PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906888

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906888

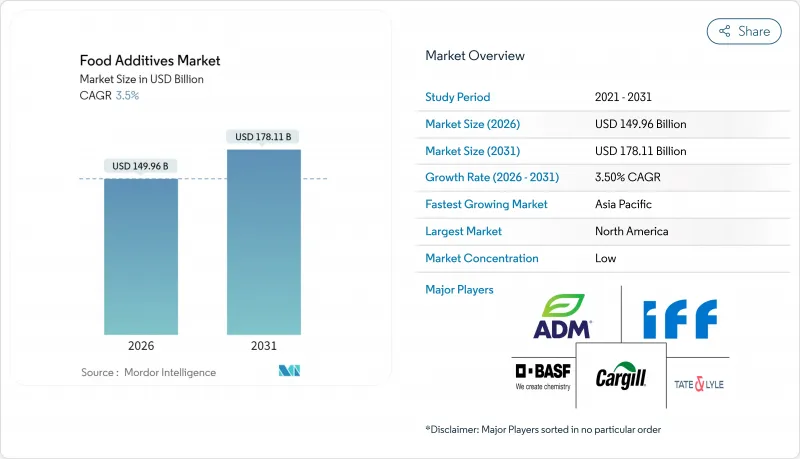

Food Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global food additives market is expected to grow from USD 144.89 billion in 2025 to USD 149.96 billion in 2026 and is forecast to reach USD 178.11 billion by 2031 at 3.5% CAGR over 2026-2031.

This measured growth reflects the industry's maturation and the complex interplay between consumer demand for natural ingredients and the technical requirements of modern food processing. The market's trajectory indicates a fundamental shift from volume-driven expansion to value-oriented innovation, where manufacturers prioritize ingredient functionality and consumer acceptance over pure cost optimization. The industry is witnessing a substantial shift towards clean-label ingredients and natural food additives, reflecting evolving consumer preferences and regulatory requirements. Manufacturers are increasingly focusing on developing additives that can be labeled as GMO-free, natural preservatives, or organic, driving significant market growth in natural alternatives. This trend is particularly evident in categories such as colorants, acidulants, and hydrocolloids.

Global Food Additives Market Trends and Insights

Rising Demand for Processed and Convenience Food

With the rise in urbanization and a growing middle-class population, the developed and developing regions across the globe are witnessing a rising demand for processed and packaged food, leading to more demand for food additives across the globe. The consumption of processed products like bakery, confectionery, and beverages is increasing among consumers due to product innovation and product attractiveness. Young consumers and the working population are opting to consume processed beverages like cold drinks, energy drinks, and others. Consumers are driven by the improved texture, flavor, and overall sensory experience of ready meals and processed food products, hence promoting the demand for food additives, artificial ingredients, sugar, and preservatives, among others. A report by the World Health Organization (WHO) and the Indian Council for Research on International Economic Relations (ICRIER)in 2023 revealed that the sale of ultra-processed foods has witnessed a rapid rise in India over the duration of 10 years. These ultra-processed foods contain sugar and fat for longer shelf-life, artificial colors and flavors, and artificial sweeteners, and with the increase in the consumption of ready-to-eat meals and sugary drinks across the country, is likely to support the demand for food additives in coming years as well.

Increasing Demand for Natural and Clean Label Products

The demand for recognizable ingredients has transformed product development, as manufacturers shift toward natural alternatives instead of synthetic additives. This change requires comprehensive reformulation strategies to maintain product functionality while ensuring ingredient transparency. Companies must reevaluate their entire production processes, from sourcing raw materials to adjusting manufacturing parameters. Plant-based and microbial preservatives are emerging as viable options, with companies such as Galactic developing solutions that extend shelf life and ensure food safety while meeting regulatory requirements. These natural preservatives undergo extensive testing to validate their efficacy across different food matrices and storage conditions. The clean label trend has created opportunities for biotechnology firms to produce fermentation-based ingredients that fulfill both natural and functional requirements, establishing them as premium substitutes for synthetic additives. These fermentation processes are optimized to yield consistent, high-quality ingredients that can effectively replace traditional chemical preservatives while maintaining product stability and safety.

Stringent Regulatory Frameworks

Regulatory complexity affects market participants through divergent approval processes across jurisdictions, creating barriers to global product launches and increasing compliance costs. Companies must navigate various regulatory frameworks, documentation requirements, and safety standards in each market in which they operate. The FDA's revocation of authorization for erythrosine (Red No. 3) in foods demonstrates the heightened scrutiny of food additives, requiring companies to maintain comprehensive safety databases and regulatory expertise. Companies must continuously monitor regulatory changes, update their compliance protocols, and invest in scientific research to support product safety claims. State-level regulations, including California's ban on specific chemical additives in schools, have created multiple compliance requirements that affect product formulation and market entry strategies. These varying requirements necessitate region-specific product modifications and separate supply chain management systems. This regulatory environment increases operational costs and complexity while constraining additive development innovation, as companies must allocate significant resources to compliance rather than research and development initiatives.

Other drivers and restraints analyzed in the detailed report include:

- Enhanced Shelf Life and Preservation Needs

- Technological Advancements in Food Processing

- High Research and Development and Innovation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bulk sweeteners hold a 54.62% market share in 2025, serving as essential ingredients in food and beverage formulations across baked goods and processed foods. Food colorants are experiencing the highest growth rate with a 6.65% CAGR during 2026-2031, driven by increasing consumer preference for visually appealing products and the shift from synthetic to natural alternatives. These colorants maintain established safety standards through scientific validation and defined acceptable daily intake levels. Preservatives continue to show consistent demand due to food safety requirements and extended supply chains that necessitate antimicrobial protection. Emulsifiers are growing in importance due to the expansion of plant-based and convenience foods that require advanced texture control.

Natural colorants are gaining market value as consumers increasingly prefer products without synthetic chemicals, despite higher costs and processing challenges. Enzymes demonstrate strong growth potential in the product portfolio. Anti-caking agents and acidulants perform specific functions in powder and processed food applications, with silicon dioxide and calcium phosphate serving as commonly approved anti-caking agents across food categories. Hydrocolloids are becoming increasingly important for texture modification, particularly as manufacturers develop improved mouthfeel and stability in reduced-fat and plant-based products.

Dry form additives hold 62.95% market share in 2025, due to their superior storage stability, transportation efficiency, and ease of handling in industrial food processing operations. Liquid additives show a growth rate of 5.95% CAGR during 2026-2031, driven by applications requiring precise dosing, immediate solubility, and integration into liquid food systems. The dominance of dry additives stems from practical manufacturing considerations, as powder forms provide extended shelf life, lower shipping costs, and simplified inventory management compared to liquid variants. Anti-caking solutions maintain powder flowability by reducing moisture-induced caking, with calcium carbonate solutions demonstrating potential for reduction in caking under severe conditions.

Liquid additives see increased adoption in beverage applications and specialized food processing, where immediate dispersion and uniform distribution are essential for product quality. The expansion of functional beverages and liquid nutritional products increases demand for liquid additive forms that integrate effectively without impacting taste, appearance, or stability. Emulsifiers such as lecithin play a vital role in combining water and oil-based ingredients, maintaining textural uniformity across products from infant formulas to baked goods and spreads. Advances in encapsulation and controlled-release systems allow dry additives to achieve liquid-like performance while retaining the handling benefits of powder forms, resulting in hybrid solutions that balance functionality and operational efficiency.

The Food Additives Market Report Segments the Industry Into Product Type (Preservatives, Bulk Sweeteners, Sugar Substitutes, Emulsifiers, and More), Form (Dry and Liquid), Source (Natural and Synthetic), Application (Bakery and Confectionery, Dairy and Desserts, Beverages, and More), and Geography (North America, Europe, Asia-Pacific, and More). Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

North America holds 30.98% market share in 2025, driven by advanced food processing infrastructure, comprehensive safety standards, and consumer acceptance of premium additive solutions. The region's established regulatory framework facilitates product development while encouraging innovation in natural and functional ingredients. The FDA's increased post-market evaluation of food chemicals demonstrates the region's safety commitment, though this may restrict new synthetic additive entries. North American food manufacturers focus on clean label formulations, exemplified by Cargill's high-intensity sweeteners portfolio, including EverSweet(R), Truvia(R), and ViaTech(R). The region's expertise in biotechnology and precision fermentation enables advanced additive development, despite market entry challenges from high costs and regulatory requirements.

Asia-Pacific shows the highest growth rate at 4.45% CAGR during 2026-2031, supported by urbanization, middle-class expansion, and increased processed food consumption. China's National Health Commission's approval of 30 new food additives in 2024 indicates strong regulatory support in the region's primary market. Japan's food processing sector, valued at USD 190 billion, reflects regional trends toward pre-prepared foods and enhanced safety standards. The region benefits from manufacturing efficiencies and raw material availability, making it a strategic production hub for domestic and international markets.

Europe maintains market distinction through strict regulations, natural ingredient preferences, and sustainable food production practices. The European Commission's support for bio-based innovations, including various fermentation technologies, reinforces the region's sustainable additive development. EU-wide regulatory alignment offers market access benefits, despite rigorous compliance standards. The region's focus on organic and natural products creates opportunities for additives meeting both functional requirements and sustainability standards.

- Cargill Incorporated

- Archer Daniels Midland Company

- BASF SE

- International Flavors and Fragrances Inc.

- Tate & Lyle PLC

- Kerry Group PLC

- Ajinomoto Co. Inc.

- Givaudan SA

- Corbion NV

- Eastman Chemical Company

- Ingredion Incorporated

- Chr. Hansen Holding A/S

- DSM-Firmenich

- Symrise AG

- Jungbunzlauer Suisse AG

- Roquette Freres S.A.

- Celanese Corporation

- Lycored Corp.

- Kemin Industries

- GNT Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for the Processed and Conveniece Food

- 4.2.2 Increasing Demand for Natual and Clean Label Products

- 4.2.3 Enhanced Shelf Life and Preservation Needs

- 4.2.4 Technological Advancements in Food Processing

- 4.2.5 Growing Demand for Fortified and Functional Beverage

- 4.2.6 Evolving Consumer Preference for Taste and Texture

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Frameworks

- 4.3.2 High R&D and Innovation Cost

- 4.3.3 Labeling Challenges and Transparency Pressures

- 4.3.4 The Adverse Effects of Food Additives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Preservatives

- 5.1.2 Bulk Sweeteners

- 5.1.3 Sugar Substitutes

- 5.1.4 Emulsifiers

- 5.1.5 Anti-Caking Agents

- 5.1.6 Enzymes

- 5.1.7 Hydrocolloids

- 5.1.8 Food Flavors and Enhancers

- 5.1.9 Food Colorants

- 5.1.10 Acidulants

- 5.2 By Form

- 5.2.1 Dry

- 5.2.2 Liquid

- 5.3 By Source

- 5.3.1 Natural

- 5.3.2 Synthetic

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Dairy and Desserts

- 5.4.3 Beverages

- 5.4.4 Meat and Meat Products

- 5.4.5 Soups, Sauces, and Dressings

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Spain

- 5.5.2.4 France

- 5.5.2.5 Italy

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Cargill Incorporated

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 BASF SE

- 6.4.4 International Flavors and Fragrances Inc.

- 6.4.5 Tate & Lyle PLC

- 6.4.6 Kerry Group PLC

- 6.4.7 Ajinomoto Co. Inc.

- 6.4.8 Givaudan SA

- 6.4.9 Corbion NV

- 6.4.10 Eastman Chemical Company

- 6.4.11 Ingredion Incorporated

- 6.4.12 Chr. Hansen Holding A/S

- 6.4.13 DSM-Firmenich

- 6.4.14 Symrise AG

- 6.4.15 Jungbunzlauer Suisse AG

- 6.4.16 Roquette Freres S.A.

- 6.4.17 Celanese Corporation

- 6.4.18 Lycored Corp.

- 6.4.19 Kemin Industries

- 6.4.20 GNT Group

7 Market Opportunities and Future Outlook