PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644842

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644842

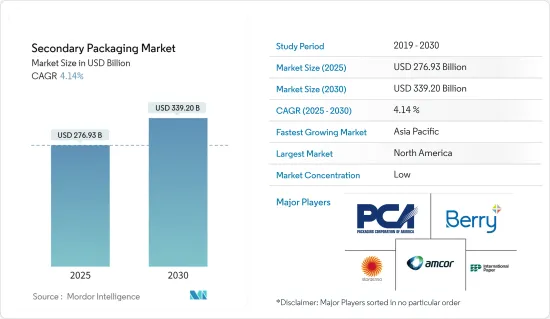

Secondary Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Secondary Packaging Market size is estimated at USD 276.93 billion in 2025, and is expected to reach USD 339.20 billion by 2030, at a CAGR of 4.14% during the forecast period (2025-2030).

Key Highlights

- Secondary packaging plays a pivotal role in product protection by holding them together and optimizing the product for transportation. Cartons, trays, and film bundles are a few examples of secondary packaging available in several shapes and sizes. Secondary packaging is also important for brand marketing and product display.

- The increasing deployment of secondary packaging for multiple end-user industries, including food and beverage, pharmaceuticals, cosmetics, personal care, and household care, is boosting market growth.

- Companies providing secondary packaging aim for circularity and sustainability as a growth strategy to increase the availability of recycled solutions for secondary packaging applications. In June 2023, LyondellBasell and AFA Nord entered a partnership to recycle post-commercial flexible secondary packaging waste. In the joint venture, LMF Nord GmbH planned to build a recycling plant to turn LDPE waste into quality recycled plastic material that can be used in packaging.

- Secondary packaging in healthcare is used to provide an additional level of protection and organization for primary packaging, including bottles, vials, and blisters. Secondary packaging can also provide important information about the product, such as dosage instructions, expiration dates, and regulatory information, and help prevent counterfeiting and tampering, thus boosting product demand.

- Various manufacturers of secondary packaging are subject to stringent regulations, which can make it challenging for them to innovate new products. Also, evolving consumer preferences for secondary packaging can make it difficult for manufacturers to compete in the market.

Secondary Packaging Market Trends

The Folding Cartons Segment is Expected to Hold a Significant Market Share

- Folding carton demand has been increasing across many industries, including food and beverage, healthcare, personal care, homecare, retail, and others, as the focus shifts to eco-friendly and sustainable practices. The need for folding cartons is driven by consumer awareness of sustainable packaging preferences, availability of raw materials, the lightweight, biodegradable, and recyclable nature of paper, and deforestation.

- Rapidly growing tourism in different countries has led to the high consumption of processed food, carbonated beverages, and ready-to-eat foods. The food service industry's requirement for secondary packaging has been reshaped, fueling the demand for folding cartons that are approved by the FDA (Food and Drug Administration). The availability of versatile and eye-catching food folding cartons boosts product demand.

- Various companies are investing in mergers and acquisitions as an expansion strategy to boost their market share. In September 2023, Graphic Packaging, a US packaging company, announced the acquisition of Bell Inc., a US folding carton company. The acquisition included Bell's three converting facilities in the United States, which is likely to grow Graphic's presence in the food service packaging market.

- Various companies are manufacturing personalized and innovative folding cartons to package different beauty products, including cosmetics, skincare, and haircare, boosting the demand. Companies are also aiming toward sustainable packaging by using eco-friendly materials to make folding cartons.

- According to the Forest and Agriculture Association of the United States, in 2023, the production capacity of paper and paperboard was approximately 258,631 thousand tons globally. The production of paper and paperboard has been stable over the past decade with respect to the growing demand in various end-user industries. Such factors are expected to create an opportunity for the players in the market to develop new products to capture market share.

North America is Expected to Hold a Significant Market Share

- The North American market for secondary packaging is being driven by the increasing usage of environment-friendly materials in secondary packaging. End users, such as the food and beverage, pharmaceutical, and cosmetic industries, are becoming increasingly aware of the need to utilize environment-friendly packaging materials to cater to growing sustainability demand. Folding cartons made from recyclable and biodegradable materials like paperboard promote sustainability, propelling market growth.

- Increasing customer spending and growing online shopping sales influence the expansion of e-commerce. According to the US Census Bureau, e-commerce sales accounted for 15.6% of all US retail sales in the first quarter of 2024, higher than the first quarter of 2023, propelling the market growth.

- The rapidly booming pharmaceutical industry in North America and the growing advancements in developing a variety of new drugs are driving the demand for secondary packaging. In May 2024, Sharp Services, a United States-based contract packaging company, announced the expansion of its Pennsylvania manufacturing site to increase its production capacity for sterile injectables secondary packaging.

- The secondary packaging for beverages serves different purposes. The secondary packaging is used to protect heavy bottles from breaking, and it reduces costs by shipping multiple items together. It may sometimes be used as a barrier or protection against sunlight exposure or other external challenges. The secondary packaging for beverages helps in product marketing and enhances product visibility, thus driving market growth.

Secondary Packaging Industry Overview

The secondary packaging market is fragmented, with major players adopting various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in the market. Some of the major players in the market are Amcor, International Paper Company, Reynolds Packaging, Stora Enso, WestRock, Ball Corporation, and Berry Global.

- May 2024: Mondi unveiled a new secondary paper packaging solution, "TrayWrap," to replace plastic shrink film used for food and beverage products. TrayWrap is made from 100% krafted paper, which is fully recyclable.

- September 2023: WestRock, a United States-based company, merged with Smurfit Kappa, an Ireland-based company, to create Smurfit WestRock to manufacture sustainable packaging solutions. The joint venture was a strategic move by the companies to expand Smurfit's product portfolio in corrugated and containerboard, along with regional expansion for various end-user markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the Geo-Political Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Industrial and Consumer Activities across the World

- 5.1.2 Increased Need for Safe Transportation

- 5.2 Market Restraints

- 5.2.1 Changing Consumer Needs and Awareness Towards a Sustainable Environment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Plastic Crates

- 6.1.4 Wraps and Films

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Consumer Electronics

- 6.2.5 Personal Care and Household Care

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Berry Global Inc.

- 7.1.3 Packaging Corporation of America

- 7.1.4 Stora Enso Oyj

- 7.1.5 WestRock Company

- 7.1.6 Ball Corporation

- 7.1.7 International Paper Company

- 7.1.8 Sealed Air Corporation

- 7.1.9 Reynolds Group Holdings

- 7.1.10 Mondi Group

- 7.1.11 Multi-Pack Solutions LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET