PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911278

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911278

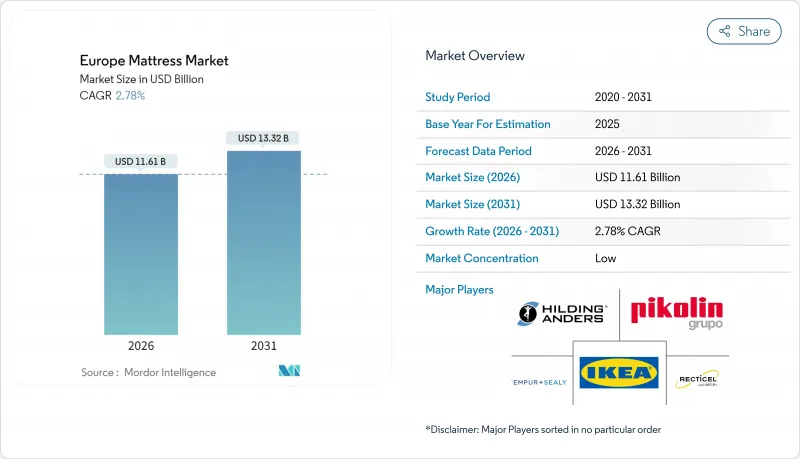

Europe Mattress - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe mattress market size in 2026 is estimated at USD 11.61 billion, growing from 2025 value of USD 11.30 billion with 2031 projections showing USD 13.32 billion, growing at 2.78% CAGR over 2026-2031.

Moderate yet consistent expansion is underpinned by premiumization, demographic aging, stringent circular-economy rules, and the rapid maturation of online direct-to-consumer (D2C) channels. Mature household penetration in Western Europe is steering growth toward replacement demand, value-added features, and smart sleep technologies. Regulatory levers, including the Ecodesign for Sustainable Products Regulation (ESPR) and Extended Producer Responsibility (EPR) frameworks, are reshaping product development and end-of-life strategies. Competitive intensity is rising as incumbents embrace omnichannel models while digital-native challengers scale across borders. Opportunities cluster around orthopaedic innovations, hospitality refurbishment cycles, and circular business models that cut costs and satisfy tightening environmental mandates.

Europe Mattress Market Trends and Insights

Growing Demand for Premium & Luxury Mattresses

Affluent households and boutique hospitality chains continue to trade up, favoring advanced materials, certified sustainability, and tailored ergonomics. Segment resilience is reinforced by wellness-centric consumer mindsets, with traceable supply chains and carbon-neutral labeling becoming table stakes. Manufacturers are vertically integrating to secure premium foam grades and artisanal upholstery, locking in margins and raising entry barriers. Retailers are curating experiential showrooms where in-store diagnostics match sleepers with bespoke builds. As premium penetration deepens, late-cycle demand shifts from mass propositions to differentiated wellness narratives.

Rapid Shift Toward Online D2C "Bed-in-a-Box" Sales

Digital-first disruptors lowered purchase friction through free trials, compressed packaging, and border-agnostic logistics. Pandemic-era adoption has endured, with omnichannel hybrids emerging-Emma's flagship in London demonstrates that physical storefronts amplify digital funnels. Cost-effective last-mile networks and algorithmic personalization sharpen competitive edges, yet the General Product Safety Regulation (GPSR) amplifies compliance overheads for web-only sellers. Data-rich feedback loops accelerate product iteration cycles, allowing D2C brands to refresh line-ups quarterly, far faster than traditional catalog rotations.

Market Saturation in Western Europe Curbing First-Time Sales

Household mattress ownership approaches 1.07 units per dwelling in Germany, France, and the Netherlands, trimming headroom for new transactions. Growth pivots to premium upgrades, smart add-ons, and subscription replacements that smooth cash outlays. Small regional makers face consolidation pressure as retail real estate rationalizes. The shift intensifies competition for share-of-wallet against adjacent wellness products such as adjustable bases and sleep trackers. Brands, therefore, refine loyalty programs and recycling to lock in repeat purchase cycles.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population Spurring Orthopaedic & Therapeutic Products

- Hospitality Refurbishment Cycles Driving Bulk Replacement

- Volatile Polyurethane & Latex Prices Squeezing Manufacturer Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid models are the fastest risers, advancing at a 4.22% CAGR from 2026-2031, buoyed by the fusion of coil responsiveness with foam contouring. Hybrid share gains leverage young households' desire for balanced comfort and hotter sleepers' need for airflow. In the commercial sphere, hotels adopt hybrids to heighten guest reviews while meeting durability benchmarks. The Europe mattress market size for hybrids is expected to reach USD 4.45 billion by 2031, equivalent to 33.10% of category revenue. Sensor-enabled hybrids capable of sleep-stage reporting, temperature modulation, and maintenance alerts further distinguish premium tiers, strengthening brand lock-in.

Foam and latex remain vital niche categories. Viscoelastic foam supports healthcare pressure-relief applications, whereas natural latex attracts eco-conscious buyers. Innerspring/coil formats preserve a 47.78% share, underlining the residual demand for budget comfort and firm feel preferences. Regulatory emphasis on recyclability accelerates coil-foam separable constructions, reducing disassembly labor and diverting tonnage from landfill. The segment's success is increasingly dependent on manufacturers' ability to balance performance, sustainability, and cost-effectiveness while meeting evolving regulatory requirements.

Queen-size holds the lion's 34.71% share, aligning with standard European bed frames and hospitality bedding protocols. However, king-size growth accelerates to 3.52% CAGR as rising disposable incomes and larger dwelling footprints in the Nordics and Germany accommodate upsizing. The Europe mattress market size for king-size units will exceed USD 3.34 billion by 2031, supported by couples seeking enhanced personal space and luxury hoteliers upgrading suites. Logistics hurdles-bulkier freight and higher last-mile costs-are countered through vacuum-roll compression and white-glove delivery.

Single and double formats cater to student housing, first apartments, and elder-care facilities, preserving volume albeit at lower average selling prices. Custom lengths for healthcare bariatric beds and super-king options in ultra-luxury resorts introduce SKUs that challenge operational complexity yet deliver margin uplift. The growth in king-size demand is also driving innovation in adjustable bases and smart bedroom ecosystems, as consumers seek integrated sleep solutions. Market players are investing in flexible manufacturing capabilities that can efficiently produce multiple size categories while maintaining quality consistency across their product portfolios.

The Europe Mattress Market Report is Segmented by Product Type (Innerspring/Coil, Foam, Latex, Hybrid, Other Mattress Types), Mattress Size (Single-Size, Double-Size, Queen-Size, King-Size, Custom & Specialty Sizes), End User (Residential, Commercial), Distribution Channel (B2C/Retail, B2B/Project), and Geography. The Market Forecasts are Provided in Terms of Value (USD), Based On Availability.

List of Companies Covered in this Report:

- Hilding Anders

- Tempur Sealy International Inc.

- Recticel NV/SA

- IKEA Group

- Pikolin Group

- Silentnight Group

- Emma - The Sleep Company

- Simba Sleep

- Magniflex

- Dormeo (Studio Moderna)

- Serta Simmons Bedding LLC

- Hypnos Beds

- Harrison Spinks

- Bensons for Beds

- Relyon Beds

- Dorelan

- Koninklijke Auping BV

- Beter Bed Holding NV (M line)

- Sleepeezee

- Ergoflex

- Dunlopillo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand For Premium & Luxury Mattresses

- 4.2.2 Rapid Shift Toward Online D2C "Bed-In-A-Box" Sales

- 4.2.3 Ageing Population Spurring Need For Orthopaedic & Therapeutic Products

- 4.2.4 Hospitality Refurbishment Cycles Driving Bulk Replacement

- 4.2.5 EU Circular-Economy Rules Accelerating Recyclable Mattress Adoption

- 4.2.6 Emergence Of European Smart-Sleep Tech Integrated Into Mattresses

- 4.3 Market Restraints

- 4.3.1 Market Saturation In Western Europe Curbing First-Time Sales

- 4.3.2 Volatile Polyurethane & Latex Prices Squeezing Manufacturer Margins

- 4.3.3 Upcoming EPR Fees Raising End-Of-Life Disposal Costs

- 4.3.4 Carbon-Border Tariffs Inflating Locally-Made Input Costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

- 4.8 Insights on Consumer Behavior Analysis and Preferences in the Market (key motivational factors, preferred sales channel, demographics, key influencers and decision-makers)

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Innerspring / Coil

- 5.1.2 Foam (including memory foam)

- 5.1.3 Latex

- 5.1.4 Hybrid

- 5.1.5 Other Mattress Types

- 5.2 By Mattress Size

- 5.2.1 Single-size Mattress

- 5.2.2 Double-size Mattress

- 5.2.3 Queen-size Mattress

- 5.2.4 King-size Mattress

- 5.2.5 Custom & Specialty Sizes

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Mass Merchandisers

- 5.4.1.2 Specialty Mattress Stores (including exclusive brand outlets)

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Project

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Hilding Anders

- 6.4.2 Tempur Sealy International Inc.

- 6.4.3 Recticel NV/SA

- 6.4.4 IKEA Group

- 6.4.5 Pikolin Group

- 6.4.6 Silentnight Group

- 6.4.7 Emma - The Sleep Company

- 6.4.8 Simba Sleep

- 6.4.9 Magniflex

- 6.4.10 Dormeo (Studio Moderna)

- 6.4.11 Serta Simmons Bedding LLC

- 6.4.12 Hypnos Beds

- 6.4.13 Harrison Spinks

- 6.4.14 Bensons for Beds

- 6.4.15 Relyon Beds

- 6.4.16 Dorelan

- 6.4.17 Koninklijke Auping BV

- 6.4.18 Beter Bed Holding NV (M line)

- 6.4.19 Sleepeezee

- 6.4.20 Ergoflex

- 6.4.21 Dunlopillo

7 Market Opportunities & Future Outlook

- 7.1 Smart Mattresses Integrating Sleep Health Monitoring

- 7.2 Eco-Friendly Materials Driving Consumer Purchase Decisions