi Group

- Printpack Inc.

- Multi-Color Corporation

- ACME Printing

- O'Neil Printing

- Xerox Corporation (Print Services)

- Smurfit Westrock (Print and Packaging)

- Berry Global Group (Graphics Services)

- Seiko Epson Corporation (Commercial Inkjet Systems)

- HP Inc. (PageWide Industrial)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth in on-demand packaging print runs

- 4.2.2 Rising adoption of variable-data printing for personalized marketing

- 4.2.3 Sustained demand for promotional print from retail and CPG brands

- 4.2.4 Transition toward eco-friendly substrates and vegetable-based inks

- 4.2.5 Integration of printed electronics (RFID, NFC) into packaging and labels

- 4.2.6 Emergence of micro-factory "print-as-a-service" hubs close to customers

- 4.3 Market Restraints

- 4.3.1 Ongoing shift of advertising spend to digital media channels

- 4.3.2 Volatile prices of paper, ink and energy inputs

- 4.3.3 Stringent VOC and chemical-use regulations on conventional inks

- 4.3.4 Shortage of semiconductor components for new digital presses

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investment Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Type

- 5.1.1 Offset Lithography

- 5.1.2 Digital Inkjet

- 5.1.3 Flexographic

- 5.1.4 Screen

- 5.1.5 Gravure

- 5.1.6 Other Printing Types

- 5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Advertising

- 5.2.3 Publishing

- 5.2.3.1 Books

- 5.2.3.2 Magazines

- 5.2.3.3 Newspapers

- 5.2.3.4 Other Publishing

- 5.2.4 Corporate and Transactional Printing

- 5.2.5 Other Application

- 5.3 By Print Material

- 5.3.1 Paper and Cardboard

- 5.3.2 Plastic and Synthetic Substrates

- 5.3.3 Fabric and Textiles

- 5.3.4 Metal and Foils

- 5.3.5 Other Materials

- 5.4 By Format

- 5.4.1 Large-Format Printing

- 5.4.2 Small-Format Printing

- 5.4.3 Direct-to-Object Printing

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Kenya

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Toppan Inc.

- 6.4.2 Dai Nippon Printing Co., Ltd.

- 6.4.3 R.R. Donnelley & Sons Company

- 6.4.4 Quad/Graphics Inc.

- 6.4.5 Transcontinental Inc.

- 6.4.6 Cenveo Worldwide Limited

- 6.4.7 Cimpress plc

- 6.4.8 Deluxe Corporation

- 6.4.9 Shutterfly LLC

- 6.4.10 LSC Communications LLC

- 6.4.11 Mondi Group

- 6.4.12 Printpack Inc.

- 6.4.13 Multi-Color Corporation

- 6.4.14 ACME Printing

- 6.4.15 O'Neil Printing

- 6.4.16 Xerox Corporation (Print Services)

- 6.4.17 Smurfit Westrock (Print and Packaging)

- 6.4.18 Berry Global Group (Graphics Services)

- 6.4.19 Seiko Epson Corporation (Commercial Inkjet Systems)

- 6.4.20 HP Inc. (PageWide Industrial)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment