PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851355

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851355

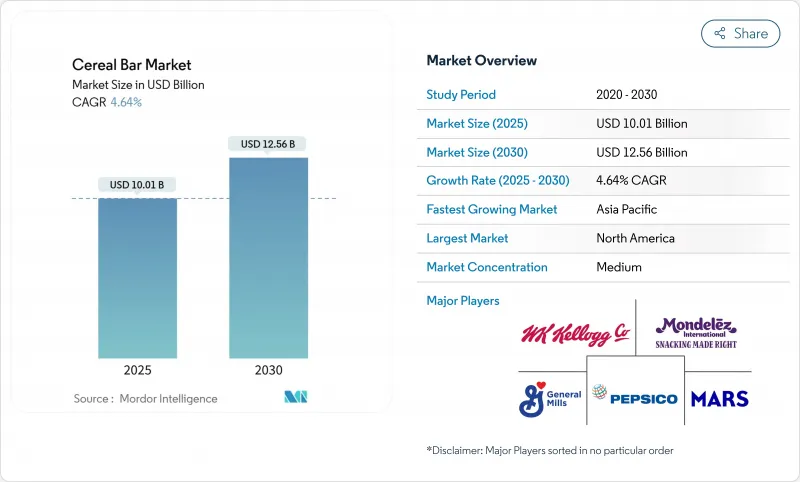

Cereal Bar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cereal bar market is projected to grow from USD 10.01 billion in 2025 to USD 12.56 billion by 2030, expanding at a CAGR of 4.64%.

Significant shifts in consumer preferences and product innovations are reshaping the competitive landscape. The Asia-Pacific region is growing rapidly, outpacing the more mature North American market, which faces rising competition from emerging players. Health-focused offerings are taking center stage in the market's evolution. Organic variants, though constituting only a small portion of current sales, are witnessing robust growth. This surge in health consciousness is prompting major players, like General Mills, to reformulate their products, introducing protein-enriched options to cater to fitness enthusiasts. However, the industry faces hurdles: tightening sugar-reduction regulations pose compliance challenges, and volatility in raw material prices, especially for nuts and seeds, is pressuring margins on premium products. Meanwhile, the distribution landscape is shifting, with online retail channels expanding rapidly, outpacing the overall market growth and compelling traditional players to rethink their market strategies.

Global Cereal Bar Market Trends and Insights

Expansion of On-The-Go Snack Bars Consumption

Modern lifestyles are driving cereal bars to become essential daily nutrition rather than occasional treats. The "snackification" trend is accelerating this transformation as urban professionals and fitness enthusiasts actively replace traditional meal preparation with convenient nutrition options. Consumers are increasingly viewing cereal bars as convenient, functional meal replacements that align with their health and wellness goals. According to the 2024 IFIC Food and Health Report, 74% of Americans snack daily , with many seeking snacks that offer added nutritional benefits like protein and fiber, making cereal bars a popular choice for health-conscious snacking. Manufacturers are actively enhancing their products by reformulating them to improve nutritional density and deliver functional benefits that meet the evolving demands of consumers. This shift is redefining competition in the market, as companies focus on health-driven innovation rather than solely competing on taste or price.

Rising Health Consciousness Boosts Demand for Nutritious Snack Bars

Health consciousness has evolved from a niche concern to a mainstream priority, reshaping the growth trajectory of the cereal bar market. A 2024 report from the International Food Information Council reveals that 62% of consumers, particularly those with higher incomes, now prioritize healthfulness as a key purchasing driver . This shift propels innovation from mere health claims to authentic nutritional enhancements. In response, manufacturers are incorporating functional ingredients such as flaxseed, quinoa, and legumes, enhancing nutritional profiles while reducing sugar content. Additionally, brands are addressing evolving consumer demands by introducing products designed to meet specific dietary requirements, such as high-protein or low-sugar formulations. For instance, KIND offers protein-enriched bars with a low glycemic index, catering to both fitness-oriented consumers and individuals managing diabetes. This health-centric evolution not only paves the way for premium positioning but also raises the baseline expectations for nutritional quality across all price points.

Raw-Material Price Volatility for Nuts and Seeds

Cereal bar manufacturers grapple with significant margin pressures and strategic hurdles due to price volatility in key ingredients, especially nuts and seeds. This volatility stems from various factors: climate change's toll on crop yields, geopolitical disruptions affecting supply chains, and heightened competition for raw materials from other food sectors. Premium and organic products, which heavily depend on these ingredients for their nutritional edge, feel the brunt of this impact. In response, manufacturers are adopting diverse strategies: some are vertically integrating to secure their supply, others are reformulating products to lessen reliance on these volatile ingredients, and many are exploring innovative sourcing methods, like upcycling food byproducts. Larger manufacturers, equipped with advanced hedging capabilities and a broad supplier network, are turning this volatility into a strategic advantage. In contrast, smaller players are grappling with heightened margin pressures. This scenario is prompting a fundamental reevaluation of product formulations, with a growing focus on alternative protein sources and novel ingredients that promise similar nutritional benefits but with enhanced price stability.

Other drivers and restraints analyzed in the detailed report include:

- Growing Fitness Trends Fuel Consumption of Cereal Bars

- Clean-Label and Plant-Based Bars Rising in Demand

- Sugar-Reduction Regulation Tightening Hinders Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Breakfast/Granola Bars maintain market leadership with 80.21% share in 2024, benefiting from established consumer habits and widespread retail presence. However, the Other Bars segment, which includes specialized protein, energy, and functional variants, is growing at 6.11% CAGR (2025-2030), significantly outpacing the overall market. This growth is driven by increasing consumer demand for targeted nutritional benefits rather than general sustenance, particularly among fitness enthusiasts and health-conscious demographics. The protein bar category exemplifies this trend, having overtaken traditional cereal bars in sales volume and accounting for approximately half of the snack bar market's retail value.

The innovation focus has shifted decisively toward specialized formulations, with manufacturers introducing novel ingredients and functional benefits to differentiate their offerings. General Mills' Nature Valley Protein Smoothie Bars illustrate this trend, targeting consumers seeking specific nutritional profiles rather than generic energy sources. The emergence of specialized subcategories like muscle recovery, energy, indulgent, and meal replacement bars reflects the market's evolution toward precision nutrition, creating opportunities for premium positioning and brand loyalty among increasingly knowledgeable consumers.

The Cereal Bar Market Report Segments the Industry Into Product Type (Breakfast/Granola Bars, and Other Bars), Functional Claim (Organic and Conventional), Distribution Channel (Convenience/Grocery Stores, Supermarkets/Hypermarkets, Specialty Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America secures 36.11% of the revenue, driven by deep-rooted health-focused snacking habits and robust disposable incomes. The region's well-established retail infrastructure and widespread availability of diverse product offerings further bolster its dominance. Consumers in North America are increasingly seeking convenient, on-the-go snacks that align with their health and wellness goals, such as high-protein and low-sugar options. Additionally, the growing trend of clean-label products, which emphasize natural and minimally processed ingredients, is shaping purchasing decisions. The presence of major market players and their continuous innovation in flavors, packaging, and nutritional profiles also contributes to the region's strong performance.

Asia-Pacific emerges as a formidable contender, boasting an 8.20% CAGR, the highest among all regions. Urbanization is steering the busy middle class towards on-the-go nutrition. Meanwhile, in India, Indonesia, and Vietnam, digital commerce is surmounting traditional infrastructure hurdles. As gym culture gains traction, Chinese consumers are turning to Western protein bars, albeit with a preference for local flavors like red bean and matcha. Indian innovator Yoga Bar has expanded its portfolio from granola bars to muesli, nut butters, and breakfast mixes, leveraging direct-to-consumer logistics. In this dynamic landscape, global brands are adapting by tailoring SKUs to regional tastes, offering smaller packages, and moderating sweetness to foster customer loyalty. Additionally, Europe showcases a dual narrative of market maturity and a tilt towards premiumization. Northern regions are emphasizing higher protein content, while Mediterranean areas, in tune with their culinary heritage, are favoring fruit-nut blends. The EU's rigorous health-claim regulations, though elevating scientific substantiation costs, significantly enhance post-approval consumer trust. Amidst nut sourcing challenges, there's a strategic pivot towards sunflower, pumpkin, and chickpea ingredients, a move aimed at profit margin stabilization.

South America and the Middle East and Africa, though still in their infancy, show significant potential. Urban centers in Brazil and Mexico are gravitating towards a balanced cereal bar market, straddling the line between indulgence and health. However, rural penetration faces hurdles due to price sensitivity and a fragmented trade landscape. In the Gulf Cooperation Council, expatriate sports communities are embracing premium protein bars, yet consumption lags behind global norms. By forging distribution partnerships and localizing facilities, brands can mitigate tariffs and resonate more authentically with local consumers.

- WK Kellogg Co.

- General Mills Inc.

- PepsiCo Inc.

- Mondelez International Inc.

- Mars Inc.

- McKee Foods Corporation

- Nestle S.A.

- Post Holdings Inc.

- NuGo Nutrition

- Associated British Foods PLC (Jordans)

- Riverside Natural Foods Ltd.

- Sproutlife Foods Pvt. Ltd. (Yoga Bar)

- Hormel Foods Corp. (Skippy PB-Bar)

- The Organic Snack Company

- Simply Delicious Inc.

- Kodiak Cakes

- Magic Spoon

- Simpl Innovative Brands Pvt. Ltd. (Phab)

- Wingreens World

- Cosmic Nutracos Solutions Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of On-The-Go Snack Bars Consumption

- 4.2.2 Rising Health Consciousness Boosts Demand for Nutritious Snack Bars

- 4.2.3 Growing Fitness Trends Fuel Consumption of Cereal Bars

- 4.2.4 Clean-Label and Plant-Based Bars Rising in Demand

- 4.2.5 Product Innovation and Diverse Flavor Profiles

- 4.2.6 Growing Popularity of Functional and Fortified Bars

- 4.3 Market Restraints

- 4.3.1 Sugar-Reduction Regulation Tightening Hinders Growth

- 4.3.2 Raw-Material Price Volatility for Nuts and Seeds

- 4.3.3 Counterfeit and Unlabelled Bars Restricts Growth

- 4.3.4 Limited Market Penetration in Rural Areas

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Breakfast/Granola Bars

- 5.1.2 Other Bars

- 5.2 By Functional Claim

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Retail

- 5.3.5 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Singapore

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 South Korea

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Morocco

- 5.4.5.8 Rest of Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 WK Kellogg Co.

- 6.3.2 General Mills Inc.

- 6.3.3 PepsiCo Inc.

- 6.3.4 Mondelez International Inc.

- 6.3.5 Mars Inc.

- 6.3.6 McKee Foods Corporation

- 6.3.7 Nestle S.A.

- 6.3.8 Post Holdings Inc.

- 6.3.9 NuGo Nutrition

- 6.3.10 Associated British Foods PLC (Jordans)

- 6.3.11 Riverside Natural Foods Ltd.

- 6.3.12 Sproutlife Foods Pvt. Ltd. (Yoga Bar)

- 6.3.13 Hormel Foods Corp. (Skippy PB-Bar)

- 6.3.14 The Organic Snack Company

- 6.3.15 Simply Delicious Inc.

- 6.3.16 Kodiak Cakes

- 6.3.17 Magic Spoon

- 6.3.18 Simpl Innovative Brands Pvt. Ltd. (Phab)

- 6.3.19 Wingreens World

- 6.3.20 Cosmic Nutracos Solutions Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK