PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693602

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693602

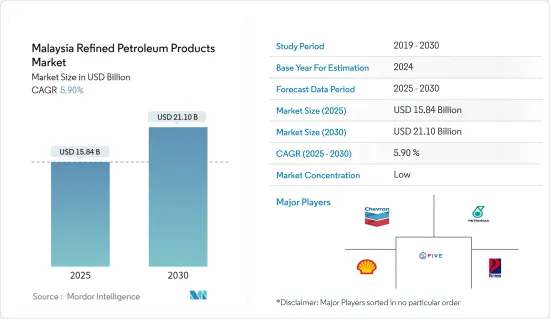

Malaysia Refined Petroleum Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Malaysia Refined Petroleum Products Market size is estimated at USD 15.84 billion in 2025, and is expected to reach USD 21.10 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

Over the long term, the major driving factor of the market is expected to be the surging demand for refined petroleum products in the country.

However, the increasing adoption of alternative fuel vehicles (AFVs) is expected to slow down the growth of the market during the forecast period.

High demand for LPG from the petrochemical sector is expected to create immense opportunities for Malaysia's refined petroleum products.

Malaysia Refined Petroleum Products Market Trends

Petrol is Expected to Dominate the Market

- Petrol, also known as gasoline, is a petroleum-derived flammable liquid used in most spark-ignited internal combustion engines, such as passenger cars, motorcycles, and commercial vehicles. Petrol is produced by the fractional distillation of crude oil, enhanced with various additives to induce particular properties.

- Blends of compounds such as tetraethyl lead and other chemicals are added to petrol to improve its chemical stability and performance characteristics, control corrosiveness, and provide fuel system cleaning. Furthermore, petrol sometimes also contains chemicals such as ethanol, methyl tertiary-butyl ether, or ethyl tertiary-butyl ether, which improves the overall combustion of vehicles.

- Popular petrol variants consumed in Malaysia are RON95 and RON97. As of April 2024, the price of RON95 hovered around USD 0.43 per liter, while RON97 stood at USD 0.73 per liter. RON95 is cheaper than RON97 petrol due to the imposition of government subsidies. However, in November 2023, the government highlighted its plans to limit the subsidy on RON-95 grade fuel in the second half of 2024. The move is intended to fill the budget gap that might impact RON-95 consumption.

- Nevertheless, the demand for petrol in Malaysia is likely to grow in the near future due to the country's rapid industrialization and urbanization, which has resulted in higher demand for passenger vehicles and two-wheelers.

- For instance, as per Malaysia Automotive Association, in 2023, about 799,731 automobiles were sold compared to 721,177 units in 2022. Passenger car sales are attributed to lead the highest growth in Malaysia. As per OPEC's Annual Statistical Bulletin, the refinery throughput in Malaysia has increased to 569 thousand barrels per day, an increase of 26% from the previous year. The increase in refinery capacity signifies a growing demand for refined petrol in Malaysia.

- Therefore, based on the factors mentioned above, petrol product type is expected to dominate the Malaysian refined petroleum products market during the forecast period.

Surging Demand for Refined Petroleum Products is Expected to Propel the Market

- Malaysia has witnessed a steady growth in sales of manufactured refined petroleum products for the past several years. The increase in refined petroleum products can be mainly attributed to the growing demand for LPG as cooking fuel in homes and particularly as a transport fuel.

- Malaysia has invested heavily in refining activities during the past two decades to meet its demand for petroleum products with domestic supplies. International companies have noted significant investments in Malaysia's refinery market. For instance, in April 2023, China's Rongsheng Petrochemical Co. Ltd highlighted its investment of up to USD 16.74 billion to set up a refining facility in Pengerang, Johor, Malaysia.

- The utilization of biofuels blended with refined petroleum products, such as heating oil, gasoline, and diesel fuel, has also been on the rise in Malaysia in recent years. In April 2024, Ecoceres, a biofuel refiner, declared that it would commence its refinery by the second half of 2025, with an estimated capacity of 350,000 metric tons annually. This is likely to lead to growth in sustainable refined petroleum products markets in the near future.

- However, with the growing demand for petroleum products and Malaysia's focus on self-reliance to meet the demand, the downstream infrastructure in the region is expected to increase significantly in the coming years. The country has formulated plans to either expand the current refineries or construct new ones.

- Furthermore, Malaysia is planning to increase downstream activities by creating higher-value-added petroleum products and becoming the oil and gas storage and trading hub. According to the Statistical Review of World Energy, oil consumption in Malaysia in 2022 stood at 894 thousand barrels per day, an increase of 15% from the previous year.

- Therefore, owing to the factors mentioned above, the growing demand for petroleum products is expected to drive the Malaysian refined petroleum products market during the forecast period.

Malaysia Refined Petroleum Products Industry Overview

The Malaysian refined petroleum products market is fragmented. Some of the major players in the market (in no particular order) include Chevron Corporation, Petroliam Nasional Berhad, Shell PLC, FIVE Petroleum Malaysia Sdn Bhd, and Petron Malaysia Refining & Marketing Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Refined Petroleum Products Consumption Forecast in million tons of Oil Equivalent, till 2029

- 4.3 Market Size and Demand Forecast, in USD billion, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.1.1 Surge in Demand of Refined Petroleum Products

- 4.6.1.2 Need for Sustainable Refined Petroleum Products

- 4.6.2 Market Restraints

- 4.6.2.1 Increase in Adoption of Alternative Fuel Vehicles

- 4.6.1 Market Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - By Product Type

- 5.1 Petrol

- 5.2 Diesel

- 5.3 LPG

- 5.4 Other Product Types (Including Kerosene and Aviation Fuel)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Chevron Corporation

- 6.3.2 Petroliam Nasional Berhad

- 6.3.3 Shell PLC

- 6.3.4 FIVE Petroleum Malaysia Sdn Bhd

- 6.3.5 Petron Malaysia Refining & Marketing Bhd

- 6.3.6 Petroleum Sarawak Berhad

- 6.3.7 Gas Malaysia Berhad

- 6.3.8 EcoCeres

- 6.3.9 PETMAL Oil Holdings Sdn Bhd

- 6.3.10 Rongsheng Petrochemical Co. Ltd

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS