PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1536797

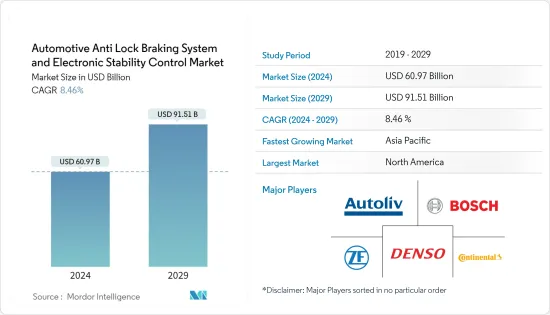

Automotive Anti Lock Braking System And Electronic Stability Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Automotive Anti Lock Braking System And Electronic Stability Control Market size is estimated at USD 60.97 billion in 2024, and is expected to reach USD 91.51 billion by 2029, growing at a CAGR of 8.46% during the forecast period (2024-2029).

In 2022, some 85 million motor vehicles were produced worldwide. In 2022, China emerged as the global leader in passenger car production, manufacturing approximately 23.84 million vehicles alongside 3.19 million commercial vehicles, solidifying its position as the foremost producer of passenger cars worldwide.

Over the long term, the increasing acceptance of ABS systems is the growing focus on safety and the potential reduction in road-accident-related deaths. Nearly 3,300 people die every day due to road crashes, and about 9/10th of the casualties occur in middle and low-income countries that have less than half of the world's total vehicles.

The automotive anti-lock brake system market is expected to show a high growth rate as these systems are starting to be used extensively in entry-level two-wheelers. Most two-wheelers in the developed markets are high-end vehicles with safety features similar to the standard. However, in emerging markets, two-wheelers are the cheapest and entry-level vehicles. Increased adoption of such safety systems in passenger vehicles is expected to boost the market during the forecast period.

However, Asia-Pacific is projected to become the key automotive anti-lock braking system market. During the forecast period, Japan, India, and China are the major automotive manufacturing hubs.

Automotive Anti-lock Braking System Market Trends

Government Regulations Likely to Drive Adoption of ABS in Passenger Cars

Due to the rising number of motor vehicles worldwide, there has been a significant increase in road accidents globally. For instance,

- In July 2023, the production of anti-lock braking systems (ABS) and electronic stability control systems (ESP) for passenger cars commenced at the Itelma LLC facility in Kostroma, making it the first such facility in Russia. The regional administration's press service informed Interfax about this development.

A new workshop equipped with a fully automated production line has been constructed to facilitate this project. Itelma LLC is also licensed to manufacture ABS and ESP systems locally. Notably, the entire project is commercially driven, with no reliance on subsidies or government funds. The production capacity aims to achieve an annual output of 850,000 units of domestic ABS and ESP systems, with the potential for expansion to 1.2 million units.

The automotive anti-lock braking system market is primarily driven by the growing demand for vehicle safety and control systems in automobiles, such as anti-lock brakes (ABS). Also, strict regulations dictating safety standards and the launch of various programs highlighting the importance of vehicle safety have fuelled market expansion.

All new passenger cars must be equipped with ABS since 2004 in Europe. The United States took nearly a decade to mandate ABS in all new passenger cars. The National Highway Traffic Safety Administration (NHTSA) mandated ABS in conjunction with Electronic Stability Control (ESC) under the provisions of the March 2007 Federal Motor Vehicle Safety Standard (FMVSS) No. 126.

The increasing safety standards in the global automotive industry are driving developing countries to follow their developed counterparts, where new passenger cars are sold with ABS as a standard feature. The Ministry of Road Transport and Highways (MoRTH) in India notified that ABS is mandatory for all new passenger cars and two-wheelers. In 2022, nearly 92% of the passenger cars sold had been equipped with ABS, owing to the compulsory ABS rule in countries like Japan and Brazil.

Considering the strict rules and regulations implemented by the governments of almost all the countries will drive the market in the future.

Government Regulations Across the World are Driving the ABS Market

The increasing rate of accidents and the continuous efforts of governments worldwide to reduce the number of casualties is a significant driver for the anti-lock braking systems market.

Asia-Pacific is one of the fastest-growing markets globally. The increasing demand for the region's anti-lock braking system (ABS) is supported by increased road safety rules, ensuring all new vehicles are equipped with ABS. For instance,

- The Indian government has mandated that all cars and mini-buses install an anti-lock braking system (ABS). According to the Road Transport Ministry, all new vehicles must comply with the norms from April 2018 onward. Similarly, all new cars of the existing models will have to install the ABS. Moreover, ABS will be mandatory for two-wheelers with more than a 125cc engine.

- Under Regulation (EU) No. 168/2013, motorcycles in the L3e-A1 subcategory must be fitted with an advanced braking system consisting of either an anti-lock braking system (ABS) or a combined braking system (CBS) or both at the discretion of the manufacturer.

The National Transportation Safety Board (NTSB) promotes anti-lock brakes in the manufacturing process of motorcycles in the United States. The NTSB does not have the right to create laws, so it aims to persuade the NHTSA, an organization responsible for introducing and enforcing road safety rules. The Insurance Institute for Highway Safety found that motorcycles with anti-lock brakes have a 31% lower crash rate than bikes without the feature.

The European Union parliament mandated that anti-lock braking systems be the standard equipment for motorcycles built in 2016. The Insurance Institute of Highway Safety reported that 8.9% of registered motorcycles were required to have anti-lock brake systems in 2017. This number has increased steadily since 2002, when anti-lock brake technology was considered standard equipment on only 0.2% of motorcycles.

The anti-lock brake system (ABS) market is anticipated to grow during the forecast period. Developed and developing countries are making the anti-lock braking system (ABS) mandatory for four-wheelers and two-wheelers to reduce the number of casualties.

Automotive Anti-lock Braking System Industry Overview

Major players, such as Robert Bosch GmbH, Autoliv Inc., Continental Reifen Deutschland GmbH, DENSO Corporation, and ZF Friedrichshafen AG, dominate the automotive anti-lock braking system market.

The companies are strategically investing, making acquisitions, and entering into partnerships in key technologies. Also, almost all passenger vehicles have an anti-lock braking system, driving market growth.

- In March 2022, ZF announced that its new Commercial Vehicle Solutions division would introduce its entire product and technology portfolio for heavy-duty trucking applications at TMC 2022 in Orlando. ZF's show floor exhibit includes a virtual tour of the company's entire commercial vehicle product line, including chassis technology: air management; suspension solutions; air disc brakes, brake actuators, and vacuum pumps; vehicle dynamics: ADAS, anti-lock braking systems (pneumatic and hydraulic), and steering solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Strict Rules and Regulations in Vehicle Safety

- 4.2 Market Restraints

- 4.2.1 Integration Complexity

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Motorcycles

- 5.1.2 Passenger Cars

- 5.1.3 Commercial Vehicles

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 United Arab Emirates

- 5.2.4.4 South Africa

- 5.2.4.5 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Continental Reifen Deutschland GmbH

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corporation

- 6.2.4 Autoliv Inc.

- 6.2.5 ZF Friedrichshafen AG

- 6.2.6 Robert Bosch GmbH

- 6.2.7 Haldex AB

- 6.2.8 WABCO Holdings Inc.

- 6.2.9 Hyundai Mobis Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Sensors and AI