PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687350

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687350

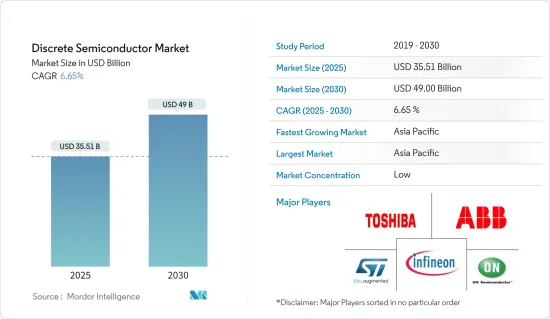

Discrete Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Discrete Semiconductor Market size is estimated at USD 35.51 billion in 2025, and is expected to reach USD 49.00 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 427.21 billion units in 2025 to 544.99 billion units by 2030, at a CAGR of 4.99% during the forecast period (2025-2030).

Key Highlights

- As new applications emerge and existing technologies evolve, the demand for more advanced and efficient semiconductors increases. Advancements such as miniaturization, increased power efficiency, and improved performance open new possibilities for integrating semiconductors into various devices and systems. Innovations in areas like the Internet of Things (IoT), artificial intelligence (AI), and autonomous vehicles drive the demand for discrete semiconductors.

- Additionally, the rising demand for high-energy and power-efficient devices in the automotive and electronics segment and the increasing demand for green energy power generation drive the market.

- Furthermore, the global consumer electronics market continues to experience rapid growth, fueled by factors such as rising disposable incomes, changing lifestyles, and technological advancements. Consumer electronics, including smartphones, tablets, wearables, and home appliances, heavily rely on discrete semiconductors. The increasing demand for these devices translates into a higher demand for discrete semiconductors, driving the market's growth.

- However, the market faces several restraints that impact its growth and development. The increasing competition from integrated circuits (ICs) is a significant challenge for the market's growth. ICs offer a compact and cost-effective solution, which led to a decline in the demand for discrete semiconductors. This shift in the market preference poses a significant challenge for the discrete semiconductors industry.

- Continuous Russia-Ukraine conflict, as well as China's "Zero Tolerance Policy," has led to a significant increase in global inflation, impacting multiple sectors, including the electronic components industry, leading to climbing prices of logic, linear, discrete, advanced analog, and passive component, thus negatively impacting the growth of the market studied.

Discrete Semiconductor Market Trends

Automotive Segment Is Expected to Witness Major Growth

- Discrete semiconductors, such as diodes and transistors, are utilized in these systems to manage power flow and minimize energy losses efficiently. The demand for discrete semiconductors in the automotive industry is thus driven by the growing emphasis on vehicle electrification.

- Autonomous driving and ADAS technologies are revolutionizing the automotive industry, requiring sophisticated electronics and discrete semiconductors to enable real-time data processing, sensor fusion, and vehicle control. These systems heavily rely on high energy and power-efficient devices to ensure precise and reliable operation.

- Discrete semiconductors are crucial in enabling autonomous driving functions like adaptive cruise control, lane-keeping assist, and collision avoidance. The surge in demand for autonomous driving and ADAS technologies has consequently driven the need for high-energy and power-efficient devices in the automotive industry.

- Furthermore, with the transition to EVs, the number of car companies building SiC-based inverter prototypes has rapidly increased in the past few years. In the sector, the primary applications for SiC power MOSFETs, diodes, and modules are onboard electric vehicle (EV) chargers, DC/DC converters, and drivetrain inverters. Plug-in hybrid EVs and BEVs use onboard chargers to refuel the vehicle battery either at home or at a public charging station.

- Moreover, the global automotive industry is undergoing a significant transformation, as highlighted by the IEA, with potentially far-reaching implications for the energy sector. According to projections, the rise of electrification is anticipated to result in a daily elimination of the need for 5 million barrels of oil by 2030.

China is Expected to Lead the Market

- The discrete semiconductor market in China is experiencing substantial growth due to the increasing number of industries in the country and their integration with automation to enhance return on investment. China has the largest manufacturing industry globally, contributing significantly to market demand. Manufacturing companies in China prioritize adopting 4.0 solutions to optimize and elevate their operations, thereby propelling market expansion.

- The growth of governmental initiatives in strengthening the country's semiconductor ecosystem and the country's emergence as a global producer of automotive and consumer electronic sectors would support the market's growth.

- The market's growth in the country is expected to be greatly influenced by the automotive segment, as there is a rising demand for discrete semiconductor devices in automotive manufacturing. For instance, in January 2024, the China Association of Automobile Manufacturers announced that China's automobile industry achieved a remarkable milestone, with production and sales surpassing 30 million units annually. This clearly indicates the immense growth potential of the automobile market.

- China's automotive sector experienced significant growth, solidifying the country's position as a key player in the worldwide automotive market. The Chinese government considers the automotive industry, along with its auto parts segment, to be crucial pillars of the nation's economy.

- The popularity of EVs is rising globally. China is a dominant adopter of electric vehicles worldwide. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric vehicles, to advance the country's transportation sector.

- The government's efforts to attain carbon neutrality objectives by 2060 are projected to enhance the need for discrete semiconductors by leveraging the growth of various sectors, including the electric vehicle market. According to China's Development Plan for the New Energy Automobile Industry (2021-2035), electric vehicles could capture a 25% market share by 2025.

- Consequently, China is implementing more assertive measures to incentivize the adoption of electric vehicles, thereby expediting the adoption of discrete semiconductors for their extensive utilization in EVs. In August 2023, CAAM reported that China manufactured 589,000 battery electric vehicles (BEVs), comprising 551,000 passenger BEVs and 38,000 commercial BEVs. Additionally, 254,000 plug-in hybrid electric vehicles (PHEVs) were produced in China during the same month, with 253,000 being passenger PHEVs and 1,000 being commercial PHEVs.

Discrete Semiconductor Industry Overview

The discrete semiconductor market is fragmented, with several prominent players, such as ABB Ltd, ON Semiconductor Corporation, Infineon Technologies AG, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, and NXP Semiconductors NV (to be acquired by Qualcomm). The market players strive to innovate advanced and comprehensive products to cater to consumers' complex and evolving requirements.

- March 2024: Infineon introduced the first product in its new advanced MOSFET technology OptiMOS 7 80 V. The IAUCN08S7N013 features a significantly increased power density and is available in the versatile, robust, and high-current SSO8 5 x 6 mm2 SMD package. The OptiMOS 780 V offering perfectly matches the upcoming 48 V board net applications. It is designed specifically for the high performance, high quality, and robustness needed for demanding automotive applications like automotive DC-DC converters in EVs, 48 V motor control, for instance, electric power steering (EPS), 48 V battery switches, and electric two- and three-wheelers.

- February 2024: Onsemi unveiled its 1200 V SPM31 Intelligent Power Modules (IPMs), showcasing the cutting-edge Field Stop 7 (FS7) Insulated Gate Bipolar Transistor (IGBT) technology. These IPMs, known for their superior efficiency and compact design, boast a higher power density, ultimately translating to a reduced overall system cost compared to their industry counterparts. Leveraging these optimized IGBTs, the SPM31 IPMs find their sweet spot in applications like three-phase inverter drives, notably in heat pumps, commercial HVAC systems, servo motors, and various industrial pumps and fans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain / Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment

- 5.1.2 Increasing Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Restraints

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Diode

- 6.1.2 Small Signal Transistor

- 6.1.3 Power Transistor

- 6.1.3.1 MOSFET Power Transistor

- 6.1.3.2 IGBT Power Transistor

- 6.1.3.3 Other Power Transistor

- 6.1.4 Rectifier

- 6.1.5 Thyristor

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 South Korea

- 6.3.6 Taiwan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices and Storage Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Diodes Incorporated

- 7.1.8 Nexperia BV

- 7.1.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 7.1.10 Eaton Corporation PLC

- 7.1.11 Hitachi Energy Ltd (Hitachi Ltd)

- 7.1.12 Mitsubishi Electric Corporation

- 7.1.13 Fuji Electric Co Ltd

- 7.1.14 Analog Devices Inc.

- 7.1.15 Vishay Intertechnology Inc.

- 7.1.16 Renesas Electronics Corporation

- 7.1.17 Rohm Co. Ltd

- 7.1.18 Microchip Technology

- 7.1.19 Qorvo Inc.

- 7.1.20 Wolfspeed Inc.

- 7.1.21 Texas Instrument Inc.

- 7.1.22 Littelfuse Inc

- 7.1.23 WeEn Semiconductors

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS