PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687845

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687845

DIY Home Improvement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

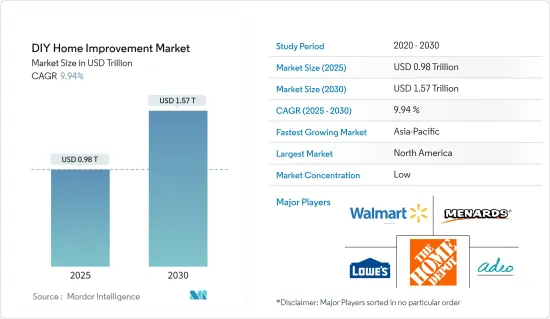

The DIY Home Improvement Market size is estimated at USD 0.98 trillion in 2025, and is expected to reach USD 1.57 trillion by 2030, at a CAGR of 9.94% during the forecast period (2025-2030).

The do-it-yourself (DIY) home improvement market has grown significantly in recent years. It is expected to expand significantly throughout the forecast period. The DIY home improvement industry is anticipated to grow rapidly in the next few years due to the growing customer preference for DIY items and the notable uptick in the adoption of cutting-edge technologies. The increasing number of employed women in emerging nations and their involvement in interior design decision-making drive the sales of the materials needed for these projects. Subsequently, there is an increasing adoption of DIY home improvement products. The use of DIY products lowers long-term costs compared to work outsourced to expensive labor. Therefore, the demand for DIY home improvement products is a significant factor driving the market studied.

DIY Home Improvement Market Trends

DIY Shops are Preferable Distribution Channels for the Industry

As most DIY resources are online, in-store displays significantly influence how DIY consumers learn to manage DIYs. These strategies have increased sales for big-box retailers and are just as useful for small and local home improvement businesses. Most often, small companies excel over big box stores regarding customer service and store-consumer relationships. About 82% of DIYers are likely to explore products in the store, even if the final purchase is made online. Millennial DIYers are more likely to seek the product and purchase quality products in-store, especially for products like paint.

Rise in DIY Market in North America

Throughout the forecast period, North America is expected to hold the largest revenue share of the global market, owing to growing urbanization and rising consumer disposable income. Other factors projected to fuel market revenue growth in the region include rising participation in home decor initiatives and an increased interest in enhancing the visual appeal of homes. The increased popularity and adoption of ready-to-assemble (RTA) furniture in the United States are driving the market. The popularity of innovatively designed RTA furniture is growing in the United States. Customization is becoming more popular. Thus, leading vendors are producing custom-designed RTA furniture for bespoke interiors, which has helped them attract more DIY consumers, increasing revenue. Growing investments by home improvement enterprises in creating new home improvement techniques is another factor projected to fuel market revenue growth.

DIY Home Improvement Industry Overview

The DIY home improvement market is fragmented, with many players. Major foreign companies involved in the do-it-yourself home improvement industry have been included in the report. Currently, a few significant competitors control the industry in terms of market share. But consumer income is what drives demand. Big businesses compete by buying in bulk, offering a wide range of goods, and using efficient marketing and merchandising techniques. Small businesses concentrate on a certain market niche and compete by offering a wide range of goods and first-rate customer support. Home Depot, Walmart Inc., Menard Inc., Lowe's, and ADEO are a few of the major companies in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Customization and Personalization

- 4.2.2 Increasing Home Improvement and Renovation Trends

- 4.3 Market Restraints

- 4.3.1 Lack of Expertise Restraining the Market

- 4.3.2 The Cost of the Materials can be a Significant Restraint

- 4.4 Market Opportunities

- 4.4.1 Growing Number of DIY Retail Stores Provides an Opportunity for Individuals to Showcase and Sell their DIY Creations

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Lumber and Landscape Management

- 5.1.2 Decor and Indoor Garden

- 5.1.3 Kitchen

- 5.1.4 Painting and Wallpaper

- 5.1.5 Tools and Hardware

- 5.1.6 Building Materials

- 5.1.7 Lighting

- 5.1.8 Plumbing and Equipment

- 5.1.9 Flooring, Repair, and Replacement

- 5.1.10 Electrical Work

- 5.2 Distribution Channel

- 5.2.1 DIY Home Improvement Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Furniture and Other Physical Stores

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 Japan

- 5.3.3.3 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Peru

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Groupe ADEO

- 6.2.2 Home Depot

- 6.2.3 Lowe's Companies Inc.

- 6.2.4 Menard

- 6.2.5 Walmart

- 6.2.6 Ace Hardware

- 6.2.7 Travis Perkins

- 6.2.8 Kingfisher PLC

- 6.2.9 Hornbach Holding

- 6.2.10 Bauhaus

- 6.2.11 Obi (Tengelmann)

- 6.2.12 Hagebau

- 6.2.13 Maxeda

- 6.2.14 Crate and Barrel*

7 MARKET FUTURE TRENDS

8 DISCLAIMER