PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537607

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537607

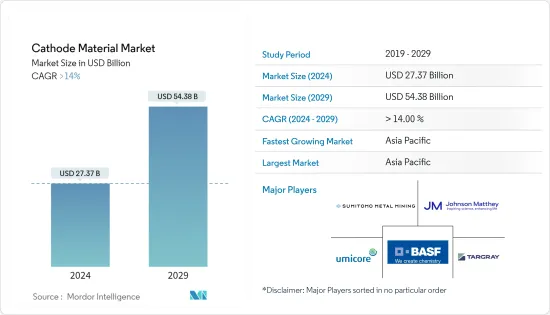

Cathode Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Cathode Material Market size is estimated at USD 27.37 billion in 2024, and is expected to reach USD 54.38 billion by 2029, growing at a CAGR of greater than 14% during the forecast period (2024-2029).

The COVID-19 pandemic had a mixed impact on the global cathode materials market. While there was a temporary slowdown in the manufacturing and automotive sectors, which are major consumers of cathode materials, the growth in electric vehicles (EVs) and renewable energy sectors remained strong. Nevertheless, in 2021, the industry showed signs of recovery and consequently increased its market demand again.

Key Highlights

- Over the medium term, increasing demand from electric vehicle manufacturers and increasing demand from consumer electronics are some of the factors driving the growth of the market studied.

- On the flip side, the stringent safety regulations for batteries through storage and transportation are restraints for the market's growth.

- However, the ongoing research and advancement in cathode material and efficient electrolytes may offer opportunities for market growth.

- Asia-Pacific dominates the market, owing to the growing application of cathode material in the automotive industry, which augments the demand for cathode material.

Cathode Material Market Trends

Automotive Industry to Dominate the Market

- The automotive sector dominates due to the extensive consumption of cathode material in vehicle batteries. Increasing fuel demand and reduced Li-ion battery prices have encouraged automobile manufacturers to invest more in electric vehicles.

- The global demand for electric vehicles is rising on account of factors such as increasing investments by governments across the world toward the development of electric vehicles and charging stations.

- Additionally, rising environmental concerns have further benefited the demand for electric vehicles. The large-scale production of EV batteries has resulted in lowering the cost of the batteries, which has fueled the demand for electronic vehicles among the people. The EV battery is one of the significant components of the electric vehicle. Thus, surging demand for electric vehicles is anticipated to benefit the production of cathode materials used in the batteries.

- According to the International Energy Agency (IEA), electric car (including both battery electric vehicles and hybrid electric vehicles) markets observed exponential growth in 2022 as sales globally exceeded 10 million. A total of 14% of all new cars sold in 2022 were electric.

- Furthermore, as per IEA estimates, by the end of 2023, a total of 14 million electric vehicles were sold, representing a 35% Y-o-Y increase.

- Owing to the increased demand for electric vehicles, automotive lithium-ion (Li-ion) battery demand also observed an increase of about 65% and was valued at 550 GWh in 2022 compared to about 330 GWh in 2021.

- Thus, due to the abovementioned point, the automotive (electric vehicle) industry is likely to grow significantly, which, in turn, is expected to enhance the demand in the market studied.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is home to countries like China, India, and Japan, which are among the largest and fastest-growing markets for electric vehicles and electronics products.

- In the year 2022, China was the frontrunner in the global electric vehicles market, accounting for around 60% of global electric car sales. More than 50% of the world's electric cars are made in China.

- In 2022, electric car sales in India, Thailand, and Indonesia observed significant growth, and collectively, sales of electric cars in these countries were around 80,000 units, which was an increase of more than 200% compared to 2021.

- In India, EV and component manufacturing are gaining significant momentum due to a supportive government incentive program of about USD 3.2 billion that has attracted investments totaling USD 8.3 billion.

- Furthermore, to increase the adoption of EVs, the government of Thailand and Indonesia are also strengthening their policy support schemes.

- The world's largest electronics production base is in China. The fastest growth in the electronics sector has been recorded for electrical products, such as mobile phones, televisions, and computers.

- According to the National Bureau of Statistics, the Chinese electronics market grew by 13% in 2022 compared to 10% growth in 2021. The estimated growth rate for 2023 was 7%. The Chinese market is the largest in the world, even more significant than the combined markets of all industrialized countries.

- Hence, with all such applications and robust demand in the region, Asia-Pacific is expected to be the largest market during the forecast period.

Cathode Material Industry Overview

The cathode material market is partially fragmented in nature, with a number of players operating in the market. Some of the major companies in the market (not in any particular order) are Sumitomo Metal Mining Co. Ltd, Johnson Matthey, BASF SE, Targray, and Umicore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing demand from Automotive Industry

- 4.1.2 Increasing Production of Electronics Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Safety Issues with Transportation and Storage

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Battery Types (Alkaline Battery, Nickel Cadmium Battery, etc)

- 5.2 By Material

- 5.2.1 Lithium Iron Phosphate

- 5.2.2 Lithium Cobalt Oxide

- 5.2.3 Lithium-Nickel Manganese Cobalt

- 5.2.4 Lithium Manganese Oxide

- 5.2.5 Lithium Nickel Cobalt Aluminium Oxide

- 5.2.6 Lead Dioxide

- 5.2.7 Other Materials (Sodium Iron Phosphate, Oxyhydroxide, and Graphite)

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Consumer Electronics

- 5.3.3 Power Tools

- 5.3.4 Energy Storage

- 5.3.5 Other Applications (Medical Devices, Aerospace Components, etc)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middl East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 BASF SE

- 6.4.3 Hitachi Ltd

- 6.4.4 Johnson Matthey

- 6.4.5 LG Chem

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 MITSUI MINING & SMELTING CO. LTD

- 6.4.8 POSCO FUTURE M

- 6.4.9 PROTERIAL, Ltd.

- 6.4.10 Sumitomo Metal Mining Co. Ltd

- 6.4.11 Targray

- 6.4.12 Umicore

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Cathode Material and Efficient Electrolyte

- 7.2 Other Opportunities