PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910710

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910710

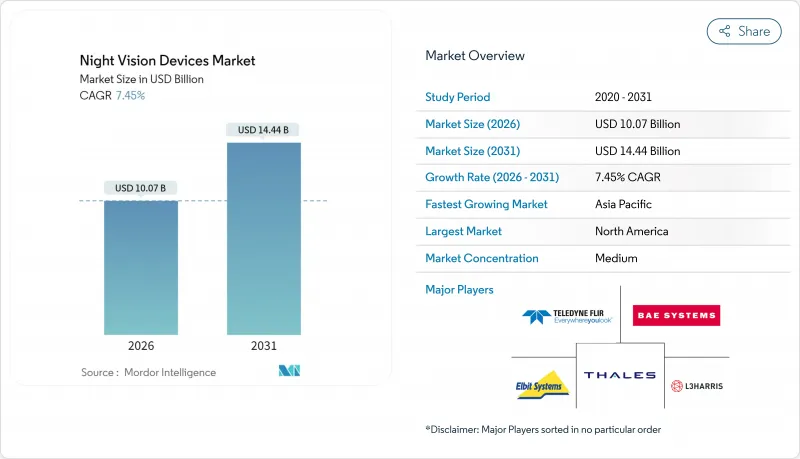

Night Vision Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The night vision devices market was valued at USD 9.37 billion in 2025 and estimated to grow from USD 10.07 billion in 2026 to reach USD 14.44 billion by 2031, at a CAGR of 7.45% during the forecast period (2026-2031).

The night vision devices market is gaining momentum as defense ministries institutionalize low-light capability, automotive regulators mandate thermal cameras for commercial fleets, and miniaturization breakthroughs lower weight and power needs. Investment flows also reflect rising civilian demand, with wildlife conservation agencies deploying thermal sensors to combat poaching and public-safety departments integrating fused-sensor goggles for tactical operations. Supply-side dynamics feature consolidation among U.S. contractors, highlighted by Teledyne's USD 710 million purchase of Excelitas in 2024, alongside export-control policies that encourage domestic sourcing in allied nations.

Global Night Vision Devices Market Trends and Insights

Rising Defense Modernisation Budgets

Defense budgets across NATO and allied regions are prioritizing night-vision capabilities in baseline infantry kits, rather than specialized add-ons. The U.S. Army delivered more than 18,000 ENVG-B units by 2024 and now links goggles wirelessly to weapon-mounted sights, turning every soldier into a networked sensor. German and French future-soldier programs follow similar doctrine shifts, ensuring that volume procurement keeps recurring orders flowing. Procurement shifts from discretionary to essential status, smooths the revenue profile for suppliers active in the night vision devices market. Parallel growth is emerging in law enforcement agencies that are adopting military-grade optics for counter-terror missions. This expanding institutional demand underpins predictable, multiyear contract pipelines for the night vision devices market.

Automotive Thermal Cameras Mandated by FMVSS-127

Federal Motor Vehicle Safety Standard 127 sets rear-visibility rules that standard backup cameras cannot meet during night or heavy rain. Thermal imaging fills that gap, and Teledyne FLIR already markets sensors ruggedized for fleet trucks. The mandate creates immediate volume demand, reducing per-unit costs across the night vision devices market chain. The adoption of automotive OEMs drives the development of common component platforms, allowing defense programs to benefit from the falling cost curves. Tier-1 suppliers partner with semiconductor foundries to add automotive-grade reliability, reinforcing scale economies that benefit both civilian and military contracts. Fleet operators achieve lower lifecycle costs as shared production stabilizes spare part availability.

High Lifecycle and Calibration Cost

Ownership costs stretch well beyond the sticker price. A U.S. Homeland Security study lists repair bills of USD 500-2,000 per unit and replacement expenses reaching USD 5,000. Periodic calibration remains mandatory to sustain sensor accuracy for mission-critical tasks. Multi-sensor goggles require specialist technicians and dedicated software, raising maintenance contracts to near weapon-system levels. Commercial buyers, such as security firms or small police departments, face budget hurdles, which can delay refresh cycles. Vendors in the night vision devices market respond with modular designs and extended service agreements; however, the total cost of ownership continues to slow adoption outside defense circles.

Other drivers and restraints analyzed in the detailed report include:

- Digitised Soldier-Vision Programmes (ENVG-B, DNVT)

- Commercial UAV Night-Vision Integration

- Export-Control (ITAR/Wassenaar) Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cameras accounted for 33.56% of the night vision devices market share in 2025, capitalizing on the adoption of these devices across military vehicles, commercial fleets, security perimeters, and drones. The segment benefits from FMVSS-127 mandates that anchor multi-year purchasing schedules in North America. As sensor cores shrink, integrators package cameras into compact modules that slot easily into vehicle grilles, aerial gimbals, and fixed installations. Revenue resilience stems from a diversified customer portfolio that hedges against fluctuations in defense spending. In parallel, goggles post an 8.02% CAGR by offering hands-free situational awareness essential to soldier modernisation programs. Law-enforcement teams echo military practice, procuring fused-sensor goggles for urban operations that span daylight, dusk, and complete darkness. Monoculars and binoculars serve marine navigation and hunting niches, where long-range spot-and-identify functions matter most. Rifle scopes stay niche yet command premium pricing as precision shooters demand image stability and ballistic calculators. Other types, including helmet-mounted displays, emerge where augmented reality overlays drive mission performance.

Segment growth patterns mirror the evolving needs of users. Soldiers and tactical police units prioritize weight savings and intuitive interfaces, fueling demand for goggle refresh cycles every few years. Camera users emphasize ruggedness and network connectivity, pushing manufacturers to integrate Ethernet and AI-based detection algorithms on the edge. Binoculars hold steady with incremental improvements in battery life. Manufacturers that align product roadmaps to these divergent needs secure sustained contracts, underscoring the strategic significance of product-type diversity within the night vision devices market.

The Night Vision Devices Market Report is Segmented by Device Type (Cameras, Goggles, Monoculars and Binoculars, and More), Technology (Thermal Imaging, Image Intensifier, and More), Application (Military and Defence, Wildlife Spotting and Conservation, Surveillance and Security, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the night vision devices market, accounting for 31.08% of the revenue share in 2025, thanks to defense modernization budgets, stringent automotive safety regulations, and a mature supplier base. The U.S. Army's multibillion-dollar ENVG-B program stabilizes factory workloads, while FMVSS-127 ensures civilian truck lines also integrate thermal sensors. Export controls favor domestic sourcing, keeping high-end manufacturing onshore and supporting a robust aftermarket service network.

The Asia-Pacific region records the highest 8.78% CAGR through 2031, as regional security concerns prompt Japan, South Korea, and India to accelerate the procurement of soldier-borne optics. Chinese manufacturers scale up aggressively, courtesy of state subsidies and lower labor costs, offering products 50-60% cheaper than their Western equivalents. This price edge forces global incumbents to differentiate themselves on sensor fusion, software, and secure communications protocols. Meanwhile, Australia's civil UAV rules are stimulating demand for thermal drones, particularly for bushfire monitoring in low-visibility smoke conditions.

Europe maintains steady uptake as NATO standardization drives collective procurement of interoperable night-vision kits. Programs like Germany's Future Soldier System allocate fixed percentages of infantry budgets to optical upgrades, keeping the spending stream predictable. The Middle East and Africa adopt thermal imaging for border monitoring and pipeline security, although capex cycles remain tied to resource revenues. South America exhibits selective growth, primarily centered on anti-narcotics operations in challenging jungle terrain. Overall, geographic dynamics reflect a balance between regulation-led pull in developed markets and security-driven urgency in emerging regions, underpinning a resilient long-term outlook for the night vision devices market.

- Teledyne FLIR LLC

- L3Harris Technologies Inc.

- Elbit Systems Ltd.

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Bushnell Holdings Inc.

- Exosens SAS

- Panasonic Holdings Corp.

- Excelitas Technologies Corp.

- EOTECH LLC

- Opgal Optronic Industries Ltd.

- QinetiQ Group plc

- Photonis France SAS

- Theon Sensors SA

- Rheinmetall AG

- Hensoldt AG

- SATIR Europe (Ireland) Co. Ltd.

- American Technologies Network Corp.

- AGM Global Vision LLC

- Yukon Advanced Optics Worldwide

- FLIR Systems AB (Sweden)

- Nivisys LLC

- Opticoelectron Group JSCo.

- Tactical Night Vision Company LLC

- Tak Technologies Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising defence modernisation budgets

- 4.2.2 Adoption of fused-sensor night-vision for law-enforcement

- 4.2.3 Automotive thermal cameras mandated by FMVSS-127

- 4.2.4 Digitised soldier-vision programmes (ENVG-B, DNVT)

- 4.2.5 Commercial UAV night-vision integration

- 4.2.6 Miniaturised SWaP-C image-intensifier tubes

- 4.3 Market Restraints

- 4.3.1 High lifecycle and calibration cost

- 4.3.2 Export-control (ITAR/Wassenaar) restrictions

- 4.3.3 Day-bright blooming and sensor saturation

- 4.3.4 Supply-chain scarcity of indium antimonide

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors on the Market

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Cameras

- 5.1.2 Goggles

- 5.1.3 Monoculars and Binoculars

- 5.1.4 Rifle Scopes

- 5.1.5 Other Device Types

- 5.2 By Technology

- 5.2.1 Thermal Imaging

- 5.2.2 Image Intensifier

- 5.2.3 Infra-Red Illumination

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Military and Defense

- 5.3.2 Wildlife Spotting and Conservation

- 5.3.3 Surveillance and Security

- 5.3.4 Navigation and Marine

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core Segments, Financials, Strategic Info, Market Share, Products and Services, Recent Developments)

- 6.4.1 Teledyne FLIR LLC

- 6.4.2 L3Harris Technologies Inc.

- 6.4.3 Elbit Systems Ltd.

- 6.4.4 BAE Systems plc

- 6.4.5 Thales Group

- 6.4.6 Raytheon Technologies Corp.

- 6.4.7 Bushnell Holdings Inc.

- 6.4.8 Exosens SAS

- 6.4.9 Panasonic Holdings Corp.

- 6.4.10 Excelitas Technologies Corp.

- 6.4.11 EOTECH LLC

- 6.4.12 Opgal Optronic Industries Ltd.

- 6.4.13 QinetiQ Group plc

- 6.4.14 Photonis France SAS

- 6.4.15 Theon Sensors SA

- 6.4.16 Rheinmetall AG

- 6.4.17 Hensoldt AG

- 6.4.18 SATIR Europe (Ireland) Co. Ltd.

- 6.4.19 American Technologies Network Corp.

- 6.4.20 AGM Global Vision LLC

- 6.4.21 Yukon Advanced Optics Worldwide

- 6.4.22 FLIR Systems AB (Sweden)

- 6.4.23 Nivisys LLC

- 6.4.24 Opticoelectron Group JSCo.

- 6.4.25 Tactical Night Vision Company LLC

- 6.4.26 Tak Technologies Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment