PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689837

Home Fragrances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

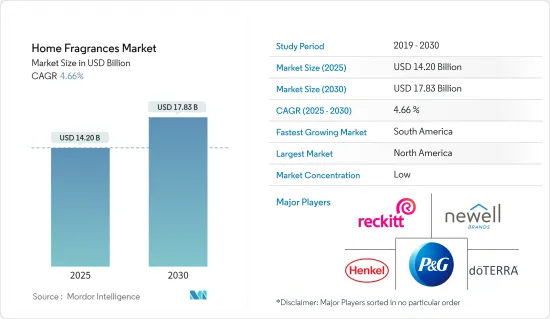

The Home Fragrances Market size is estimated at USD 14.20 billion in 2025, and is expected to reach USD 17.83 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030).

Key Highlights

- The increasing spending capacity of consumers and the rising concerns among individuals about healthy and hygienic living styles are the key factors bolstering market growth. The growing penetration of social media platforms and online retail channels is another significant factor boosting the sales of home fragrance products through e-commerce channels.

- Due to the increasing focus on creating a visually appealing and comfortable living space, consumers are spending on luxury home decor products like scented candles and diffusers. In recent years, owing to stressful lifestyles and the growing focus on improving mental health, there has been a rise in the demand for home fragrance diffusers for aromatherapy to uplift the mood by improving air quality and creating a pleasant environment.

- Moreover, manufacturers offer these products in various designs, colors, scents, and materials to cater to the preferences of individual customers. They also focus on personalizing products and introducing aesthetically pleasing products made with natural ingredients such as oils. Consumers nowadays are willing to spend more on household and toiletry products with natural and clean ingredients. Therefore, the market is anticipated to witness an increased demand for home fragrances during the forecast period. Market players are also adopting innovative strategies to capture a larger market share.

- For instance, in May 2022, Godrej Consumer Products, an Indian-based consumer goods company, launched a new TVC campaign called "If Bathrooms Could Talk" for its bathroom fragrances called Godrej Aer Power Pocket. The TVC, which Creativeland Asia conceptualized, was produced using cutting-edge graphics and animation techniques, making it visually attractive to grab consumers' attention.

Home Fragrances Market Trends

Growing Consumers' Inclination Toward Home Decor

- Consumers increasingly spend on home fragrance products like candles and diffusers as they help satisfy valued emotional needs and solve important functional problems, such as masking bad smells. These products come in various designs, colors, scents, and materials, fulfilling the diversified needs of customers worldwide. In recent years, consumers have been willing to spend more on value-added home decor items made with organic and natural ingredients due to increasing awareness about the health impacts of the ingredients used in these products. In 2022, according to a survey published by Vlam, the total household spending on organic products in Belgium increased from EUR 892 million to 992 in 2021.

- With the increasing trend of aromatherapy and at-home natural remedies for mental health and well-being, especially among young adults, customized home decor products like scented candles and diffusers are gaining immense popularity worldwide. These products are believed to improve mood, reduce stress and anxiety, promote relaxation, and improve sleep. As per the survey by Statistics Finland in 2022, 16 percent of Finns bought cosmetics and well-being products online during the past three months. The largest share of online health and beauty product shoppers were 25 to 44 years old.

- Product manufacturers and retailers often rely on innovation to provide differentiation through technology, understanding consumer trends, and sustainable production. They also invest significantly in R&D to deliver products that consumers value for meeting both emotional and functional needs. The factors mentioned above will likely positively influence market growth in the upcoming years.

North America Dominates the Market

- North America holds the largest market share in the home fragrances market globally. Furthermore, the United States is one of the largest markets for home fragrance products. This can be attributed to individuals' high per capita income levels and inclination towards value-added home decors that help satisfy valued emotional needs and solve significant functional problems of consumers.

- Home fragrance products such as scented candles, diffusers, and room sprays are often an accessible and effective way to enhance the overall ambiance and add a personalized touch to home decor. These products are also used in aromatherapy, which has gained immense acceptance, especially among young adults, due to its claimed benefits like reduced anxiety levels and relief of emotional stress, pain, muscular tension, and fatigue.

- Along with this, the increasing focus on mental health and wellness with at-home natural remedies fuels the market growth in the region. Apart from this, a significant rise in the preference for spa therapies over the years due to hectic lifestyles drives the demand for innovative home fragrances. As per the International Spa Association, in 2021, there were 21,510 spa locations across the United States, with 173 million visitors.

- The average revenue of the spa industry in the United States is estimated to be around USD 20.1 billion in 2021. Furthermore, market players adopt unique strategies to expand their customer base and market share. For instance, in 2021, Christian Dior unveiled its Canadian e-boutique with La Collection Privee Christian Dior, a portfolio of refined fragrances, candles, and soaps.

Home Fragrances Industry Overview

The home fragrances market is competitive, with the presence of many local and international players. Some leading market players are Reckitt Benckiser Group PLC, The Procter & Gamble Company, doTERRAInternational LLC, Newell Brands Inc., and Henkel AG & Co. These players focus on geographical expansions, new product launches and mergers and acquisitions, which are key strategies for operating in the global home fragrances market and gaining a competitive edge. For instance, in September 2022, Brooklinen launched a new fragrance collection that includes candles, diffusers, and room sprays.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Adoption of Multi-dimensional Products

- 4.1.2 Growing Consumers' Inclination toward Home Decor

- 4.2 Market Restraints

- 4.2.1 Rising Environmental Concerns and Raw Material Price Volatility

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sprays

- 5.1.2 Diffusers

- 5.1.3 Scented Candles

- 5.1.4 Other Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores/Grocery Stores

- 5.2.3 Online Retail

- 5.2.4 Other Didtribution channels

- 5.3 Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 SC Johnson & Sons Inc.

- 6.3.2 Reckitt Benckiser Group PLC

- 6.3.3 The Procter & Gamble Company

- 6.3.4 Newell Brands Inc.

- 6.3.5 Godrej Group

- 6.3.6 Henkel AG & Co. Kgaa

- 6.3.7 Doterra International LLC

- 6.3.8 Now Health Group Inc.

- 6.3.9 Puzhen Life Co. Ltd

- 6.3.10 Bath & Body Works Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS