PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940723

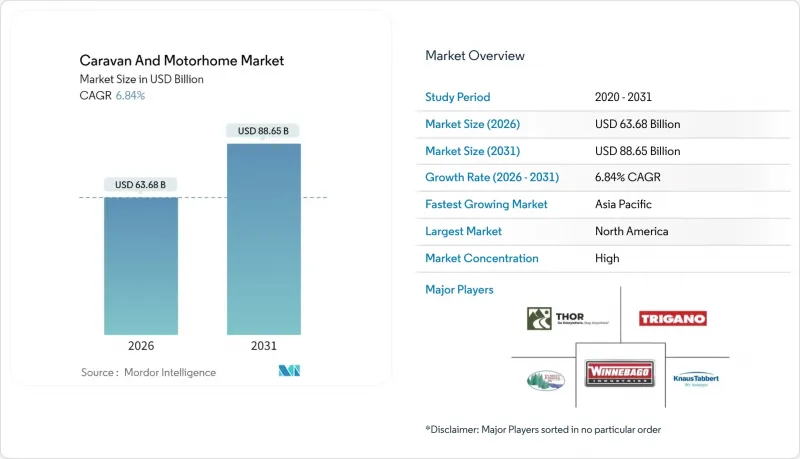

Caravan And Motorhome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The caravan and motorhome market size in 2026 is estimated at USD 63.68 billion, growing from 2025 value of USD 59.60 billion with 2031 projections showing USD 88.65 billion, growing at 6.84% CAGR over 2026-2031.

Continued growth aligns with rising demand for experiential travel, the spread of remote-work lifestyles, and sustained interest in domestic road trips that gained traction during the pandemic. Technological advances such as modular chassis platforms and 48-volt DC electrical systems enhance off-grid capability. At the same time, demographic shifts toward millennial and Gen-Z buyers inject fresh spending power into the caravan and motorhome market. North America retains leadership because of a mature RV culture and expansive campground infrastructure. In contrast, the Asia-Pacific region registers the fastest regional expansion as disposable incomes and outdoor recreation participation climb. Competitive intensity rises as European brands globalize and new entrants focus on electric and modular formats that traditional hospitality options struggle to match.

Global Caravan And Motorhome Market Trends and Insights

Growing Preference for Domestic and Outdoor Travel Post-COVID

The recent industry survey highlights a growing preference for planned camping and road trips, reflecting a shift from international to domestic travel. Safety concerns, border complexities, and the cost-effectiveness of local exploration drive this trend. RV camping continues to gain popularity, helping stabilize the caravan and motorhome market amid broader economic uncertainties. Well-developed campground networks in North America and Europe offer convenience comparable to hotels, enhancing the appeal of RV travel. For many families, owning an RV is a strategic way to manage unpredictable travel costs, reinforcing long-term demand.

Surging Millennial and Gen-Z RV Ownership

The average RV buyer's age fell from 53 to 49 years as millennials and Gen-Z consumers elevated adventure travel over asset accumulation, positioning younger cohorts to influence design and marketing strategies . Most owners aged 35-54 prioritize connectivity, sustainability, and flexible interiors, steering manufacturers toward lighter materials, solar integration, and modular furniture. Social media further amplifies demand, as peer reviews and influencer content normalize full-time or hybrid nomadic lifestyles. Lenders have responded with term structures that mirror auto financing, helping first-time buyers surmount high ticket prices. Continuous engagement through upgrades and digital features improves retention and feeds repeat purchases, supporting sustained caravan and motorhome market growth.

High Initial Purchase and Ownership Cost

The cost of financing new and used RV units is placing significant pressure on household budgets. Additional expenses like insurance, maintenance, and storage often lead to early resale, dampening customer satisfaction and reducing positive word-of-mouth. Despite strong lifestyle alignment with RV travel, younger buyers are susceptible to pricing due to limited disposable income. Oversupply in some markets has led to notable price corrections, underscoring how elevated prices can amplify volatility. The industry continues to face the challenge of managing affordability without compromising profitability.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Remote-Work-Enabled "Work-From-RV" Lifestyle

- Emergence of Modular, Upgradable RV Platforms

- Competition From DIY Van Conversions and Peer-To-Peer Rentals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Caravans captured 61.34% of the caravan and motorhome market revenue in 2025 as value-minded buyers favored lower acquisition costs and the flexibility of using the tow vehicle for daily transit. Within this segment, travel trailers span budget to luxury price points, broadening appeal, while fifth-wheel units attract full-time users seeking residential comfort. Folding campers, though lighter and garage-friendly, lose share as customers graduate to hard-sided models that offer better insulation and security. Motorhomes, however, are forecast for an 8.08% CAGR through 2031, eclipsing the broader caravan and motorhome market pace thanks to integrated living-driving layouts that ease spontaneous travel. Class B vans stand out among urban adventurers for parking convenience, whereas Class A coaches draw retirees and digital nomads willing to invest in spacious interiors.

Growing millennial interest in turnkey solutions benefits motorhomes, incorporating driver-assistance tech, solar arrays, and smart-home controls more readily than towables. Thor Industries' hybrid Class A prototype and Jayco's USD 460,000 Embark EV illustrate premium adoption of integrated propulsion and living systems. Caravan makers counter with lighter composite walls and modular interiors to close the innovation gap. As campsite booking APIs and solar-storage packages become standard, product differentiation hinges on digital ecosystems as much as floor plans. Consequently, caravans will retain volume leadership, but motorhomes will set the technological agenda of the caravan and motorhome market.

Internal combustion engine models retained 91.74% of the caravan and motorhome market revenue in 2025, reflecting well-established fueling networks and proven durability. Yet battery-electric RVs are projected for a 8.94% CAGR through 2031, well above the overall caravan and motorhome market size trajectory, as environmental regulations tighten and battery costs fall. Early entrants like Lightship's aerodynamic travel trailer highlight demand for silent operation and low running costs. Hybrid systems serve as a bridge, pairing combustion engines for range with electric motors for campground maneuverability and quiet overnight power.

Fleet rental firms adopt electrics fastest, using predictable routes and depot charging to mitigate infrastructure gaps. Consumer adoption remains sensitive to national park charging restrictions and upfront pricing, but state and provincial incentives improve ROI metrics annually. Manufacturers leverage commercial EV chassis from Ford E-Transit or Mercedes eSprinter platforms to shorten development cycles. Lighter packs free interior space as battery density rises, easing the length-regulation tension. Overall, combustion will dominate this decade, yet electrification sets the innovation narrative for the caravan and motorhome market.

The Caravan and Motorhome Market Report is Segmented by Product Type (Caravan and Motorhome), Propulsion (Internal Combustion Engine, Hybrid, and Battery-Electric), Length (Below 6m, 6-8m, and Above 8m), End User (Direct Buyers and Fleet Owners), Sales Channel (Franchise Dealerships, Company-Owned Stores, and Online Direct-To-Consumer), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America controlled 53.25% of the caravan and motorhome market revenue in 2025, underpinned by deep-rooted RV culture, vast public lands, and financing structures that ease high-ticket purchases. The United States shipments climbed in 2025 and are projected to grow in the coming years, signaling resilient domestic demand despite higher interest rates. Canada contributes specialized composite-panel suppliers and a growing cohort of full-time digital nomads, strengthening regional aftermarket ecosystems. National park entry fees and campground upgrades funnel public funds into site expansion, supporting usage growth. The caravan and motorhome market also benefits from the widespread availability of Class B conversions that suit urban storage restrictions.

Europe advanced steadily, led by Germany. Compact layouts remain essential due to narrow roads and stringent emission zones. Italy and Spain focus on agri-tourism sites that welcome RVs, diversifying overnight options beyond commercial campgrounds. Scandinavian countries see higher electric adoption spurred by renewable energy incentives, adding a technology edge to the region's caravan and motorhome market.

Asia-Pacific records the fastest 8.55% CAGR through 2031, propelled by rising disposable income and evolving tourism policies. Japan's RV market is growing, featuring innovations like electric pop-up roofs that preserve garage height limits. China's middle class shows growing interest, supported by government promotion of domestic tourism corridors, yet infrastructure gaps persist in western provinces. Australia's mature caravan scene benefits from peer-to-peer rentals, with Camplify's fleet expansion driving utilization. Emerging markets like South Korea and India invest in roadway rest areas with RV hookups, establishing early-stage demand. Overall, infrastructural progress and lifestyle shifts keep the Asia-Pacific pivotal to future caravan and motorhome market size growth.

- Thor Industries Inc.

- Forest River Inc.

- Winnebago Industries Inc.

- Trigano SA

- Knaus Tabbert AG

- Swift Group

- Erwin Hymer Group

- Jayco Inc.

- Burstner GmbH & Co. KG

- Dethleffs GmbH and Co. KG

- Triple E Recreational Vehicles

- Tiffin Motorhomes Inc.

- Coachmen RV

- REV Group

- Leisure Travel Vans

- Airstream Inc.

- Adria Mobil d.o.o

- Hobby-Wohnwagenwerk

- Westfalia Mobil GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Millennial and Gen-Z RV Ownership

- 4.2.2 Rise in Remote-Work-Enabled "Work-From-RV" Lifestyle

- 4.2.3 Growing Preference for Domestic and Outdoor Travel Post-COVID

- 4.2.4 Emergence Of Modular, Upgradable RV Platforms

- 4.2.5 Adoption of 48-V DC Electrical Architectures for Off-Grid Capability

- 4.2.6 OEM-Campground API Integrations Enabling Real-Time Site Booking

- 4.3 Market Restraints

- 4.3.1 High Initial Purchase and Ownership Cost

- 4.3.2 Interest-Rate-Sensitive Financing Environment

- 4.3.3 Competition From DIY Van Conversions and Peer-To-Peer Rentals

- 4.3.4 Grid-Access Restrictions for High-Capacity Battery RVs in National Parks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Product Type

- 5.1.1 Caravan

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhome

- 5.1.2.1 Class A

- 5.1.2.2 Class B (Van Conversions)

- 5.1.2.3 Class C

- 5.1.1 Caravan

- 5.2 By Propulsion

- 5.2.1 Internal-Combustion Engine (ICE)

- 5.2.2 Hybrid (Parallel / Series)

- 5.2.3 Battery-Electric RV

- 5.3 By Length

- 5.3.1 Below 6 meters

- 5.3.2 6-8 meters

- 5.3.3 Above 8 meters

- 5.4 By End User

- 5.4.1 Direct Buyers

- 5.4.2 Fleet Owners - Rental and Subscription Platforms

- 5.5 By Sales Channel

- 5.5.1 Franchise Dealerships

- 5.5.2 Company-Owned Stores

- 5.5.3 Online Direct-to-Consumer

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 Australia

- 5.6.4.4 South Korea

- 5.6.4.5 India

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Thor Industries Inc.

- 6.4.2 Forest River Inc.

- 6.4.3 Winnebago Industries Inc.

- 6.4.4 Trigano SA

- 6.4.5 Knaus Tabbert AG

- 6.4.6 Swift Group

- 6.4.7 Erwin Hymer Group

- 6.4.8 Jayco Inc.

- 6.4.9 Burstner GmbH & Co. KG

- 6.4.10 Dethleffs GmbH and Co. KG

- 6.4.11 Triple E Recreational Vehicles

- 6.4.12 Tiffin Motorhomes Inc.

- 6.4.13 Coachmen RV

- 6.4.14 REV Group

- 6.4.15 Leisure Travel Vans

- 6.4.16 Airstream Inc.

- 6.4.17 Adria Mobil d.o.o

- 6.4.18 Hobby-Wohnwagenwerk

- 6.4.19 Westfalia Mobil GmbH

7 Market Opportunities and Future Outlook