PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537664

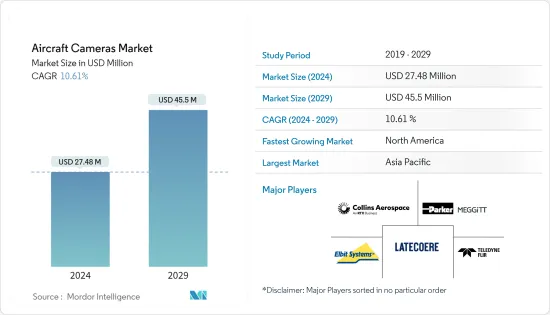

Aircraft Cameras - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Aircraft Cameras Market size is estimated at USD 27.48 million in 2024, and is expected to reach USD 45.5 million by 2029, growing at a CAGR of 10.61% during the forecast period (2024-2029).

Aircraft cameras serve a multitude of functions both within and outside aircraft. These applications range from ground maneuvering and cabin surveillance to external security measures. They play a crucial role in military operations, including refueling, surveillance, and targeting, aiding in observation, identification, and self-protection.

Rising passenger traffic is driving the demand for commercial aircraft, with many deliveries expected in the upcoming years. Simultaneously, as nations globally focus on modernizing their military capabilities, there is a heightened interest in next-gen military aircraft. This surge in commercial and military aircraft directly boosts the demand for aircraft cameras.

However, the high cost of camera imaging technology and its susceptibility to damage from hazardous events present challenges. These challenges could impede such technology's economic viability, particularly for smaller airlines. Despite these hurdles, ongoing advancements in camera technology, like improved resolution, better low-light performance, and sleeker designs, paint a promising picture for the market. Manufacturers leading these innovations are poised to gain a competitive edge by providing state-of-the-art camera solutions for aerial vehicles.

Aircraft Cameras Market Trends

Military Aircraft Segment to Dominate Market Share

- Military aircraft rely on cameras for myriad functions, from surveillance and situational awareness to targeting and self-protection. In 2023, global military expenditure reached a substantial USD 2.44 trillion. Modern military aircraft, especially the latest generations, heavily lean on imaging sensors for their diverse operations. The rising demand for military aircraft, coupled with the imperative for heightened situational awareness among military pilots, is propelling the growth of this market segment. In August 2023, the US government, under a USD 500 million Foreign Military Sales agreement, approved the sale of infrared search and track (IRST) technology to Taiwan for its F-16 Fighting Falcon fleet. This IRST, a sophisticated camera and ISR tool, is pivotal in securing aerial dominance for Taiwan.

- Furthermore, leading OEMs spearhead the development of cutting-edge multi-spectral IR laser-based countermeasure systems. These systems are designed to shield a broad spectrum of aircraft, ranging from large fixed to rotary wings, from the threat of infrared-guided missiles. For instance, in August 2023, Elbit Systems unveiled its suite of solutions, including the Directed IR Countermeasures (DIRCM), at DALO Days 2023. The showcased DIRCM solution, equipped with advanced laser technology and a high frame-rate thermal camera, excels in swift and precise threat detection and jamming. Elbit Systems' DIRCM solutions have garnered the trust of several prominent entities, such as the Israel Airforce, NATO, and the German, Italian, and Brazilian Air forces, for safeguarding their military aircraft and helicopters. These advancements are poised to fuel the segment's growth in the coming years.

Asia-Pacific Expected to Hold Largest Market Share

- During the forecast period, Asia-Pacific is poised to emerge as the dominant market for aircraft cameras, driven by escalating demands for both military and commercial aircraft. The region's robust rebound in international passenger traffic is set to bolster its commercial aviation sector.

- Notably, in June 2023, Air India inked deals with Airbus and Boeing, ordering 250 and 220 aircraft, respectively, with a subset of 10 B777X jets. Boeing's B777X lineup notably features a Ground Maneuver Camera System (GMCS), aiding pilots with views of the nose and main gear areas. In December 2023, Air India further bolstered its fleet by reaching a contract with Airbus for 20 A350-900s and 20 A350-1000s, highlighting the A350's tail cameras, designed to assist pilots during ground maneuvers. Major aircraft OEMs have intensified their focus on developing camera systems to enhance aircraft safety, particularly during landings. Airbus, for instance, initiated tests in January 2023 with its DragonFly flight system, showcasing its ability to autonomously land aircraft using computer vision and multiple cameras, especially in emergencies.

- In the military, cameras play a pivotal role in ISR operations on military aircraft. Notably, several countries in the Asia-Pacific are upgrading their surveillance aircraft with advanced EO/IR cameras. In a notable move in March 2023, the Royal Thai Navy enlisted General Atomics AeroTec Systems (GA-ATS) for extensive modernization and maintenance on two Dornier 228s, equipping them with a 360° mission radar and electro-optical/infrared camera. Such developments are driving the market's growth across the globe.

Aircraft Cameras Industry Overview

The aircraft cameras market is semi-consolidated, as only a few players account for a major market share. Elbit Systems Ltd, LATECOERE SA, Meggitt Ltd, Teledyne FLIR LLC, and Collins Aerospace (RTX Corporation) are prominent players in the market. Market players are significantly increasing their R&D investments to enhance their aircraft camera products. They aim to boost situational awareness and entice a fresh customer base.

Moreover, these players are strategically pursuing extended contracts with aircraft OEMs. Such agreements promise sustained revenues and are incredibly lucrative given the multi-year duration of aircraft programs. Additionally, a surge of new entrants, particularly in the military segment, is being witnessed, spurred by governmental initiatives favoring indigenization. This influx is poised to intensify market competition in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Commercial Aircraft

- 5.1.2 Military Aircraft

- 5.2 By Type

- 5.2.1 Internal Cameras

- 5.2.2 External Cameras

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Israel

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 KID-Systeme GmbH

- 6.2.2 LATECOERE SA

- 6.2.3 Meggitt Ltd

- 6.2.4 Teledyne FLIR LLC

- 6.2.5 Collins Aerospace (RTX Corporation)

- 6.2.6 AD Aerospace Ltd

- 6.2.7 Kappa optronics GmbH

- 6.2.8 Cabin Avionics Limited

- 6.2.9 Eirtech Aviation Services Limited

- 6.2.10 Elbit Systems Ltd

- 6.2.11 L3Harris Technologies Inc.

- 6.2.12 THALES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS