PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685687

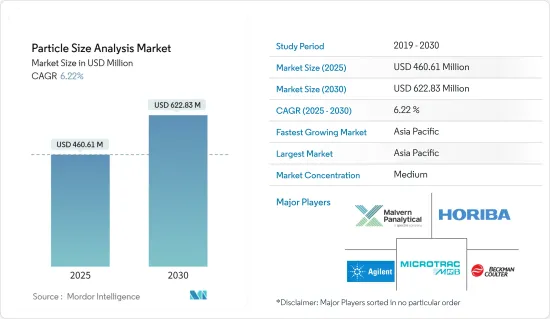

Particle Size Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Particle Size Analysis Market size is estimated at USD 460.61 million in 2025, and is expected to reach USD 622.83 million by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

Key Highlights

- The market is anticipated to experience increasing revenues soon due to its expanding applications in nanotechnology. The extensive impact of nanotechnology in cosmetology applications has led to its widespread integration into the cosmetic industry. Significant global cosmetic companies, including Pureology, Dior, L'Oreal, Proctor & Gamble, Estee Lauder, Colorescience, and Revlon, are at the forefront of integrating nanotechnology into their product lines.

- Research in nanotechnology and rising demands in critical sectors like automotive, aerospace, semiconductors, and pharmaceuticals drive the market's growth. The adoption of advanced particle size analysis methods, known for their precision and adaptability, is planned to amplify this growth. Particle size analysis fosters innovation across various industries by facilitating the creation of superior products with enhanced properties and performance.

- For instance, in May 2024, the Cornell NanoScale Facility conducted an initiative to enhance Nanotechnology Education for students of all ages. In a recent workshop held in July 2023, approximately 120 students visited Duffield Hall. The hall was reimagined as a "nano-fun" zone with interactive science demonstrations. Under Pennell's guidance, the demonstrations delved into diverse realms of nanoscience, spanning microfluidics, photonics, and materials science.

- Particle size analysis plays a crucial role in manufacturing carbon fiber components. Single-wall carbon nanotubes are often subjected to dynamic light scattering (DLS) technology to assess if the required strength of the material could be drawn from a batch of carbon nanotubes.

- However, it is worth noting that the particle size analysis market is affected by certain technique limitations. For instance, the dynamic imaging analysis technique has a restriction in determining the particle size distribution of particles smaller than one micrometer, which hinders its application in certain clinical areas. The high cost of the analyzer and the need for more awareness about the technique are anticipated to impede the growth of the particle analysis market in the predicted timeframe.

- Geopolitical tensions between major economies like Russia, Ukraine, the United States, and China may lead to fluctuations in currency exchange rates, including the Indian rupee. Currency fluctuations may affect the cost of imported equipment for particle size analysis and raw materials, influencing pricing decisions by manufacturers and retailers in the country's market.

Particle Size Analysis Market Trends

Pharmaceuticals Industry to be Largest End User

- Particle size is a critical parameter in the pharmaceutical industry, as it affects surface area and porosity, thereby impacting a drug's bioavailability, effectiveness, and shelf life. Consequently, particle size is monitored in quality control and the development of new active pharmaceutical ingredients (APIs).

- Particle size distribution (PSD) is one of the most important parameters to evaluate when assessing new drugs. For example, particle size is essential for powder inhalers used in treating various lung diseases, as it ensures the effective delivery of the API in powder form to the lungs. The drug is prepared as a powder and inhaled without any propellant gas. The API may be applied in its pure form or adhered to a carrier material, such as lactose.

- The particle size analysis market is experiencing significant growth, driven by the escalating demand for pharmaceutical products. Several critical factors contribute to this expansion, including the rising spending power of consumers, the enhancement of health infrastructure, advancements in diagnostic technologies, and the increased accessibility of pharmaceutical products. According to IQVIA (Midas Quantum) data, US pharmaceutical sales in 2023 were projected to reach approximately USD 678 billion, and global pharmaceutical sales in 2023 were projected to reach approximately USD 1.607 trillion, underscoring the robust growth trajectory of the sector.

- The growth of the pharmaceutical industry in emerging countries also creates a favorable outlook for developing the market. For instance, in recent years, India has emerged as the leading provider of generic medicines, occupying about 20% of the global market share.

- According to Invest India, the country is the world's largest vaccine manufacturer. As particle size analysis is crucial in pharmaceutical manufacturing, as off-spec particle sizes can lower yields, impede production, and ultimately reduce profits, the growing pharmaceutical sales are anticipated to positively impact the market's growth.

- Leading pharmaceutical companies allocate substantial capital to R&D, advanced technologies, and strategic alliances. These investments drive the particle size analysis market's growth and innovation.

- In 2023, Merck & Co. led the industry in R&D spending, significantly outpacing its competitors. Merck & Co. allocated 50.79% of its budget to R&D, partly driven by classifying its USD 10.3 billion Prometheus acquisition as R&D expenditure. In comparison, Roche Pharmaceuticals, Novartis, and Lilly also demonstrated firm R&D commitments, with their ratios ranging from 27% to 30%. Such investments are anticipated to continue to drive the market's growth further.

Asia-Pacific to Register Major Growth

- This region is one of the fastest-growing markets for particle size analysis. The emergence of different new techniques in determining the size of particles and size distribution and growing new industrial applications, especially pharmaceuticals, are expected to boost the market of particle size analyzers in the region.

- The chemical industry holds a significant share of the particle size analysis market, and its expansion drives the demand for particle size analysis. With the region's increasing chemical production, precise control over particle size becomes essential. Particle size directly impacts a chemical's properties, performance, and reactivity.

- For example, catalysts in chemical reactions often depend on specific particle sizes for optimal efficiency. Using particle size analysis techniques, chemical manufacturers can ensure they produce materials with the desired characteristics. This results in better product quality, optimized reaction yields, and the potential development of innovative new chemicals. The growing emphasis on precision and control within the Asian chemical industry will continue to propel the demand for advanced particle size analysis equipment and techniques.

- The region is leading the advancement of nano-sensor technology. South Korea holds the second-highest nanotechnology patents, followed by Japan, China, and Taiwan. This increase in nanotechnology patents is expected to augment market growth, necessitating particle sizing analysis for the tracking of nanoparticles.

- Various semiconductor components are manufactured with the help of particle size analyzers. The region offers a tremendous opportunity for growth. With a large base of untapped markets, such as Vietnam, Indonesia, and India, as well as vast raw material reserves and a leading market for underground mining operations, the region is emerging as one of the biggest markets for mining activity. Australia is one of the largest markets for mining innovation. The strong demand for innovation in the mining sector and continual government support are expected further to develop the market opportunity for particle size analysis.

Particle Size Analysis Industry Overview

The particle size analysis market is semi-consolidated with the presence of major players like Malvern Panalytical Ltd, Horiba Ltd, Agilent Technologies Inc., Microtrac Inc. (Verder Scientific GmbH & Co. KG), and Beckman Coulter Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

June 2024 - Micromeritics Instrument Corporation announced the establishment of direct sales, service, and customer support operations in India. This expansion demonstrates the company's commitment to providing industry-leading solutions and exceptional customer service to the growing Indian market, which would align with the company's growth strategy in emerging economies.

December 2023 - Sympatec GmbH announced the delivery of its 5000th HELOS laser diffraction sensor to the Spanish partner agency NOVATEC. NOVATEC supplied systems for quality control of raw materials through to the product in various industries such as cement, mining, steel, and industrial and scientific research. This showed the company's growth strategy by establishing a partnership network in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Macroeconomic Factors in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Research Activity in the Field of Nanotechnology

- 5.1.2 Advent of Online and Inline Particle Size Analysis

- 5.2 Market Restraints

- 5.2.1 High Costs and Operational Drawbacks

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Taylor Dispersion Analysis

- 6.1.2 Dynamic Light Scattering

- 6.1.3 Nanoparticle Tracking Analysis

- 6.1.4 Resonant Mass Measurement

- 6.1.5 Laser Diffraction

- 6.1.6 Other Technologies

- 6.2 By Dispersion Type

- 6.2.1 Wet Particle

- 6.2.2 Dry Particle

- 6.2.3 Spray Particle

- 6.3 By End-user Industry

- 6.3.1 Chemicals

- 6.3.2 Food, Beverage, and Nutrition

- 6.3.3 Mining

- 6.3.4 Agriculture and Forestry

- 6.3.5 Pharmaceuticals

- 6.3.6 Energy

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Malvern Panalytical Ltd

- 7.1.2 Horiba Ltd

- 7.1.3 Agilent Technologies Inc.

- 7.1.4 Microtrac Inc. (Verder Scientific GmbH & Co. KG)

- 7.1.5 Beckman Coulter Inc.

- 7.1.6 IZON Science Limited

- 7.1.7 Shimadzu Corporation

- 7.1.8 Sympatec GmbH

- 7.1.9 Micromeritics Instruments Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS