PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537604

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1537604

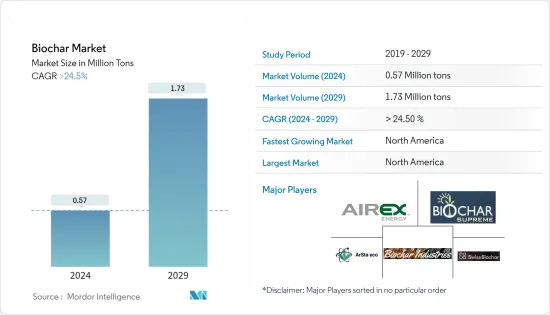

Biochar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Biochar Market size is estimated at 0.57 Million tons in 2024, and is expected to reach 1.73 Million tons by 2029, growing at a CAGR of greater than 24.5% during the forecast period (2024-2029).

The COVID-19 pandemic negatively affected the biochar market. The biochar market experienced disruptions in supply chains due to lockdowns affecting the availability of raw materials and labor required for biochar production, leading to delays and shortages in some regions. However, the pandemic highlighted the importance of sustainability resilience in various sectors, including agriculture. As a result, there was a growing interest in sustainable agricultural practices such as biochar application, leading to increased demand for biochar products.

Key Highlights

- The growing demand for organic foods in developing countries and increasing applications for plant growth and development are expected to drive the demand in the biochar market.

- On the flip side, high production costs and competition from alternate sources are expected to hinder the growth of the market studied in the coming years.

- Furthermore, increasing concerns regarding soil health and agricultural productivity and rising demand for renewable energy and biomass valorization are expected to provide growth opportunities to the biochar industry over the forecast period.

- North America is expected to dominate the market due to the growing demand for organic food across the region.

Biochar Market Trends

Agriculture Segment to Dominate the Market

- Biochar is a solid byproduct obtained from biomass pyrolysis. It is rich in carbon. It is a porous material that is used for various applications, such as soil improvement and remediation.

- Biochar is widely recognized for its ability to improve soil health and fertility. When added to soil, biochar enhances soil structure, increases water retention capacity, and promotes beneficial microbial activity. These properties lead to higher crop yields and improved agricultural productivity, making biochar a valuable input for farmers.

- Hence, using biochar in agriculture production increases yields while decreasing negative environmental impacts.

- Currently, China and the United States are the forerunners in using biochar for agricultural purposes.

- The total value of agricultural exports in the United States reached USD 184.5 billion in 2023, according to the data published by the US Census Bureau, the US Department of Agriculture, and the US Department of Commerce.

- Moreover, according to the US Department of Agriculture and the National Agricultural Statistics Service, the total wheat production in the United States increased from 1.64 billion bushels in 2021 to 1.81 billion bushels in 2023.

- Thus, the factors mentioned above are expected to increase the demand for biochar in agriculture applications in the coming years.

North America to Dominate the Market

- North America has been one of the leading regions in terms of biochar production and consumption. Countries such as the United States and Canada have seen increased interest in biochar for agriculture, environmental remediation, and carbon sequestration purposes.

- North America, particularly the United States and Canada, has a highly developed agricultural sector. Farmers in these countries are increasingly adopting biochar as a soil redemption for enhancing soil fertility, water retention, and crop productivity. The advanced agricultural practices in the region drive demand for biochar products.

- For instance, Canada received a contribution of CAD 7.5 million (USD 5.5 million) from the Natural Resources Canada (NRCan) through the Investments in Forest Industry Transformation (IFIT) program. This program aims to support the competitiveness and transformation of Canada's forest sector in advanced technologies and products.

- Furthermore, in Canada, Airex Energy Inc., Groupe Remabec, and SUEZ have collaborated to create CARBONITY. It is Canada's first industrial biochar production plant situated at Port-Cartier, Quebec (QC). This collaboration between SUEZ and Airex Energy is intended to produce 350,000 tonnes of biochar by 2035.

- Moreover, Canadian oil and gas company Petrox Resources Corporation (Petrox) has signed a Memorandum of Understanding (MoU) to co-operate with compatriot M&L Renewable Energy Group Ltd, a renewable energy project developer. This MoU is intended to develop a biochar facility in Edmonton, Alberta, with the intention of developing similar plants at multiple locations in Canada.

- According to the US Department of Agriculture and the Economic Research Service, by the end of 2022, Texas had about 246,000 farms, making it the largest US state in terms of agricultural production. As of 2022, Missouri ranked second among the top ten states, with 95,000 farm holdings.

- Thus, the factors mentioned above are expected to drive the biochar market in North America during the forecast period.

Biochar Industry Overview

The biochar market is partially consolidated, with a few major players dominating a significant portion of the market. The major players (not in any particular order) include Biochar Industries, Biochar Supreme, Swiss Biochar, Arsta Eco, and Airex Energy, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Plant Growth and Development

- 4.1.2 Growing Demand for Organic Foods in Developing Countries

- 4.2 Restraints

- 4.2.1 High Production Costs

- 4.2.2 Competition from Alternative Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Technology

- 5.1.1 Pyrolysis

- 5.1.2 Gasification Systems

- 5.1.3 Other Technologies (Hydrothermal Carbonization)

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Animal Farming

- 5.2.3 Industrial Uses

- 5.2.4 Other Applications (Environmental Remediation)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Australia

- 5.3.1.3 South Korea

- 5.3.1.4 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 Sweden

- 5.3.3.3 Austria

- 5.3.3.4 Switzerland

- 5.3.3.5 United Kingdom

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Airex Energy

- 6.4.2 Arsta Eco

- 6.4.3 Biochar Industries

- 6.4.4 Biochar Now LLC

- 6.4.5 Biochar Supreme

- 6.4.6 BIOSORRA

- 6.4.7 Carbon Gold Ltd

- 6.4.8 Diacarbon Energy Inc.

- 6.4.9 Karr Group

- 6.4.10 Phoenix Energy

- 6.4.11 Pyreg GmbH

- 6.4.12 PyroCore

- 6.4.13 Sunriver Biochar

- 6.4.14 Swiss Biochar

- 6.4.15 Wonjin Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Concerns Regarding Soil Health and Agricultural Productivity

- 7.2 Rising Demand from Renewable Energy and Biomass Valorization