PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910496

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910496

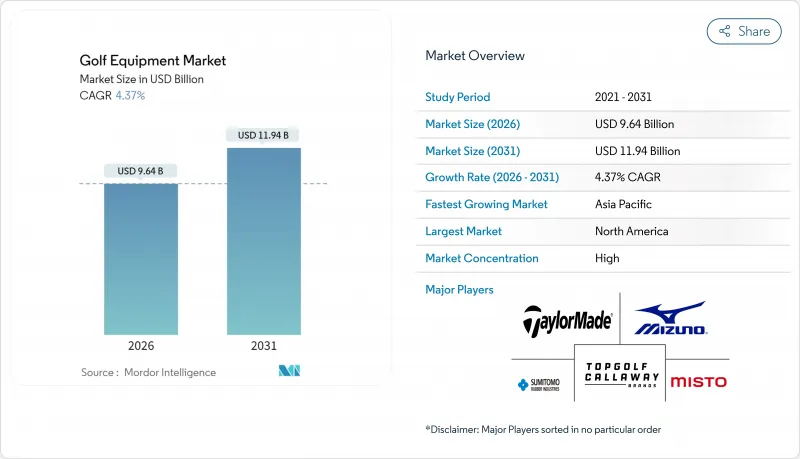

Golf Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The golf equipment market size in 2026 is estimated at USD 9.64 billion, growing from 2025 value of USD 9.24 billion with 2031 projections showing USD 11.94 billion, growing at 4.37% CAGR over 2026-2031.

This growth trajectory is buoyed by record on-course participation, an unprecedented influx of female and minority golfers, and the swift adoption of smart, AI-driven clubs and simulators, which are proving invaluable for novices. In a nod to sustainability, manufacturers are hastening the integration of recycled and bio-based materials, aligning with the eco-conscious goals of prominent associations and course operators. Urban areas are witnessing a surge in golf-centric entertainment venues, drawing in fresh audiences, a trend bolstered by government grants that ease access for youth and collegiate programs. While challenges like weather unpredictability and rising equipment costs loom in the near term, the expanding consumer base and a trend towards premiumization are fostering a consistent replacement cycle, bolstering the long-term outlook for the golf equipment market.

Global Golf Equipment Market Trends and Insights

Rising popularity of golf among younger and female demographics

According to the National Golf Foundation, the number of female golfers in the United States has grown significantly, reaching nearly 7.9 million in 2024. This marks a notable rise in participation, increasing from 20% in 2012 to 28% in 2024.This demographic transformation represents a critical structural shift influencing equipment demand. Globally, Asia leads in engagement, with 26.2 million adults participating in golf as of 2023, and women accounting for 43% of off-course participants. The region's prominence is further highlighted by the fact that 56 of the top 100 players in the Rolex Women's World Golf Rankings are from Asia. This shift has prompted equipment manufacturers to develop gender-specific product lines and targeted marketing strategies to cater to this growing segment. For instance, in October 2024, the company launched the beginner-friendly Topgolf Shop, designed to address the challenge that only 25% of the 3.4 million first-time golfers in 2023 continued playing long-term. As manufacturers adapt to these changes, the focus on inclusivity and accessibility is reshaping product development priorities, ensuring the industry aligns with the evolving needs of a more diverse player base.

Technological innovations in golf equipment

Companies are leveraging AI-powered systems to deliver real-time performance optimization and personalized coaching, enhancing the overall golfing experience. For instance, LIV Golf's partnership with Salesforce in June 2025 aims to revolutionize global operations through advanced AI applications. The adoption of smart golf simulators is accelerating, with over 6 million golfers in the United States utilizing these systems. This rapid growth has prompted legislative action, such as the proposed BIRDIE Act, which seeks to address copyright protection for golf courses in the digital domain. Additionally, collaborations between companies like Uneekor and technology leaders such as LG are fostering the development of integrated simulation experiences, further enhancing the appeal of golf technology. The convergence of hardware and software is not only creating new revenue streams and customer engagement opportunities but is also reshaping the traditional equipment replacement cycle. This technological evolution is particularly impactful as it addresses long-standing barriers, such as the complexity of the sport, which has historically deterred new players. By offering data-driven insights and personalized guidance, AI is making golf more accessible and appealing to a broader audience, fundamentally transforming the way the sport is played and experienced.

High initial investment and cost of equipment

High initial investments and the overall costs of golf equipment pose significant barriers, particularly for newcomers and casual players, curbing the global golf equipment market's growth. A complete set of golf clubs from renowned brands like Callaway, TaylorMade, or Titleist typically costs between USD 800 and USD 2,000. Including essentials such as golf bags, balls, shoes, gloves, and apparel can push a single player's total expenditure beyond USD 2,500. This hefty price tag deters many budget-conscious consumers from either entering or remaining in the sport. Beyond equipment, ongoing expenses like green fees, coaching, and club memberships amplify the financial strain, bolstering golf's reputation as an elite sport. These financial challenges are especially evident in emerging markets in the Asia-Pacific, Latin America, and certain Eastern European regions, where disposable incomes are lower. The National Golf Foundation (NGF) reports that in the U.S., costs rank among the top three reasons lapsed or non-golfers cite for their absence from the sport. Additionally, concerns about hefty equipment investments have made parents wary, impacting junior participation as they question the long-term commitment of their children to the sport.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of golf tourism and travel

- Government and institutional support programs

- Limited awareness and accessibility in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, golf clubs command a dominant 38.52% share of the market, underscoring their pivotal role in the sport and the relentless technological innovations that fuel frequent upgrades. Major manufacturers, responding to this demand, are rolling out extensive product lines with superior performance traits and tailored fitting options. While professional golfers and dedicated amateurs gravitate towards premium clubs for a competitive edge, recreational players bolster sales with their preference for entry-level and mid-tier options. Modern golf clubs, boasting advanced materials, aerodynamic designs, and adjustable features, not only command higher price tags but also entice golfers to upgrade more frequently. Equipment makers, recognizing this trend, pour substantial resources into R&D, crafting proprietary innovations and performance claims that resonate with golfers' aspirations.

Apparel is set to be the fastest-growing segment, projected to expand at a 4.82% CAGR from 2026 to 2031. This surge mirrors golf's cultural shift, intertwining with contemporary fashion trends. The rapid growth of the apparel segment is largely fueled by younger and female golfers, who approach golf attire as a blend of functionality and fashion. Influenced by athletic wear, golf apparel now emphasizes moisture-wicking fabrics, stretchy materials, and styles that seamlessly transition from the course to casual outings. Unlike the durable nature of clubs, golfers frequently refresh their apparel, benefiting the segment. Collaborations between golf and fashion brands are broadening the market's reach, tapping into lifestyle channels and presenting fresh revenue streams for equipment manufacturers, who see apparel as a bridge to deeper brand connections.

In 2025, the mass market category captures a commanding 62.15% share, underscoring the widespread accessibility of golf equipment and the pivotal role of value-driven products in bolstering overall market volume. Catering to both newcomers and recreational players, mass market products prioritize functionality over premium features or brand prestige. Leveraging economies of scale in manufacturing and distribution, this segment enables companies to offer competitive pricing without compromising on quality for casual golfers. Spanning big-box retailers, online platforms, and pro shops at public courses, the mass market category ensures golf equipment reaches the widest customer base. Manufacturers strategically use mass market offerings to cultivate brand awareness and foster customer loyalty, often crafting upgrade paths that nudge consumers towards premium products as their skills and dedication to the sport evolve.

Forecasted to grow at a robust 5.17% CAGR from 2026 to 2031, the premium segment signals a rising consumer inclination to invest in top-tier equipment. This trend aligns with increasing participation in golf and players' evolving skills and dedication. Affluent demographics, perceiving golf equipment as both performance enhancers and status symbols, fuel this premium growth. They readily justify higher expenditures for the perceived benefits of quality and exclusivity. The premium segment stands out by integrating technological advancements, offering custom fitting services, and emphasizing brand prestige, all of which elevate its appeal beyond mere functionality. Moreover, professional endorsements and validation on tours significantly bolster marketing efforts, as golfers gravitate towards equipment favored by industry professionals. These dynamics mirror a broader consumer shift towards premiumization in sporting goods, where decisions are influenced by performance, craftsmanship, and brand association, transcending basic equipment needs.

The Golf Equipment Market Report is Segmented by Product Type (Golf Club, Golf Balls, and More), Category (Mass and Premium), End Use (Adult and Kids/Children), Distribution Channel (Offline Channel and Online Channel), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America commands a dominant 48.05% share of the global golf equipment market. The region boasts the world's largest base of golf participants. National Golf Foundation (NGF), in 2023, around 26.6 million people in the United States played golf, representing an increase of around 4% from the previous year. Major golf organizations in the region underscore this institutional backing, making substantial financial investments in player development and facility enhancements, thereby ensuring a consistent demand for equipment. With a more diverse participant base, manufacturers are pivoting, crafting products and marketing strategies that resonate with a wider audience. Both Canada and Mexico play pivotal roles in this regional growth, bolstering golf tourism and facilitating a cross-border trade in equipment. Furthermore, the region's established market dynamics favor premium product sales and the swift adoption of technological innovations.

Asia-Pacific is on the rise, boasting a robust 6.17% CAGR projected from 2026 to 2031. This growth is largely fueled by proactive government initiatives. A prime example is Golf Saudi's strategic endeavors, which include the Aramco Team Series and the PIF Saudi International tournament. Simultaneously, infrastructure is booming, with new courses sprouting in Vietnam, Indonesia, and other burgeoning markets. The region's expansion is further buoyed by increasing disposable incomes, a burgeoning golf tourism sector, and the rising prominence of Asian players on global tours, which in turn spurs local participation and equipment sales. Within Asia-Pacific, China, Japan, and India stand out as the largest markets, each showcasing unique traits: China is rapidly developing its golf infrastructure, Japan leans towards premium equipment in its established market, and India's burgeoning middle class is increasingly viewing golf as a symbol of status.

Europe's golf scene is thriving, buoyed by a solid base of 14 million golfers and substantial institutional support. A testament to this backing is The R&A's impressive GBP 200 million investment spread over a decade, aimed at boosting participation. Companies like Srixon are championing comprehensive environmental visions and eco-friendly product lines. Concurrently, golf course certification programs, such as the GEO Certified(R) Development recognition, are steering facilities towards sustainable practices. Meanwhile, South America, the Middle East, and Africa are emerging as new frontiers in the golf equipment market. Infrastructure projects, like the inaugural golf course in Benin and Saudi Arabia's bold golf tourism push, are lighting the way. Yet, these regions grapple with challenges: equipment distribution hurdles, cost-related barriers, and a general lack of awareness. Thankfully, with government backing and international investments, many of these issues are being tackled, unveiling fresh opportunities for adaptive equipment manufacturers.

- Topgolf Callaway Brands Corp.

- Misto Holdings Corp.

- Sumitomo Rubber Industries, Ltd

- TaylorMade Golf Co. Inc.

- Karsten Manufacturing Corporation(Ping Inc.)

- Mizuno Corporation

- Bridgestone Sports Co. Ltd.,

- PumaSE

- Adidas Group

- Nike, Inc.

- Amer Sports(Wilson Sporting Goods Co)

- Parsons Xtreme Golf, LLC

- Honma Golf Co., Ltd.

- Tour Edge Golf Mfg., Inc.

- Volvik Inc.

- Bettinardi Golf, Inc.

- LA Golf Partners, Inc.

- TheParkside Group(MacGregor Golf Company i)

- Golf Brands Inc(Ben Hogan Golf Equipment Company, LLC)

- Yonex Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising popularity of golf among younger and female demographics

- 4.2.2 Technological innovations in golf equipment

- 4.2.3 Expansion of golf tourism and travel

- 4.2.4 Government and institutional support programs

- 4.2.5 Focus on sustainable and eco-friendly products

- 4.2.6 Growth of golf entertainment venues and simulator-based play

- 4.3 Market Restraints

- 4.3.1 High initial investment and cost of equipment

- 4.3.2 Limited awareness and accessibility in emerging markets

- 4.3.3 Weather dependency affecting play frequency

- 4.3.4 Complexity and learning curve

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Golf Club

- 5.1.2 Golf Balls

- 5.1.3 Golf Bags and Accessories

- 5.1.4 Apparel

- 5.1.5 Footwear

- 5.1.6 Other Product Types

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By End Use

- 5.3.1 Adult

- 5.3.2 Kids/Children

- 5.4 By Distribution Channel

- 5.4.1 Offline Channel

- 5.4.2 Online Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Topgolf Callaway Brands Corp.

- 6.4.2 Misto Holdings Corp.

- 6.4.3 Sumitomo Rubber Industries, Ltd

- 6.4.4 TaylorMade Golf Co. Inc.

- 6.4.5 Karsten Manufacturing Corporation(Ping Inc.)

- 6.4.6 Mizuno Corporation

- 6.4.7 Bridgestone Sports Co. Ltd.,

- 6.4.8 PumaSE

- 6.4.9 Adidas Group

- 6.4.10 Nike, Inc.

- 6.4.11 Amer Sports(Wilson Sporting Goods Co)

- 6.4.12 Parsons Xtreme Golf, LLC

- 6.4.13 Honma Golf Co., Ltd.

- 6.4.14 Tour Edge Golf Mfg., Inc.

- 6.4.15 Volvik Inc.

- 6.4.16 Bettinardi Golf, Inc.

- 6.4.17 LA Golf Partners, Inc.

- 6.4.18 TheParkside Group(MacGregor Golf Company i)

- 6.4.19 Golf Brands Inc(Ben Hogan Golf Equipment Company, LLC)

- 6.4.20 Yonex Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK