PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851796

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851796

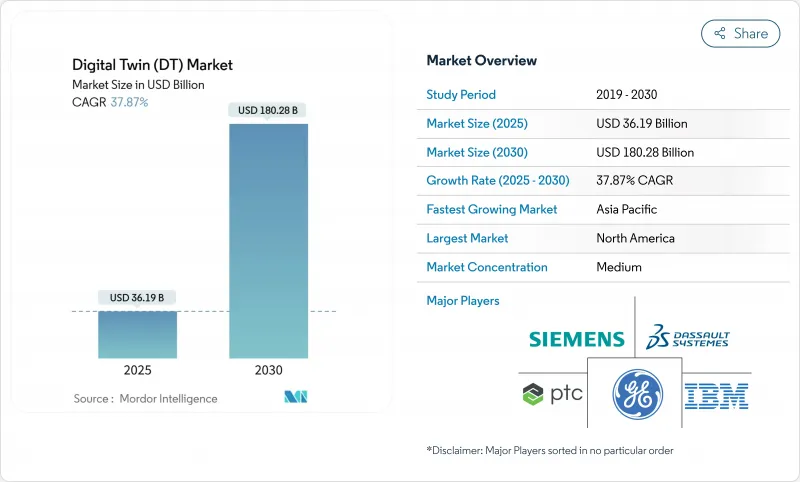

Digital Twin (DT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The digital twin market currently stands at USD 36.19 billion in 2025 and is projected to reach USD 180.28 billion in 2030, advancing at a 37.87% CAGR.

Tailwinds include the maturation of industrial IoT platforms, wider edge-AI deployment, and regulatory requirements for safety-critical infrastructure. Manufacturing remains the largest application thanks to established smart-factory investments, while Oil and Gas shows the strongest growth as producers seek asset-integrity gains in harsh operating conditions. Regionally, North America retains the lead, but Asia-Pacific is closing the gap as public programs in China, India, and Japan channel funding toward large-scale digitalization. Solutions account for most spending today, yet services are scaling quickly as firms seek integration expertise. Cloud deployment is growing faster than on-premises, signaling rising confidence in remote data-management safeguards and scalable architectures. Cyber-security gaps and scarce physics-based modeling talent temper the growth outlook, though they have not altered the primary trajectory of adoption.

Global Digital Twin (DT) Market Trends and Insights

Rapid growth of industrial IoT platforms

Widespread IIoT deployment supplies real-time data that keeps digital models synchronized with factory floors. Siemens reported EUR 9 billion (USD 9.72 billion) digital business revenue in 2024, up 22% on the strength of its Xcelerator ecosystem. Honeywell's Forge platform processes 3 billion+ datapoints daily, cutting unplanned downtime by 35% in client plants. Standardized protocols such as OPC UA and MQTT reduce integration friction, enabling plants to deploy twins in weeks rather than months. The result is steady cost avoidance, quicker root-cause analysis, and more predictable capacity planning.

Expansion of edge/AI inference at the device level

Moving analytics from cloud to edge trims latency and preserves data sovereignty. Microsoft and Siemens co-developed Industrial Foundation Models that run inference at the asset, allowing millisecond-level responses for anomaly detection. Audi now operates virtual PLCs through edge-deployed twins that optimize cycle times in real manufacturing lines. Local simulation also limits bandwidth consumption because only exception of data moves upstream. Specialized chips and containerized runtimes further cut deployment costs for tier-two suppliers, accelerating the spread of AI-ready twins throughout value chains.

Cyber-physical security vulnerabilities across IT/OT stacks

The Spanish National Cybersecurity Institute notes that twins bridging IT and OT widen attack surfaces, exposing process controllers to data-integrity threats. Recent ransomware events forced manufacturers to halt production for days while cleansing twin data lakes. Average deployment delays of 18 months arise as firms integrate zero-trust architectures and train staff. Multi-tenant twins add complexity because partner access must be segmented without slowing collaboration.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory push for asset-intensive industries to digitise safety-critical infrastructure

- Demand for virtual commissioning to cut CAPEX

- Shortage of domain-specific physics-based modelling expertise

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing contributed 35.8% of the digital twin market in 2024 thanks to embedded IIoT sensors, predictive maintenance programs, and continuous-improvement cultures. Automotive and electronics plants deploy line-level twins to analyze takt-time fluctuations and quality-yield patterns, trimming scrap rates by double digits. Energy-efficiency gains add another payback layer, particularly in resource-intensive metallurgy and cement operations. The segment is forecast to expand steadily, preserving its quantitative edge even as other verticals catch up.

Oil and Gas, though smaller today, is projected to grow at a 29.3% CAGR to 2030 as offshore operators require remote inspection and fault-isolation capabilities. The upstream segment deploys reservoir twins that integrate seismic data and production logs, allowing engineers to simulate well-workover scenarios before mobilizing rigs. Midstream companies apply pipeline twins for leak detection, while downstream refineries like Shell have documented 20% unplanned downtime reductions using twins verified by DNV standards. Government decarbonization targets further propel adoption as twins optimize flare minimization and heat-integration strategies. Across both segments, AI-assisted scenario testing elevates twins from monitoring to decision-support systems, reinforcing their share of total deployments.

The solutions category-software platforms, physics engines, and connected hardware-accounted for 63.6% of spending in 2024 as companies acquired core capabilities. Vendors bundle modeling libraries with visualization engines so process engineers can assemble replicas without coding from scratch. Licensing models are shifting to consumption-based tiers, broadening access among tier-two suppliers.

Services, however, are scaling faster at a 31.4% CAGR. Implementation consultancies align data pipelines, create semantic models, and validate simulation fidelity. Managed-service contracts monitor twin health metrics, apply patches, and tune algorithms for drift, yielding predictable OPEX for asset owners. As outcome-based agreements proliferate-Rolls-Royce TotalCare guarantees engine uptime backed by twin analytics-service partners assume more risk, tying fees to efficiency gains rather than billable hours. This model strengthens customer loyalty and encourages continuous platform enhancements.

The Digital Twin Market Report is Segmented by Application (Manufacturing, Energy and Power, Aerospace and Defense, Oil and Gas, Automotive, and Others), Component (Solutions/Platforms, and Services), Deployment Mode (On-Premises, and Cloud), Enterprise Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), and Geography.

Geography Analysis

North America commanded 38.4% of digital twin market revenue in 2024 driven by early Industry 4.0 rollouts, extensive aerospace programs, and robust venture funding for industrial SaaS. U.S. aviation regulators' acceptance of simulation-based certification has spurred widespread twin investment among aircraft OEMs and Tier-1 suppliers. Energy majors in Canada and the United States deploy pipeline and LNG terminal twins to cut methane leak rates, aligning with tightening environmental policy. Cloud adoption is particularly strong due to mature cyber-insurance frameworks and standardized data-protection mandates.

Asia-Pacific posts the highest CAGR at 27.2%, supported by government megaprojects. China's Digital China Construction plan mandates urban digital twins for new infrastructure, creating large procurement pipelines for domestic and foreign vendors. India's Sangam Digital Twin scheme integrates network twin capability into nationwide telecom upgrades as the country moves toward 6G readiness. Japan's NTT Digital Twin Computing Initiative supports city-scale replicas that feed transportation and disaster-response algorithms. South Korea and Singapore push smart-factory and smart-port pilots, emphasizing real-time carbon-footprint tracking. The region's supply-chain centrality means lessons learned here propagate quickly to global OEMs.

Europe advances steadily as regulatory imperatives take center stage. The digital product passport forces manufacturers to embed traceability across product life cycles, effectively making a lightweight twin mandatory for high-volume goods. Germany's Plattform Industrie 4.0 provides standardized administration shell guidelines, reducing integration overhead for SMEs. France invests in virtual shipyard twins to maintain competitive edge in naval construction, while the Nordics use building twins to meet net-zero codes. The Middle East and Africa remain nascent but promising: the UAE and Saudi Arabia are piloting oil-field twins and giga-project city twins, seeking efficiency and sustainability benefits prior to large-scale expansion.

- ANSYS, Inc.

- AVEVA Group plc

- Bentley Systems, Incorporated

- Cal-Tek S.R.L.

- Cityzenith, Inc.

- Dassault Systemes SE

- General Electric Company

- Hexagon AB

- International Business Machines Corporation

- Lanner Group Limited (Royal HaskoningDHV)

- Mevea Ltd.

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Rescale, Inc.

- Robert Bosch GmbH (Bosch.IO)

- SAP SE

- Schneider Electric SE

- Siemens AG

- Amazon Web Services, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of industrial IoT platforms

- 4.2.2 Expansion of edge/AI inference at the device level

- 4.2.3 Regulatory push for asset-intensive industries to digitise safety-critical infrastructure

- 4.2.4 Demand for virtual commissioning to cut CAPEX in brownfield projects

- 4.2.5 Rise of outcome-based service contracts needing real-time asset replica data

- 4.2.6 Proliferation of digital product passports in EU and U.S.

- 4.3 Market Restraints

- 4.3.1 Cyber-physical security vulnerabilities across IT/OT stacks

- 4.3.2 Shortage of domain-specific physics-based modelling expertise

- 4.3.3 Opaque IP ownership of data generated in federated twins

- 4.3.4 Fragmentation of simulation standards limiting interoperability

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Manufacturing

- 5.1.2 Energy and Power

- 5.1.3 Aerospace and Defense

- 5.1.4 Oil and Gas

- 5.1.5 Automotive

- 5.1.6 Others

- 5.2 By Component

- 5.2.1 Solutions/Platforms

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 ASEAN

- 5.5.5.6 Australia

- 5.5.5.7 New Zealand

- 5.5.5.8 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ANSYS, Inc.

- 6.4.2 AVEVA Group plc

- 6.4.3 Bentley Systems, Incorporated

- 6.4.4 Cal-Tek S.R.L.

- 6.4.5 Cityzenith, Inc.

- 6.4.6 Dassault Systemes SE

- 6.4.7 General Electric Company

- 6.4.8 Hexagon AB

- 6.4.9 International Business Machines Corporation

- 6.4.10 Lanner Group Limited (Royal HaskoningDHV)

- 6.4.11 Mevea Ltd.

- 6.4.12 Microsoft Corporation

- 6.4.13 Oracle Corporation

- 6.4.14 PTC Inc.

- 6.4.15 Rescale, Inc.

- 6.4.16 Robert Bosch GmbH (Bosch.IO)

- 6.4.17 SAP SE

- 6.4.18 Schneider Electric SE

- 6.4.19 Siemens AG

- 6.4.20 Amazon Web Services, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment