PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1548897

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1548897

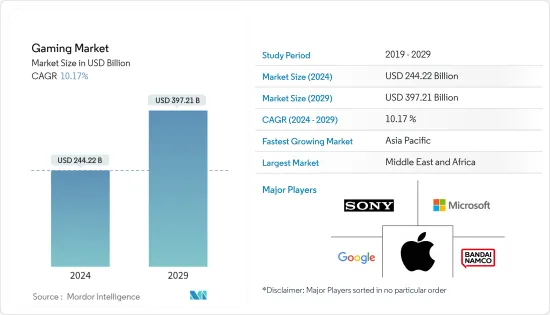

Gaming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Gaming Market size is estimated at USD 244.22 billion in 2024, and is expected to reach USD 397.21 billion by 2029, growing at a CAGR of 10.17% during the forecast period (2024-2029).

Key Highlights

- The global gaming industry is experiencing increased demand due to rising internet connectivity, growing smartphone adoption, and the introduction of high-bandwidth networks like 5G. In addition, several operators have launched commercial 5G services with significant population penetration, opening new opportunities for mobile vendors to introduce 5G smartphones in the market.

- The continuous technological advancements in the gaming industry are also significantly propelling the industry's growth. They enhance the way games are created and improve users' overall gaming experience. Game developers in emerging economies continually strive to enhance the gaming experience. They achieve this by developing and optimizing codes for various platforms, including PlayStation, Xbox, and Windows PC. These efforts result in a unified product delivered to gamers via cloud platforms.

- According to NewGenApps, by 2025, the global user base of AR and VR games is estimated to increase to 216 million. According to a worldwide survey of technology company executives, startup founders, and investors, 59% of the respondents believe gaming will dominate the investment in developing VR (Virtual Reality) technology. In addition, as cryptocurrency continues to be a global phenomenon, various industries across the world are identifying ways to incorporate crypto into their products and services as game developers are inventing new methods to leverage cryptos for purchasing and trading in-game products, cosmetics, and unlocked characters.

- The gaming market share is significantly driven by the rising adoption of gaming platforms like E-sports. E-sports are witnessing a significant increase in market share in the current market scenario, thereby driving the overall gaming industry across the world. The entire e-sports market is anticipated to grow over the coming years. Most of the audience and players of E-sports are millennials. Thus, esports publishers target these customers by personalizing the gameplay experience and offering the game on different platforms through the console, PC, and mobile.

- The gaming industry is witnessing a surge in Non-Fungible Tokens (NFTs) and a growing adoption of the play-to-earn (P2E) model. These trends are reshaping game development, gameplay, and revenue streams, providing players and developers with fresh opportunities for interaction and income.

- According to gaming industry trends, the market is witnessing rising fraud cases, such as copyright infringement and fake gaming sites, among others. Emerging and evolving fraud trends are increasing account takeover attacks across industries, especially online gaming. Game hacking is further increasing, resulting in fraud related to customer accounts and personal identity thefts.

Gaming Industry Trends

Console Games Gaming Type Segment Holds Significant Market Share

- Over the past few years, the demand for gaming consoles has steadily increased, driven by a growing gamer base and ongoing technological advancements and improvements. The amount of time consumers spend on gaming has increased as the number of games and the variety are diversified. Moreover, unique games and gaming content are also being created continuously.

- According to the data shared by ZarkCentral, the amount of time consumers spend on gaming is rising, with the global average being 7.11 hours per week. Gamers in European countries spent the most time gaming, with almost 7.98 hours per week. As per adjoe GmbH, gamers spent 20 minutes daily on average with the simulation gaming app. Moreover, the number of games and the variety have diversified over the years.

- In 2023, Indian gamers, as per a survey by Google and Lumikai, an Indian gaming-focused venture capital fund, devoted an average of 4.7 hours weekly to real-money gaming, marking the highest engagement. In comparison, hyper-casual games saw an average of just 2.6 hours per week.

- Currently, the hardware requirement of many games and the multipurpose use of home consoles for purposes such as browsing, providing various other applications, etc., have further enabled gaming industry growth. The release of supportive multiple provision accessories, such as 4K and 8K TVs, effectively drives the demand for home consoles. They provide a better gaming experience than other options available.

- Video game companies and consumers continue to move away from physical game disks and prefer the convenience of digital downloads. Major gaming companies, such as Microsoft, Sony, and Nintendo, offer free digital games to people who are subscribed to their online services. Multiple companies are developing new platforms and services to buy and play games.

Asia Pacific to be the Largest Market

- Asia-Pacific encompasses diverse economies, from advanced technological hubs like China, Japan, and South Korea to rapidly developing nations such as India, Indonesia, and others. This diversity creates a favorable environment for gaming companies looking to capitalize on varied consumer preferences and spending capacities.

- Hence, companies in the region are continuously launching new gaming products and software to accommodate the growing number of gamers in the region. For instance, in May 2024, Asus announced that it had launched a new handheld gaming console, Rog Ally, equipped with the latest chip from AMD. The company also said it will come with a bigger battery and better thermals to provide a better user experience.

- Again, in December 2023, Tencent Holdings introduced Last Sentinel, a big-budget console game. Tencent focuses on expanding into the international market, catering to Chinese consumers' changing preferences, and engaging resources in big-budget console games. These developments indicate the growing demand for gaming solutions in the region.

- Technological innovations, the growing popularity of mobile gaming, and the soaring interest in E-sports majorly drive the market in Japan. With its ease of access and affordability, mobile gaming has increased the gaming penetration rate in Japan, making it a lucrative market for mobile game developers. This momentum is further fueled by the rise of social gaming, where multiplayer games are integrated with social media platforms, fostering community and connectedness among players.

- Several global gaming companies have entered the Japanese market through strategic initiatives such as partnerships and acquisitions. For instance, in February 2024, KOJIMA PRODUCTIONS Co. Ltd announced that it has an action espionage game in the pipeline, a brand-new IP combining film and gaming elements. The company plans to develop this game in collaboration with Sony.

Gaming Market Overview

The gaming market share is highly consolidated with the biggest gaming companies like Sony, Microsoft, Nintendo, Tencent Holdings Limited, and Electronic Arts Inc., among others. The biggest companies in the console gaming landscape are Sony (PlayStation), Microsoft (Xbox), and Nintendo (Switch). These gaming companies are investing in R&D and developing technology that offers gamers high-quality graphics, high computing power, and faster speed. In terms of console units sold, in 2023, Sony's PlayStation PS5 led the market with around 20.9 million units sold, followed by Nintendo (Switch) with 17.97 million units and Xbox XS 3.14 million units (September 2023). Other gaming companies are also entering the gaming and esports industry.

For instance, in November 2023, NCSOFT, a global developer and publisher, partnered with Sony Interactive Entertainment (SIE). This collaboration spans multiple global business domains, focusing on the mobile sector. For Sony, teaming up with NCSOFT is a pivotal move, aligning with its vision to extend the PlayStation brand's influence beyond consoles, targeting a more diverse audience.

In August 2023, Bandai Namco and Oasys, a gaming-centric blockchain network, collaborated to develop an AI-driven virtual pet game. The game centers around a set of NFT-based digital creatures named RYU. Drawing inspiration from the iconic Tamagotchi, these RYU creatures evolve unique personalities and abilities in response to user interactions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Internet Penetration

- 5.1.2 Emergence of Cloud Gaming

- 5.1.3 Adoption of Gaming Platforms, such as E-sports Betting and Fantasy Sites

- 5.2 Market Restraints

- 5.2.1 Issues such as Piracy, Laws and Regulations, and Concerns Relating to Fraud During Gaming Transactions

6 MARKET SEGMENTATION

- 6.1 By Gaming Type

- 6.1.1 Mobile Games

- 6.1.2 Console Games

- 6.1.3 Downloaded/Box PC

- 6.1.4 E-sports

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Russia

- 6.2.2.5 Spain

- 6.2.2.6 Italy

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Argentina

- 6.2.5.3 Mexico

- 6.2.6 Middle East and Africa

- 6.2.6.1 United Arab Emirates

- 6.2.6.2 Saudi Arabia

- 6.2.6.3 Iran

- 6.2.6.4 Egypt

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sony Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Apple Inc.

- 7.1.4 Realnetworks LLC (Gamehouse)

- 7.1.5 Bandai Namco Holdings Inc.

- 7.1.6 Take-Two Interactive Software Inc.

- 7.1.7 Nexon Co. Ltd

- 7.1.8 Nintendo Co. Ltd

- 7.1.9 Beijing Elex Technology Co. Ltd

- 7.1.10 Electronic Arts Inc.

- 7.1.11 Ubisoft Entertainment SA

- 7.1.12 Square Enix Holdings Co. Ltd

- 7.1.13 ZeptoLab UK limited

- 7.1.14 Tencent Holdings Ltd

- 7.1.15 Sega Sammy Holdings Inc.

- 7.1.16 Capcom Co. Ltd

- 7.1.17 NetEase Inc.

- 7.1.18 37 Interactive Entertainment

- 7.1.19 Jam City Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS