PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642987

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642987

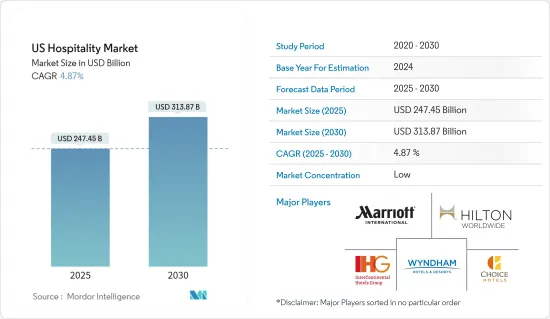

US Hospitality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US Hospitality Market size is estimated at USD 247.45 billion in 2025, and is expected to reach USD 313.87 billion by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

The US hospitality industry encompasses diverse segments: lodging, F&B services, event planning, entertainment, and tourism. In recent years, the sector witnessed robust growth, buoyed by strong consumer spending, low unemployment, and a surge in domestic and international travel.

While leisure travel rebounded swiftly, business travel lagged, as consumers favored domestic locales and outdoor experiences. This preference shift shaped the recovery paths of hotels, resorts, vacation rentals, and outdoor recreational businesses. Technology emerged as a key driver, with digital platforms facilitating bookings, contactless payments, and elevating guest experiences. The F&B sector swiftly adapted to evolving consumer trends, placing a premium on off-premises options like takeout, delivery, and al fresco dining. Restaurants embraced technology, bolstering online ordering and contactless payment systems to prioritize customer safety and convenience.

US Hospitality Market Trends

US Hotel Occupancy Soars, Fueled by Diverse Factors and Economic Uptick

Multiple factors, such as business and leisure travel, events, and conventions, propelled the demand for hotel occupancy in the United States. Economic conditions, consumer confidence, and evolving travel patterns further influenced hotel occupancy growth. Following a strong performance in the previous year, the US hotel sector continued its upward trajectory this year. After several consecutive years of rising occupancy rates, many markets achieved record highs. Currently, the sector outperformed its performance in the previous year.

While weekday demand has shown improvement, leisure travel remains the primary catalyst for the industry's resurgence. New York, Las Vegas, Orlando, Los Angeles, Miami, and San Francisco stand out for their vibrant hotel markets. Higher occupancy rates often translate into increased revenue for hotels. As rooms fill, hotels can generate more income through room rates, additional services, and amenities. This revenue surge bolsters the hospitality market's overall growth and profitability.

US Hospitality Market Thrives on International Travelers' Surge

International travelers are pivotal in propelling the US hospitality market. Their presence fuels demand across various lodging options, spanning hotels, resorts, vacation rentals, and more. These travelers, whether for leisure or business, actively book accommodations, bolstering occupancy rates and revenue for the hospitality sector. Data from the UNWTO World Tourism Barometer reveals a significant surge in foreign visitor visits this year, a nearly fourfold increase from January to July (+172% YoY). This surge has propelled the industry close to its pre-pandemic levels, primarily attributed to a robust international travel demand and the ease of travel restrictions.

The tourism sector, a critical economic expansion and employment factor, has consistently grown and diversified over the past decades. It is now one of the world's largest and fastest-growing economic sectors. The US bolsters its global appeal as a premier travel destination by attracting international travelers. Positive experiences and word-of-mouth endorsements from these visitors further solidify the US's allure, paving the way for sustained growth in the hospitality industry.

United States Hospitality Industry Overview

The competitive landscape of the US hospitality industry is dynamic and diverse, with numerous players competing across various sectors. The industry is further influenced by emerging trends such as the rise of alternative lodging options (e.g., Airbnb), the integration of technology to enhance guest experiences, sustainability initiatives, and changing consumer preferences for personalized and unique travel experiences. Marriott International, Hilton Worldwide Holdings, InterContinental Hotels Group (IHG), Choice Hotels International Inc., and Wyndham Hotels & Resorts are significant players in the US hospitality industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Tourism Increasing Demand for Hospitality Services

- 4.2.2 Consistent Demand for Business Travel and Corporate Hospitality Services

- 4.3 Market Restraints

- 4.3.1 Stringent Government Policies and Regulations Limiting the Market Growth

- 4.3.2 Lack of Skilled Labor is a Challenge for the Market

- 4.4 Market Opportunities

- 4.4.1 Integration of Technology Such as AI, Automation, and Data Analytics

- 4.4.2 Rising Trend of Personalized Travel Experiences and Experiential Tourism

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

- 4.8 Insights Into Technological Advancements in the Industry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chain Hotels

- 5.1.2 Independent Hotels

- 5.2 By Segment

- 5.2.1 Service Apartments

- 5.2.2 Budget and Economy Hotels

- 5.2.3 Mid and Upper Mid-Scale Hotels

- 5.2.4 Luxury Hotels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Marriott International

- 6.2.2 Hilton Worldwide

- 6.2.3 Wyndham Hotels & Resorts

- 6.2.4 InterContinental Hotels Group (IHG)

- 6.2.5 Choice Hotels International

- 6.2.6 Best Western Hotels & Resorts

- 6.2.7 Hyatt Hotels Corporation

- 6.2.8 G6 Hospitality

- 6.2.9 Aimbridge Hospitality

- 6.2.10 Airbnb*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US