PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689734

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689734

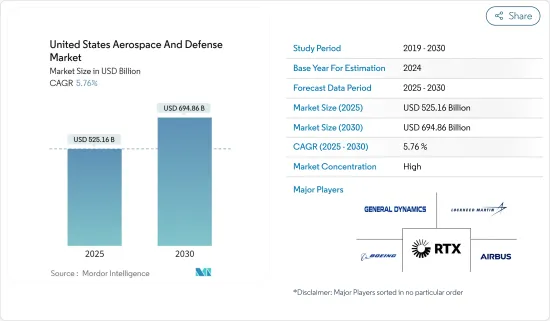

United States Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Aerospace And Defense Market size is estimated at USD 525.16 billion in 2025, and is expected to reach USD 694.86 billion by 2030, at a CAGR of 5.76% during the forecast period (2025-2030).

The US aerospace and defense sector is one of the largest in terms of infrastructure and manufacturing activities. The market is expected to grow primarily due to the armed forces' procurement and upgrade activities to counter emerging threats. Several contracts from the military, air force, and naval force are currently underway, and many new contracts are anticipated to be dispersed during the forecast period, creating a parallel demand for defense equipment.

The US military uses multiple aircraft across the air force and naval aircraft. Owing to the increasing international conflict with China over its aggression in the South China Sea, the US is gearing up to tackle any potential issues China might create for countries with close ties with the US, like Taiwan and Japan. As a result, significant investments in upgrading the existing fleet and purchasing a new fleet equipped with efficient technologies have been witnessed over the past year.

The growing adoption of advanced technologies such as 3D printing, artificial intelligence, and big data analytics in developing aviation and defense equipment will create better opportunities in the coming years. However, issues related to the supply chain and evolving cybersecurity risks may hinder market growth.

United States Aerospace And Defense Market Trends

The Space Sector is Expected to Witness the Highest Growth During the Forecast Period

Space capabilities give the US and its allies unprecedented advantages in national decision-making, military operations, and homeland security. While a handful of private companies have driven the most recent space exploration efforts, there are ongoing discussions for establishing the Space Force as the sixth US military branch.

The US satellite manufacturing and launch industry is a rapidly evolving industry that plays a critical role in the country's space exploration and national security efforts. In recent years, this industry has undergone significant changes due to technological advancements, increasing demand for satellite services, and the presence of various prominent players. The demand for new satellite launches is driven by the need for various satellite services, such as providing low-latency internet access from space. In April 2022, Kuiper Systems LLC, a subsidiary of Amazon, announced that it had received approval from the Federal Communications Commission to launch 1,500 satellites by 2026. The company plans to reach 3,236 satellites by 2029, offering broadband internet services worldwide. The company secured around 83 launch services from Blue Origin, Arianespace, and United Launch Alliance (ULA) to launch these satellites.

The US Space Command will likely benefit the US Department of Defense (DoD) and the US aerospace and defense industry. The US Space Command, which oversees space operations using personnel and assets managed by the Space Force, will likely support A&D companies in accelerating investments in innovative technologies and capabilities. Thus, growing spending on space research and development and an increasing number of satellite launches drive market growth across the country.

The Air Force is Expected to Showcase Remarkable Growth During the Forecast Period

The US Air Force is equipped with the most modern technology that provides air support for land and naval forces and aids the troops on and around a battlefield. The Air Force continues developing and procuring next-generation aircraft to meet the demands of significant power conflicts with Russia and China. The US Air Force comprises 13,247 operational, reserve, and out-of-service aircraft. The country's diplomatic and military relations with nations such as Japan and Taiwan have compelled it to drive significant investments into increasing the fleet of aircraft to counter any provocative military action from China successfully.

The US involvement in the military conflict in the Middle East majorly drove its procurement of attack aircraft and transport aircraft. The Department of Air Force proposed a budget request of USD 194 billion for FY 2023, an increase of USD 20.2 billion or 11.7% from the FY 2022 budget request. For instance, in May 2023, it was announced that the US Air Force intends to award a contract in 2024 for its sixth-generation fighter jet as it races to retain its edge against rapid advances in Chinese military technology. The country's defense agencies have been on a spree of procurements given the Russia-Ukraine War that drove significant US weapon supply to Ukraine.

The Air Force has successfully implemented several procurement plans to tackle any Russian threat. Owing to significant procurement initiatives, together with the future-ready plans of the USAF, the demand in the Air Force is expected to register a substantial growth rate during the forecast period.

US Aerospace & Defense Industry Overview

The US aerospace and defense market is consolidated in nature. Some prominent players in the market are General Dynamics Corporation, Airbus SE, Lockheed Martin Corporation, The Boeing Company, and RTX Corporation. With the changing regulations, companies must align their product portfolio to the evolving requirements of end users. The market is also significantly influenced by the dispersion of upgrade contracts to enhance the capabilities of the current fleet of active aerial assets. The active role of the US in the global political front has resulted in the growth of the demand for advanced aircraft, UAVs, and satellites.

In order to gain long-term contracts and enhance market share, players are investing significantly in the R&D of sophisticated product offerings. Furthermore, continuous R&D has fostered technological advancements in platforms and associated products and solutions of the US aerospace and defense market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET SEGMENTATION

- 4.1 Commercial and General Aviation

- 4.1.1 Market Overview

- 4.1.2 Market Dynamics

- 4.1.2.1 Drivers

- 4.1.2.2 Restraints

- 4.1.2.3 Opportunities

- 4.1.3 Market Trends

- 4.1.4 Segmentation: Commercial Aircraft

- 4.1.4.1 Air Traffic

- 4.1.4.2 Training and Flight Simulators

- 4.1.4.3 Airport Services (Ground Support Equipment and Logistics)

- 4.1.4.4 Structures

- 4.1.4.4.1 Airframe

- 4.1.4.4.1.1 Materials (Composite, Metal and Metal Alloys, Others)

- 4.1.4.4.1.2 Adhesives and Coatings

- 4.1.4.4.2 Engine and Engine Systems

- 4.1.4.4.3 Cabin Interiors

- 4.1.4.4.4 Landing Gear

- 4.1.4.4.5 Avionics and Control Systems

- 4.1.4.4.5.1 Communication System

- 4.1.4.4.5.2 Navigation System

- 4.1.4.4.5.3 Flight Control System

- 4.1.4.4.5.4 Health Monitoring System

- 4.1.4.4.6 Electrical Systems

- 4.1.4.4.7 Environmental Control Systems

- 4.1.4.4.8 Fuel and Fuel Systems

- 4.1.4.4.9 MRO

- 4.1.4.4.10 Research and Development

- 4.1.4.4.11 Supply Chain Analysis (Design, Raw Materials, Manufacturing, Assembly, Testing, and Certification)

- 4.1.4.4.12 Competitor Analysis

- 4.1.5 Segmentation: General Aviation (includes Business Jets, Helicopter, and Personal Aircraft)

- 4.1.5.1 Air Traffic

- 4.1.5.2 Training and Flight Simulators

- 4.1.5.3 Airport Services (Ground Support Equipment and Logistics)

- 4.1.5.4 Structures

- 4.1.5.4.1 Airframe

- 4.1.5.4.1.1 Materials (Composite, Metal and Metal Alloys, Others)

- 4.1.5.4.1.2 Adhesives and Coatings

- 4.1.5.4.2 Engine and Engine Systems

- 4.1.5.4.3 Cabin Interiors

- 4.1.5.4.4 Landing Gear

- 4.1.5.4.5 Avionics and Control Systems

- 4.1.5.4.5.1 Communication System

- 4.1.5.4.5.2 Navigation System

- 4.1.5.4.5.3 Flight Control System

- 4.1.5.4.5.4 Health Monitoring System

- 4.1.5.4.6 Electrical Systems

- 4.1.5.4.7 Environmental Control Systems

- 4.1.5.4.8 Fuel and Fuel Systems

- 4.1.5.4.9 MRO

- 4.1.5.4.10 Research and Development

- 4.1.5.4.11 Supply Chain Analysis

- 4.1.5.4.12 Competitor Analysis

- 4.2 Military Aircraft and Systems

- 4.2.1 Market Overview

- 4.2.2 Defense Spending and Budget Allocation Details

- 4.2.2.1 Army

- 4.2.2.2 Navy and Marine Corps

- 4.2.2.3 Air Force

- 4.2.3 Market Dynamics

- 4.2.3.1 Drivers

- 4.2.3.2 Restraints

- 4.2.3.3 Opportunities

- 4.2.4 Market Trends

- 4.2.5 MRO

- 4.2.6 Research and Development

- 4.2.7 Training and Flight Simulators

- 4.2.8 Competitor Analysis

- 4.2.9 Supply Chain Analysis

- 4.2.10 Customer/Distributor Information

- 4.2.11 Segmentation: Combat Aircraft

- 4.2.11.1 Structures

- 4.2.11.1.1 Airframe

- 4.2.11.1.1.1 Materials (Composite, Metal and Metal Alloys, Others)

- 4.2.11.1.1.2 Adhesives and Coatings

- 4.2.11.1.2 Engine and Engine Systems

- 4.2.11.1.3 Landing Gear

- 4.2.11.2 Avionics and Control Systems

- 4.2.11.2.1 General Avionics

- 4.2.11.2.2 Mission Specific Avionics

- 4.2.11.3 Missiles and Weapons

- 4.2.12 Segmentation: Non-Combat Aircraft

- 4.2.12.1 Structures

- 4.2.12.1.1 Airframe

- 4.2.12.1.1.1 Materials (Composite, Metal and Metal Alloys, Others)

- 4.2.12.1.1.2 Adhesives and Coatings

- 4.2.12.1.2 Engine and Engine Systems

- 4.2.12.1.3 Landing Gear

- 4.2.12.2 Avionics and Control Systems

- 4.2.12.2.1 General Avionics

- 4.2.12.2.2 Mission Specific Avionics

- 4.2.12.3 Missiles and Weapons

- 4.3 Unmanned Aerial Systems

- 4.3.1 Market Overview

- 4.3.2 Market Dynamics

- 4.3.2.1 Drivers

- 4.3.2.2 Restraints

- 4.3.2.3 Opportunities

- 4.3.3 Market Trends

- 4.3.4 Research and Development

- 4.3.5 Competitor Analysis

- 4.3.6 Regulatory Landscape and Future Policy Changes

- 4.3.7 Segmentation

- 4.3.7.1 Commercial

- 4.3.7.2 Military

- 4.4 Space Systems and Equipment

- 4.4.1 Market Overview

- 4.4.2 Market Dynamics

- 4.4.2.1 Drivers

- 4.4.2.2 Restraints

- 4.4.2.3 Opportunities

- 4.4.3 Market Trends

- 4.4.4 Research and Development

- 4.4.5 Competitor Analysis

- 4.4.6 Regulatory Landscape and Future Policy Changes

- 4.4.7 Customer Information

- 4.4.8 Segmentation: Space Launch Vehicle, Spacecraft, and Ground Systems (Market Size and Forecast)

- 4.4.9 Segmentation: Satellites

- 4.4.9.1 By Subsystem

- 4.4.9.1.1 Command and Control System

- 4.4.9.1.2 Telemetry, Tracking, Commanding and Monitoring (TTCM)

- 4.4.9.1.3 Antenna System

- 4.4.9.1.4 Transponders

- 4.4.9.1.5 Power System

- 4.4.9.2 By Application

- 4.4.9.2.1 Military

- 4.4.9.2.2 Commercial

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 Airbus SE

- 5.1.2 BAE Systems plc

- 5.1.3 Fincantieri S.p.A

- 5.1.4 GKN Aerospace

- 5.1.5 Leonardo S.p.A

- 5.1.6 Naval Group

- 5.1.7 QinetiQ Group PLC

- 5.1.8 Rheinmetall AG

- 5.1.9 Rolls-Royce plc

- 5.1.10 Safran SA

- 5.1.11 THALES

- 5.1.12 Lockheed Martin Corporation

- 5.1.13 The Boeing Company

- 5.1.14 RTX Corporation

- 5.1.15 Northrop Grumman Corporation

- 5.1.16 General Dynamics Corporation

- 5.1.17 L3Harris Technologies Inc.

- 5.1.18 Embraer SA

- 5.1.19 Textron Inc.