PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536881

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536881

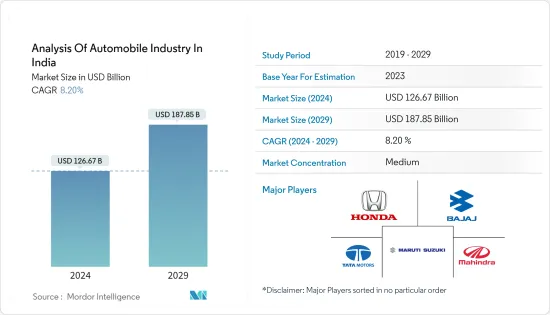

Analysis Of Automobile Industry In India - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Analysis Of Automobile Industry In India Market size is estimated at USD 126.67 billion in 2024, and is expected to reach USD 187.85 billion by 2029, growing at a CAGR of 8.20% during the forecast period (2024-2029).

The Indian economy has been expanding with the rise in disposable income of middle-class consumers. This, in turn, has a favorable impact on the increasing demand for automobiles. Vehicle manufacturing has increased rapidly over the last few years as a result of the country's low production costs. The automotive industry is gaining traction as vehicle manufacturing increases.

Increasing corporate interest in tapping into rural markets has been instrumental in driving the expansion of the Indian automobile industry. The surge in logistics and passenger transportation sectors is driving the demand for commercial vehicles. Prospective market growth is projected to be fueled by emerging trends such as the adoption of electric vehicles, particularly in the three-wheeler and small passenger vehicle segments. However, the primary challenge for the Indian automobile industry is regulatory compliance and adherence to stringent emissions standards.

The country stands as a notable player in automotive exports, with robust growth prospects anticipated in the coming years. Moreover, various government initiatives like the Automotive Mission Plan 2026, Scrappage Policy, and production-linked incentive schemes are poised to elevate India's status to a key global leader in the automotive sector.

Indian Automobile Market Trends

The Two-Wheelers Segment to Register Fastest Growth over the Forecast Period

The Indian two-wheeler industry is gaining immense popularity in the country due to the fuel efficiency and lower purchase costs of two-wheelers, the country's rapidly growing population, road traffic congestion, lack of parking spaces, inadequate mobility infrastructure, and reduced carbon emissions, particularly in electric variants.

Moreover, the two-wheelers segment dominates the market in terms of volume, owing to the expanding middle-class population and a huge percentage of Indians being young. India has a line-up of festivals and auspicious periods between August and November, pushing up two-wheeler sales in the country. Rural India, which forms nearly two-thirds of the country's population, accounts for 55% of the total two-wheeler sales.

- As per the Society of Indian Automobile Manufacturers (SIAM), two-wheeler sales increased from 1,35,70,008 to 1,58,62,087 units in FY-2022-23 compared to the previous year.

- According to the Society of Manufacturers of Electric Vehicles, sales of electric two-wheelers, which was 53,258 in April 2022, increased to 86,194 units in March 2023 and registered exponential growth.

Moreover, due to the high demand for two-wheelers in India, numerous automotive companies are focusing on launching new models with advanced features, better fuel-efficient models, and security measures. For instance,

- In January 2024, Ducati revealed its plans to introduce eight new motorcycle models to the Indian market. The renowned Italian luxury motorcycle brand will also inaugurate two new showrooms in India in 2024. Among the upcoming Ducati offerings showcased at the Ducati World Premiere 2024 are the Multistrada V4 RS, DesertX Rally, Panigale V4 Racing Replica 2023, Diavel for Bentley, Monster 30° Anniversario, and Panigale V4 SP2 30° Anniversario 916.

- In January 2023, India's two-wheeler maker, Hero MotoCorp, started commercial production trials for flex fuel motorcycles, which will be introduced in the 100-125 cc mass market.

Furthermore, the growing demand for two-wheelers for touring purposes is trending in the country. Many companies collaborate with large groups and organized clubs to explore new destinations in India and across the country's borders. This, in turn, is further anticipated to boost the two-wheelers segment of the Indian automobile industry.

The Electric Fuel Type Segment is Expected to Witness Significant Growth over the Forecast Period

The Indian government's strict regulations in response to the rising levels of vehicular emissions and increased demand for environment-friendly automobiles are likely to drive the growth of the industry over the forecast period. Along with various schemes, the government announced a battery-swapping policy in the Union Budget 2022-2023, allowing depleted batteries to be switched out for charged ones at specific charging points, increasing the viability of electric vehicles for potential buyers.

- Electric vehicle sales in India jumped by 49.25% year-on-year to 15,29,947 units in 2023, according to data released by the Federation of Automobile Dealers' Association (FADA).

The Government of India has undertaken multiple initiatives to promote the manufacturing and adoption of electric vehicles in the country to reduce emissions and develop e-mobility in the wake of rapid urbanization. The National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) helped create the initial interest and exposure to electric mobility.

Moreover, the country announced an ambitious roadmap for decarbonization during COP26, outlining targets for 2030. These include a 50% reduction in carbon emissions from the energy sector and achieving a renewable energy capacity of 500 GW. India aims to triple its current renewable capacity to meet these objectives. It has committed to the global EV30@30 campaign, striving for electric vehicles (EVs) to represent at least 30% of new vehicle sales by 2030.

- As of March 2023, a total of 6,586 public charging stations (PCS) were operational in the country. Delhi had the largest number of public electric vehicle charging stations in India, close to 1.9 thousand stations. It was followed distantly by Karnataka at 704 stations. In India, the majority of electric vehicles were electric two and three-wheelers.

The Indian government has also provided tax exemptions and subsidies to electric vehicle manufacturers and consumers to promote the domestic electric vehicle industry. As per the phased manufacturing proposal, the government has imposed a 15% customs duty on parts used to manufacture electric vehicles and 10% on imported lithium-ion cells.

With 100% FDI, new production centers, and a greater drive to improve charging infrastructure, India's electric vehicle industry is picking up speed. Other development factors for the Indian electric vehicle industry include federal subsidies and policies supporting more significant discounts for Indian-made electric two-wheelers and a boost for localized ACC battery storage manufacturers. Improved government regulations and policies, such as not requiring licenses to operate EV charging stations in the country, are further aiding the market's growth.

Hence, the Indian automobile industry is expected to witness robust growth during the forecast period due to the aforementioned factors.

With 100% FDI, new production centers, and a greater drive to improve charging infrastructure, India's electric vehicle industry is picking up speed. Other development factors for the Indian electric vehicle industry include federal subsidies and policies supporting more significant discounts for Indian-made electric two-wheelers and a boost for localized ACC battery storage manufacturers. Improved government regulations and policies, such as not requiring licenses to operate EV charging stations in the country, are further aiding the market's growth.

Hence, the Indian automobile industry is expected to witness robust growth during the forecast period due to the aforementioned factors.

Indian Automobile Industry Overview

The Indian automobile industry is reasonably concentrated, with the top five players having most of the market share in all the segments. The major players in the passenger car segment include Maruti Suzuki India Limited (Suzuki Motor Corporation), Tata Motors Limited, Hyundai Motor Company, Mahinda and Mahindra Limited, and Honda Motor Company.

The two-wheeler market is also concentrated, with major players occupying the majority share of the market. The key players in the two-wheeler market include Hero MotoCorp Limited, Honda Motorcycle & Scooter India Pvt. Ltd (Honda Motor Company), TVS Motor Company, Bajaj Auto Limited, and Royal Enfield.

Major players in the various segments are investing in R&D and infrastructure to gain the upper hand. For instance,

- In November 2023, Toyota Motor Corporation announced the expansion of its third car manufacturing plant in Bidadi, Karnataka, India, with an investment of approximately INR 3,300 crore (USD 396 million), which would increase its production capacity by 100 thousand units per annum.

- In June 2023, Musashi Seimitsu Industries, Japan, invested INR 700 million (USD 8.42 million) to expand its manufacturing facility in India. The company collaborated with Bharat New-Energy Company (BNC) Motors in India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Growing Economy, Coupled with Rising Disposal Incomes and Urbanization, Fuels Demand for the Market

- 4.2 Market Restraints

- 4.2.1 Various Regulatory Changes, Safety Standards, and Taxation Policies by the Government may Hamper the Market

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Two-wheelers

- 5.1.2 Passenger Cars

- 5.1.3 Commercial Vehicles

- 5.1.4 Three-wheelers

- 5.2 By Fuel Type

- 5.2.1 Diesel

- 5.2.2 Petrol/Gasoline

- 5.2.3 CNG and LPG

- 5.2.4 Electric

- 5.2.5 Others

- 5.3 By Region

- 5.3.1 North India

- 5.3.2 South India

- 5.3.3 East India

- 5.3.4 West India

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.1.1 Two-wheelers

- 6.1.2 Passenger Cars

- 6.1.3 Commercial Vehicles

- 6.1.4 Three-wheelers

- 6.2 Company Profiles*

- 6.2.1 Two-wheelers

- 6.2.1.1 TVS Motor Company

- 6.2.1.2 Hero Moto Corp.

- 6.2.1.3 Honda Motorcycle & Scooter India Pvt. Ltd

- 6.2.1.4 Royal Enfield

- 6.2.1.5 Bajaj Auto Corp.

- 6.2.1.6 Suzuki Motorcycle India Private Limited

- 6.2.2 Passenger Cars and Commercial Vehicles

- 6.2.2.1 Maruti Suzuki India Limited

- 6.2.2.2 Tata Motors Limited (includes Tata and Jaguar)

- 6.2.2.3 Hyundai Motor India Ltd

- 6.2.2.4 Mahindra & Mahindra Limited

- 6.2.2.5 MG Motor India Pvt. Ltd

- 6.2.2.6 Volkswagen India

- 6.2.2.7 Renault Group (Includes Nissan and Renault)

- 6.2.2.8 Honda Cars India Ltd

- 6.2.2.9 BYD Company Ltd

- 6.2.2.10 BMW AG (includes BMW and MINI)

- 6.2.2.11 Mercedes-Benz India Pvt Ltd

- 6.2.3 Three-wheelers

- 6.2.3.1 Lohia Auto Industries

- 6.2.3.2 Piaggio & C. SpA

- 6.2.3.3 Scooters India Ltd

- 6.2.3.4 Atul Auto Limited

- 6.2.3.5 Terra Motors India Corp.

- 6.2.3.6 Kinetic Green Energy & Power Solutions Ltd

- 6.2.1 Two-wheelers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS