PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687420

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687420

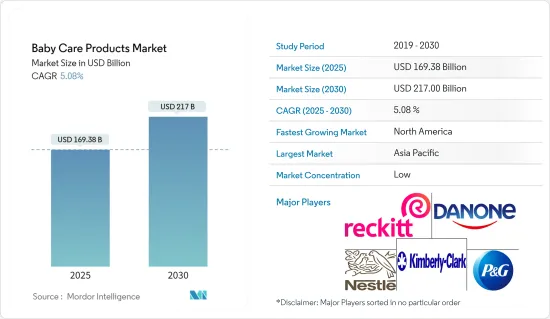

Baby Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Baby Care Products Market size is estimated at USD 169.38 billion in 2025, and is expected to reach USD 217.00 billion by 2030, at a CAGR of 5.08% during the forecast period (2025-2030).

Growing concerns about infant health are driving the market for baby care products. Environmental conditions like UV radiation, pollution, and dry climate can cause skin-related conditions such as heat rash, cradle cap, and atopic eczema, as the skin of babies is sensitive. To prevent such situations, parents prefer personal care products like baby oils, lotions, and moisturizers for their babies. Chemicals can occasionally be found in baby wipes and diapers, which can potentially irritate and cause rashes on the skin. As a result, there is a rise in consumer demand for organic baby care products. Furthermore, the demand for baby food is increasing owing to rising disposable income. Parents are willing to trade homemade food for branded organic food due to their busy lifestyles. Therefore, players are launching innovative products to meet customers' demands. For instance, in 2022, Danone launched the new Dairy & Plants Blend baby formula to meet parents' desire for feeding options suitable for vegetarian, flexitarian, and plant-based diets as per their baby's specific nutritional requirements.

Baby Care Products Market Trends

Increasing Preference for Fortified Baby Food

There is an increasing demand for fortified baby food, with rising awareness among parents about adequately fulfilling their babies' nutritional requirements. The growing demand for infant formula is influencing the market growth. Iron deficiency and anemia are usually common dietary deficiencies among children. Consequently, players in the market are introducing fortified baby food products rich in iron and folic acid for baby's physical and mental growth. For instance, in 2022, Nestle introduced two new Little Steps multigrain portions of cereal for infants and toddlers in the United Kingdom under its SMA Nutrition range. Little Steps multigrain cereals, such as oat, barley, and wheat, for babies starting at six months, and Little Steps multigrain cereals with fruit for toddlers beginning at twelve months are the two varieties. In addition to being made without added sugars, the multigrain cereals are fortified with vital nutrients, including iron, to help support the proper cognitive development of young children.

Asia-Pacific is the Largest Market

North America and Europe highly dominate the baby care products market. However, Asia-Pacific is the largest market for baby care products due to the rising birth rate. Increasing brand penetration and a vast distribution network are driving the baby care products market in the region. The e-commerce sector is further supporting the growth of the market. Several baby care product websites entered the Indian market in the last couple of years. Leading online retailers make it easy for customers to deliver their purchases to their doorstep. The online baby-care market mainly includes baby food, skincare, toiletries/ diapers, toys, gear, and baby nurseries. Large multinational consumer goods companies are extending their core personal care brands to introduce premium baby care products. For instance, in 2023, the hair care brand Vega launched a new product category, 'Baby & Mom. ' Products in the new range include baby cleansers, water wipes, grooming tools, and breast pumps, among others. The line has a dedicated segment on Vega's direct-to-customer website and is priced in the mid-segment of the market.

Baby Care Products Industry Overview

The global baby care market is highly competitive, with several regional and international players. Leading manufacturers in the baby care product market are leveraging opportunities from emerging markets to expand their consumer base. Key players are investing in physical retail and promotions to dilute the effect of a single promotion. Omnichannel strategies are likely to drive a return on investment. Large multinational consumer goods companies are extending their core personal care brands to introduce premium baby care products. Some major players in the market include Nestle S.A, Procter & Gamble Co., Kimberly-Clark Corp, Danone S.A, and Reckitt Benckiser Group plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Concerns Among Parents Toward Baby Personal Care and Hygiene

- 4.1.2 Influence of Endorsements and Aggressive Marketing

- 4.2 Market Restraints

- 4.2.1 Presence of Counterfeit Products

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Baby Skin Care

- 5.1.2 Baby Hair Care

- 5.1.3 Baby Toiletries

- 5.1.3.1 Baby Bath Products and Fragrances

- 5.1.3.2 Baby Diapers and Wipes

- 5.1.4 Baby Food and Beverages

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Pharmacies/Drug Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nestle S.A.

- 6.3.2 Procter & Gamble Company

- 6.3.3 Kimberly-Clark Corporation

- 6.3.4 Unilever PLC

- 6.3.5 Johnson & Johnson

- 6.3.6 Unicharm Corporation

- 6.3.7 Danone S.A.

- 6.3.8 Himalaya Global Holdings Ltd.

- 6.3.9 Abbott Laboratories

- 6.3.10 Royal Frieslandcampina N.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS