PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537697

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537697

Vietnam Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

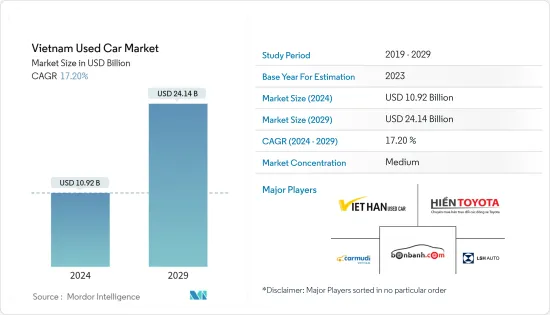

The Vietnam Used Car Market size is estimated at USD 10.92 billion in 2024, and is expected to reach USD 24.14 billion by 2029, growing at a CAGR of 17.20% during the forecast period (2024-2029).

The used car market in Vietnam has been experiencing significant growth, driven by the rising demand for affordable transportation options, the increasing availability of imported used cars, and the expanding middle-income population in Vietnam.

Various factors influence the decision to purchase a used car, including customer preference for personal mobility and hesitance when making big-ticket purchases like cars.

The influx of imported used vehicles, particularly from neighboring countries like India, Japan, and South Korea, has also been a key factor pushing the Vietnamese market for used cars. Additionally, the government's decision to reduce import taxes on used cars has made them more accessible and affordable for Vietnamese consumers. The Vietnamese government has implemented certain strategies to lower new car prices in the domestic market. These strategies include providing a SCT (Special Consumption Tax) rebate on certain automobiles based on engine displacement values.

The growing middle-income population in Vietnam has also contributed to the growth of the used car market. According to a report by the World Bank published in April 2023, the middle-income population in Vietnam is expected to reach 25 million people by 2026, up from 13 million in 2020. This demographic shift has increased the demand for personal vehicles, with many middle-income consumers opting for affordable used cars as their first vehicle purchase.

Overall, the market is expected to grow due to increased digitalization and the introduction of new automotive start-ups with cutting-edge business models.

Vietnam Used Car Market Trends

Online Booking is Witnessing Major Growth

The online booking segment is expected to play a crucial role in the development of the Vietnamese used car market during the forecast period. In recent years, with the growing advancements in technology, customers have preferred purchasing used car vehicles through online sales.

The increasing number of internet users across the country will likely enhance the use of online booking platforms in the coming few years.

- In January 2023, Vietnam had 77.93 million internet users, with an internet usage rate of 79.1% of the total population.

In addition, there has been a rise in the number of new players entering the used car market, which may continue in the coming years. These companies compete with existing players by providing customized services, new vehicles, and a low-pricing strategy. To stay ahead in the market, these companies focus on providing value-added services to prospective clients, reducing service costs, and introducing premium, well-maintained vehicle models and features into their fleets to capture a significant market share.

With the growing trend of buying used cars online through apps, app developers are improving mobile applications by adding advanced features that offer more vehicle options and comparable prices on a single platform. For example, in Vietnam, multiple online platforms, such as Bonbanh, facilitate the purchase and sale of used cars. These apps showcase various used cars that are available for sale, providing a wide range of choices.

Hence, owing to such developments, the online booking segment is expected to be the fastest-growing segment in the market during the forecast period.

Sedans Hold a Significant Market Share

Sedans continue to dominate the used car market in Vietnam. The enduring popularity of sedans in the secondhand market can be attributed to affordability, practicality, and consumer preference for traditional body styles.

- A report by the Vietnam Automobile Manufacturers' Association (VAMA) released in January 2023 highlighted that seven of the top 10 best-selling used car models in 2022 were sedans.

Many young customers prefer pre-owned sedans over entry-level cars, which has become a significant driving force in the used car market. Additionally, middle-income consumers' purchasing power has increased over the past two decades, allowing them to own sedans.

The preference for sedans in Vietnam's used car market is also influenced by cultural factors. An article by Tuoi Tre News published in February 2023 reported that sedans are often perceived as a symbol of status and success in Vietnamese society. Owning a used sedan, even an entry-level model, can be a source of pride for many consumers, further fueling the demand for this body style in the secondhand market.

Additionally, unlike sedans with lower ownership costs, owning an SUV or a truck can be quite expensive due to maintenance and fuel expenses. Finding a reliable and economical car can be challenging, but a wide range of used sedans are affordable and dependable.

Hence, with such developments across the country, the demand for sedans is likely to grow in the Vietnamese market during the forecast period.

Vietnam Used Car Industry Overview

The Vietnamese used car market is dominated by several key players, such as Carmudi Vietnam, Oto, Bonbanh.com, and LSH Auto International Limited. While some prominent players are focused on fleet expansion and collaborations, the new entrants are focused on widening their customer base by adopting varying strategies. Social media platforms, such as Facebook, and online auto classifieds portals in Vietnam, such as Oto and Carmudi, have provided high user convenience to buyers looking forward to purchasing a used car as these platforms offer a detailed description of all the listed used cars.

- In November 2023, the used car trading platform Carpla opened its fifth Automall in the system. The new Automall is located at 138 Pham Van Dong, Hanoi, and boasts an area of over 4,000 m2. It is also the second Automall to be built in the capital.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Affordability and Availability of Used Cars Compared to New Cars

- 4.2 Market Restraints

- 4.2.1 Trust and Transparency in Used Car Remained is a Key Challenge for Consumers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sports Utility Vehicle (SUV) and Multi-purpose Vehicle (MPV)

- 5.2 By Fuel Type

- 5.2.1 ICE

- 5.2.2 Electric

- 5.3 By Booking Type

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Vehicle Age

- 5.4.1 Up to 5 years

- 5.4.2 Above 5 years

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Oto (Semua Hak Cipta Dilindungi)

- 6.2.2 Bonbanh.com

- 6.2.3 Hien Toyota

- 6.2.4 SiamMotorworld

- 6.2.5 Honda Certified Used Car (Honda Automobile (Thailand) Co. Ltd)

- 6.2.6 Carmudi Vietnam

- 6.2.7 Pixy Asia Co. Ltd

- 6.2.8 Asia Web Holding (Thailand) Co. Ltd

- 6.2.9 Thanh Xuan Ford

- 6.2.10 LSH Auto International Limited

- 6.2.11 Viet Han Used Cars

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 PENETRATION OF THE USED CAR MARKET BASED ON DEMOGRAPHICS