PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537721

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537721

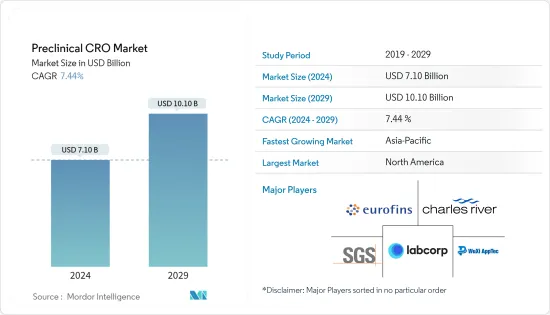

Preclinical CRO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Preclinical CRO Market size is estimated at USD 7.10 billion in 2024, and is expected to reach USD 10.10 billion by 2029, growing at a CAGR of 7.44% during the forecast period (2024-2029).

The studied market growth is primarily attributed to increasing research and development (R&D) expenditure worldwide, increasing the number of drugs in preclinical trials, and high demand for medicines uptake by chronically ill patients between 2024 and 2029.

The increasing research and development expenditure in life sciences and substantial public and private funding spending in the sector boosts market growth. For instance, the Indian Ministry of Science and Technology allocated a budget of INR 40 billion (USD 427.20 million) for the Department of Biotechnology (DBT) of India in the Union Budget for the year 2023-2024. The significant increase in funding is primarily due to the increasing R&D expenditure in the country. Hence, the rising research and development expenditure is expected to increase the adoption of preclinical CRO services to decrease the overall cost of the drug development process.

Similarly, the European Federation of Pharmaceutical Industries and Association (EFPIA) pharmaceutical research and development expenditure in 2022 reached USD 44 billion, which grew by 4.6% compared to the 2021 expenditure. Hence, the increasing R&D expenditure in Europe is expected to increase the demand for preclinical CRO services to reduce the expenditure from 2024 to 2029.

Additionally, the increasing number of drugs in preclinical stages is also expected to increase the demand for outsourcing preclinical services to reduce the cost of development and increase the chances of drug approval for conducting clinical trials. For instance, according to the ClinicalTrials.gov 2024 updated data, as of January 2024, nearly 479 thousand clinical studies were registered globally. This significant increase in clinical trials reflects the number of therapeutics and medical devices that have undergone preclinical trials and received New Drug Application Approval (NDA). Hence, the increasing number of drugs in the preclinical trials is expected to drive the studied market between 2024 and 2029.

However, a lack of standardization, monitoring issues, and stringent regulatory policies are expected to hamper the market's growth.

Preclinical CRO Market Trends

The Toxicology Testing Segment is Predicted to Witness Significant Growth Between 2024 and 2029

Toxicology testing involves the evaluation of the potential adverse effects of chemical substances or pharmaceutical compounds on living organisms. It encompasses a range of methodologies to assess these substances' safety profile, including their potential to cause harm or toxicity. In the dynamic landscape of pharmaceutical research and development, the demand for preclinical toxicology testing services offered by contract research organizations (CROs) is witnessing a significant upsurge. This surge can be attributed to various factors, including the increasing collaboration between pharmaceutical companies and CROs and technological advancements enhancing the efficiency and accuracy of toxicology testing processes.

The expanding partnership between pharmaceutical companies and CROs drives the demand for toxicology testing services. As pharmaceutical companies intensify their drug development efforts, they seek CROs' expertise and infrastructure to conduct essential preclinical toxicology studies. For instance, in May 2023, Immuter partnered with Charles River Laboratories to conduct a good laboratory practice (GLP) toxicology study for its proprietary candidate IMP761 to address autoimmune diseases. Similarly, in March 2024, Badvus Research forged a strategic alliance with Southern Research, focusing on preclinical toxicology testing and regulatory approval processes. These collaborations underscore the pivotal role of CROs in supporting drug development initiatives and ensuring regulatory compliance through comprehensive toxicology assessments.

Toxicology testing in preclinical CROs serves as a vital component of the drug development process, enabling pharmaceutical companies to evaluate the safety profiles of their candidates and make informed decisions regarding their progression in the development pipeline. Hence, increasing the vertical collaboration between pharma companies and CROs is likely to enhance the segmental growth of the market.

North America is Expected to Hold a Significant Share of the Market Between 2024 and 2029

The North American preclinical CRO market is expected to benefit from higher in-house drug development and discovery costs, rising prevalence of chronic diseases, increasing complexity in clinical trials, and a high number of investigational candidates in the development pipeline.

The higher prevalence of chronic diseases like cardiovascular diseases, diabetes, cancer, and neurological disorders necessitates the development of new therapies and treatments. Such a high and evolving burden of chronic diseases forces pharma companies to outsource preclinical trials to investigate promising candidates against those diseases, which is projected to foster the country's market growth over the study period. For instance, according to the American Cancer Society, the prevalence of lung cancer is increasing in the country, and the country reported 238,340 lung cancer cases in 2023 compared to 236,740 in 2022. This data shows a rapid increase in the incidence of cancer cases in the country, and between 2024 and 2029, the incidence of cancer will further increase; thus, the escalating burden of cancer cases in the country is projected to spur the demand for advanced therapeutics and which is in turn projected to foster preclinical trial activities and is anticipated to support country's market growth over the study period.

In addition, the higher in-house drug discovery and development costs facilitate pharmaceutical companies to outsource preclinical trial activities to reduce the cost burden and increased complexity associated with clinical trials. Thus, drug discovery and development costs are anticipated to foster demand for preclinical contract research organizations (CROs) to conduct clinical trials as they have all the required infrastructures. For instance, according to a study conducted by the World Health Organization (WHO) in 2022, the average cost to develop a new drug ranges from USD 43.4 million to USD 4.2 million. Thus, the significant cost associated with new drug development is expected to facilitate the demand for preclinical CROs to perform clinical trials and other research activities on behalf of pharmaceutical companies, as CROs have a better experience and infrastructure to conduct research services. Thus, the high demand for preclinical CROs to conduct research activities is projected to support the country's market growth over the study period.

Hence, the high prevalence of chronic diseases and the higher in-house drug discovery and development costs are expected to drive the studied market in North America between 2024 and 2029.

Preclinical CRO Industry Overview

The preclinical CRO market is highly competitive and fragmented in nature, with the presence of various well-known service providers globally. Major market players compete against each other by expanding their range of solutions and services. There are a few companies that are currently dominating the market. Key players have been involved in various strategic alliances such as acquisitions, collaborations, and the launch of advanced services to secure their position in the global market. These companies include Eurofins Scientific, Charles River Laboratories, WuXi Apptec, Labcorp Drug Development, and SGS SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Research and Development (R&D) Expenditure Worldwide

- 4.2.2 Increase in Number of Drugs in Preclinical Trials

- 4.2.3 High Demand for Medicines Uptake by Chronically Ill Patients

- 4.3 Market Restraints

- 4.3.1 Lack of Standardization and Monitoring Issue

- 4.3.2 Stringent Regulatory Policies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Service

- 5.1.1 Toxicology Testing

- 5.1.2 Bioanalysis and Drug Metabolism and Pharmacokinetics Studies

- 5.1.3 Safety Pharmacology

- 5.1.4 Other Services

- 5.2 By Mode Type

- 5.2.1 Patient Derived Organoid (PDO) Models

- 5.2.2 Patient Derived Xenograft (PDX) Models

- 5.3 By End Users

- 5.3.1 Biopharmaceutical Companies

- 5.3.2 Research Institutes and Universities

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Charles River Laboratories

- 6.1.2 Labcorp Drug Development

- 6.1.3 Thermo Fisher Scientific Inc. (Pharmaceutical Product Development (PPD))

- 6.1.4 NorthEast BioAnalytical Laboratories LLC

- 6.1.5 Parexel International Corporation

- 6.1.6 Medpace

- 6.1.7 Eurofins Scientific

- 6.1.8 WuXi App Tec

- 6.1.9 ICON PLC

- 6.1.10 SGS SA

- 6.1.11 PharmaLegacy Laboratories

- 6.1.12 Altasciences Company Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS