PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687833

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687833

Printed Circuit Board (PCB) Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

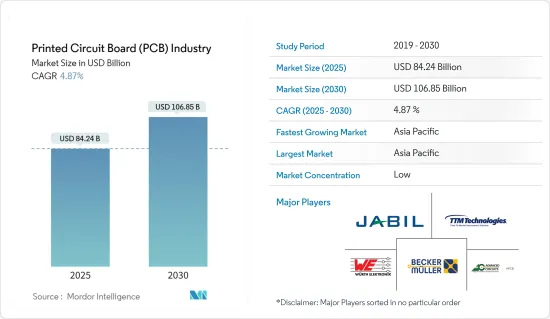

The PCB Market size is estimated at USD 80.33 billion in 2024, and is expected to reach USD 96.57 billion by 2029, growing at a CAGR of 4.87% during the forecast period (2024-2029).

Key Highlights

- Increased production of budget smartphones means that phone PCB production is expected to increase. According to Nidec, despite the downfall, 1.3 billion smartphones are shipped annually worldwide. These trends largely represent real opportunities for the PCB, as it is a vital mobile phone component that connects and supports various electronic components such as microprocessors, memory chips, sensors, and other integrated circuits.

- While consumer PCBs are certainly nothing new, the applications for PCBs for electronics and the materials used to make them have evolved over some time. This is inevitable, especially on account of the growing trend of miniaturization. Moreover, modern electronics and computer applications require PCBs with high thermal conductivity so that the heat generated can be dissipated. Different PCBs are needed for the many kinds of appliances in use. For example, the PCB needed to power a smartwatch is different from the PCB required for a computer.

- PCBs are highly suitable for portable consumer electronics due to their small size and lightweight characteristics. The growth and efficiency of the PCB assembly industry can be attributed to the significant reliance of consumer electronic products on well-designed and assembled printed circuit boards. By incorporating high-performance PCBs effectively, various consumer electronic devices can be optimized to carry out everyday tasks seamlessly. The indispensability of PCBs extends to a wide range of consumer electronics, such as smartphones, televisions, laptops, and gaming consoles, owing to their compact design and capability to accommodate intricate circuitry.

- One major trend driving the growth of the PCB market is the increasing adoption of advanced technologies such as 5G, which is significantly favored by growing investment from various government and private organizations.

- For instance, in March 2024, Ericsson announced the establishment of a dedicated entity for delivering a new dedicated entity to deliver 5G-driven digital transformation across the federal United States Government. This announcement was made taking the rising importance of 5G communication into consideration, as it is vital for US national and economic security and a key component of US defense modernization programs.

- The growing concerns regarding electronic waste, like printed circuit boards (PCBs), are a significant environmental issue that needs to be addressed. PCBs contain various hazardous materials, including lead, mercury, cadmium, and brominated flame retardants. When improperly disposed of, these substances can leach into the soil and water, posing a threat to human health and the environment.

- Improper disposal of PCBs, such as landfilling or incineration, can have serious environmental consequences. When PCBs end up in landfills, hazardous materials can seep into the soil and contaminate groundwater. Incineration of PCBs can release toxic gases and particles into the air, contributing to air pollution.

- Furthermore, factors such as the growing importance of Taiwan in the semiconductor industry and the increasing importance of diversifying semiconductor manufacturing facilities are likely to shape the supply and demand structure of PCBs in the future.

PCB Market Trends

Consumer Electronics Segment to be the Largest End-user Industry

- Owing to the growing demand for PCBs in the consumer electronics industry, the government is taking initiatives to spread awareness and provide essential training to students for PCB manufacturing.

- For instance, in February 2024, UMass Lowell announced the establishment of the Massachusetts Electronics Manufacturing Evolution (MEME) laboratory to help train students and industry workers in designing and fabricating PCBs. The project is supported with a USD 500,000 Massachusetts Skills Capital Grant for purchasing equipment for the facility. The Massachusetts Workforce Skills Cabinet offers the grant program, which is funded by the state through its capital budget.

- The PCB prototyping facility is a crucial component of modern technology, enabling entrepreneurs from countries such as the United States of America, India, and China to create cutting-edge products that can be launched globally.

- In March 2023, T-Works, India's largest prototype center, partnered with Qualcomm to establish a state-of-the-art multilayer Printed Circuit Board (PCB) fabrication facility. This new facility is anticipated to support the development of a wide range of products, including medical devices, electric vehicles, consumer electronics, industrial automation products, and more.

- Companies are developing wearable IoT devices in the consumer electronics industry to reduce users' reliance on smartphones. These devices can vary from primary and affordable gadgets like smartwatches and thermostats to advanced smart home automation applications, smart clothing, watches, hearables, and glasses. The way users work, communicate, and perform their daily tasks is being transformed by these devices. The usage and popularity of consumer IoT devices have grown significantly, and this trend is expected to continue as long as people demand IoT devices that are more affordable, faster, capable, powerful, and safer. According to Ericsson, short-range IoT devices like smart home appliances are expected to reach 25,150 million by 2027, which is expected to drive the market's growth.

- Furthermore, the rising IoT deployments and increasing demand for connected devices are expected to drive the market. The latest IoT Analytics "State of IoT-Spring 2023" report presents that the number of global IoT connections grew by 18% in 2022 to 14.3 billion active IoT endpoints.

- In 2023, the global number of connected IoT devices grew by 16% to 16.7 billion active endpoints. While 2023 growth was slightly lower than in 2022, IoT device connections are expected to continue to grow for many years. In addition, ownership of connected devices in the Asia-Pacific region is already high among those living in China, Thailand, and Vietnam.

Asia Pacific Region is Expected to Witness Significant Growth

- With the rapid development of China's electronics industry, many Chinese PCB manufacturers have emerged as leading players in the global PCB market, capturing a market share in the Asia-Pacific region. These manufacturers offer a wide range of services and capabilities, including PCB design, fabrication, and assembly, with competitive pricing and fast turnaround times. They include JLCPCB, Graperain, Fulltronics, YMS PCB Assembly, and Hitech Circuits.

- At present, there are about 2,500 PCB manufacturers in mainland China. The PCB industry in China is mainly distributed in the Pearl River Delta, the Yangtze River Delta, and the Bohai Rim, where they centralize the large component markets, good transportation conditions, and water and electricity conditions.

- Major reasons driving the growth of the PCB market in the Chinese region include lower overall cost and higher management efficiency. First, although China's demographic dividend is ending, labor costs are still lower than those of Japan, South Korea, and Taiwan and even lower than those of Europe and the United States. Second, China's environmental protection, trade unions, and welfare sectors are relatively low-cost.

- In addition, as the world's largest manufacturing country, China's PCB industry has a complete industrial chain from copper foil, glass fiber, resin, copper-clad laminates, and PCBs. PCB is close to the final products, and a great number of electronics are also finished in China.

- Benefiting from the transfer of global PCB production capacity to China and the vigorous development of downstream electronic terminal products, China's PCB industry shows a rapid development trend. The electronic information industry is a strategic, essential, and leading pillar industry for China's key development. The PCB industry, as the cornerstone of the development of the electronic information industry, has become one of the projects encouraged by China.

- Furthermore, empirical data from reputable industry associations underscores Taiwan's continued dominance in global PCB production values, with a major market share. Notably, South Korean PCB manufacturers have surpassed their Japanese counterparts, securing the third position on a regional scale.

PCB Industry Overview

The PCB market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Jabil Inc., Wurth Elektronik Group (Wurth group), TTM Technologies Inc., Becker & Muller Schaltungsdruck Gmbh, and Advanced Circuits Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

April 2024 - TTM Technologies Inc., a global manufacturer of technology solutions such as radio frequency ("RF") components and advanced printed circuit boards, opened its first manufacturing plant in Penang, Malaysia, with an investment of USD 200 million. According to the company, the new facility is built in Penang Science Park and has highly advanced and automated PCB manufacturing capabilities.

November 2023 - Jabil Inc. opened its third production facility in Chihuahua, Mexico, marking a milestone in its continued growth and commitment to the region. The plant spans more than 250,000 square feet. This expansion will be critical in supporting customers across the energy, automotive and transportation, healthcare, digital print, and retail industries. This new facility will enhance operational efficiency, flexibility, and the ability to deliver high-quality products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Miniaturization of Technology

- 5.1.2 Increasing Demand from End-user Industries

- 5.2 Market Restraints

- 5.2.1 Growing Concern Regarding Electronic Waste

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Standard Multilayer PCBs

- 6.1.2 Rigid 1-2 Sided PCBs

- 6.1.3 HDI/Micro-via/Build-up

- 6.1.4 Flexible PCBs

- 6.1.5 Rigid-flex PCBs

- 6.1.6 Others

- 6.2 By End-user Industry

- 6.2.1 Industrial Electronics

- 6.2.2 Healthcare

- 6.2.3 Aerospace and Defense

- 6.2.4 Automotive

- 6.2.5 Consumer Electronics

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jabil Inc.

- 7.1.2 Wurth elektronik group (Wurth group)

- 7.1.3 TTM Technologies Inc.

- 7.1.4 Becker & Muller Schaltungsdruck Gmbh

- 7.1.5 Advanced Circuits Inc.

- 7.1.6 Sumitomo Electric Industries Ltd (Sumitomo Corporation)

- 7.1.7 Murrietta Circuits

- 7.1.8 Unimicron Technology Corporation

- 7.1.9 Tripod Technology Corporation

- 7.1.10 AT&S Austria Technologie & Systemtechnik AG

- 7.1.11 Nippon Mektron Ltd (nok Group)

- 7.1.12 Zhen Ding Technology Holding Limited

8 VENDOR MARKET SHARE

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK OF THE MARKET