PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689708

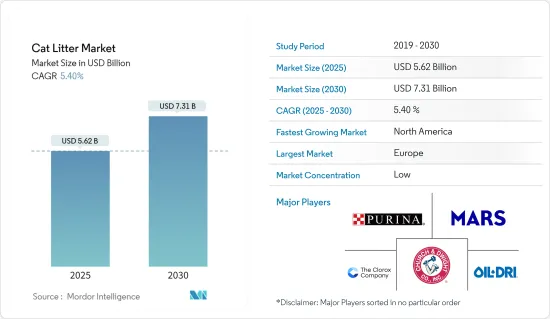

Cat Litter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cat Litter Market size is estimated at USD 5.62 billion in 2025, and is expected to reach USD 7.31 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Key Highlights

- The cat litter market is driven by the increasing adoption of pets worldwide. The recent rise in pet humanization, wherein pets are treated with increased care and hygiene, is proving to be a significant driver for the market. According to the World Pet Association, in 2023, there were over 600 million pet cats globally, compared to 420 million in 2019. The growing demand for innovative products by cat owners will likely offer lucrative opportunities to players operating in the market studied.

- Furthermore, due to growing environmental awareness, environmentally conscious consumers seek sustainable, eco-friendly, and ethically sourced alternatives. This trend is prevalent among millennials and Generation Z, who prioritize these aspects when making purchase decisions. Therefore, the key players in the market are launching tailor-made organic products. For instance, in February 2024, PetSafe introduced PetSafe ScoopFree Premium Natural Litter, designed to manage odor for over 21 days. The litter is 100% natural, made from fossilized algae, and contains no additional fragrances, dyes, or chemicals.

- With the expansion of digital technology, major companies are increasingly promoting their products online. The advertising of pet supplies on various social media platforms is becoming more widespread, thus leading to an increase in the market for cat litter.

Cat Litter Market Trends

Clumping Litter Is In High Demand

- Human hostility, adverse weather, and other concerns have led many cat owners to keep their feline friends indoors. This trend, coupled with the rising awareness of cat safety, has significantly boosted the demand for cat litter boxes, ensuring a secure environment for their pets. Unlike traditional litter, clumping litter offers a distinct advantage as it allows for easy removal of both solids and urine. Its superior odor control and the convenience of removing clumps leave the litter box consistently fresh.

- Bentonite-based clumping cat litter stands out for its exceptional moisture and urine absorption capabilities. When the liquid comes into contact with bentonite, it swells, forming effortlessly removable clumps. This unique feature has significantly boosted the demand for bentonite-based clumping cat litter in the market, offering a practical and effective option for maintaining litter box cleanliness.

- Moreover, a surge in demand for clumping litter has prompted companies to ramp up their innovation and expansion efforts. For instance, in July 2023, Purina expanded its cat litter production capacity in Virginia. This move enhanced Purina's capacity for innovative products, including Tidy Cats LightWeight formulas. It catered to the escalating consumer demand for cat litter solutions, ensuring a steady supply of high-quality products.

Europe Dominates the Market

- The Germany cat litter industry is witnessing a notable shift due to a rise in trend termed 'humanization' or anthropomorphism, where pets are increasingly treated as family members. This shift is particularly pronounced among the elderly and single individuals, who see their pets as cherished companions, enhancing their overall happiness and lifestyle. Consequently, there is a heightened emphasis on pet health and hygiene, creating a ripe market for cat litter companies to cater to this growing demand for premium products.

- The cat ownership in the UK is on the rise, catalyzing growth in the cat litter industry. In April 2022, the Pet Food Manufacturers' Association (PFMA) reported that UK households adopted over 12 million cats as pets, further fueling the demand for cat litter. Notably, 28% of UK households in the same month had at least one cat.

- Pet care retailers are ramping up their presence, enhancing product accessibility for consumers and, in turn, driving market growth. For instance, Maxi Zoo set ambitious expansion goals. Eighteen new stores opened in the first half of 2023. The retailer aims to reach 40 stores nationwide by the end of 2024, with 22 slated for launch by December 2024.

Cat Litter Industry Overview

The cat litter market is fragmented, with the major players occupying a minimal share of the studied market and others accounting for a significant share. The top players in the market are Mars Inc., Nestle SA, Church & Dwight Co Inc., Oil-Dri Corporation of America, and The Clorox Company. Manufacturers focus on mergers and acquisitions to increase their market shares. Moreover, key market players are bolstering their product offerings, focusing on direct-to-distribution channels to solidify their market standing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Pet Humanization

- 4.2.2 Growing Trend of E-commerce

- 4.3 Market Restraints

- 4.3.1 Rising Cost of Raw Material Production

- 4.3.2 Growing Concern Over Environment and Pet Health

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Clumping

- 5.1.2 Non-Clumping

- 5.2 Raw Material

- 5.2.1 Clay

- 5.2.2 Silica

- 5.2.3 Others(Wood, Vegetal, Pellets, etc.)

- 5.3 Distribution Channel

- 5.3.1 Specialized Pet Shops

- 5.3.2 Internet Sales

- 5.3.3 Hypermarkets

- 5.3.4 Other Distribution Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Mars Inc.

- 6.3.2 Nestle SA

- 6.3.3 Church & Dwight Co. Inc.

- 6.3.4 The Clorox Company

- 6.3.5 ZOLUX SAS

- 6.3.6 Healthy Pet

- 6.3.7 Kent Corporation

- 6.3.8 Oil-dri Corporation Of America

- 6.3.9 Barentz International BV

- 6.3.10 Omlet Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS