PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851113

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851113

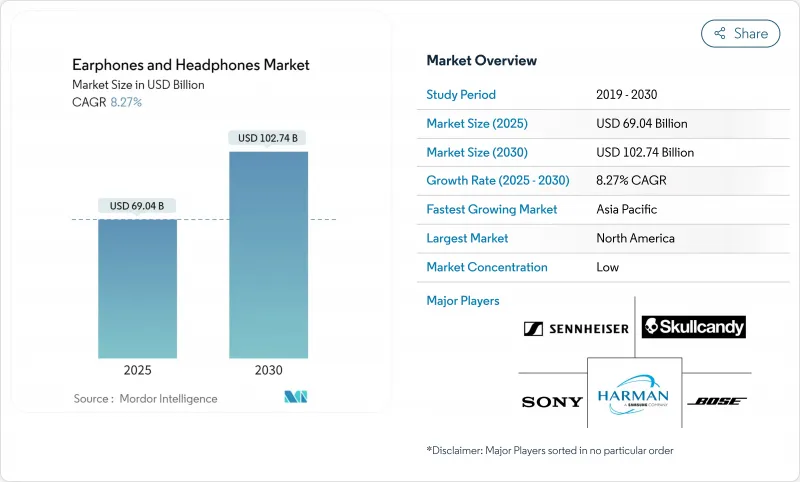

Earphones And Headphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The earphones and headphones market size reached USD 69.04 billion in 2025 and is forecast to climb to USD 102.74 billion by 2030 on an 8.27% CAGR.

Growth is underpinned by rapid consumer migration to wireless formats, rising acceptance of premium features such as spatial audio, and the spread of adaptive noise-cancellation driven by AI. Hardware is evolving into a platform for health monitoring and enterprise collaboration, which expands average use-cases and lifts replacement cycles. Competitive intensity is rising as local Asian brands challenge long-standing global leaders on price-to-feature value while niche specialists push bone-conduction and gaming-focused products into new segments.

Global Earphones And Headphones Market Trends and Insights

In-App Spatial-Audio Ecosystems Accelerating Premium-TWS Adoption in Asia

Streaming and gaming apps now embed proprietary spatial-audio rendering that performs best on designated models. Music services showcase head-tracking and Dolby Atmos, nudging users toward higher-priced buds that can unlock the full effect. Regional players mirror the approach, which increases perceived value and shortens upgrade cycles for tech-savvy consumers. The halo extends to enterprise telepresence platforms that cut meeting fatigue by placing voices in virtual space. As the feature gains mainstream awareness, premium TWS units widen their footprint beyond early adopters, raising average selling prices in the earphones and headphones market.

Enterprise Hybrid-Work Policies Fueling Demand for Boom-Mic Headsets in North America

Permanent hybrid schedules turn office headsets into strategic procurement items. Firms standardize on models certified for leading collaboration suites and specify advanced microphones able to suppress keyboard chatter without muting colleagues. Contact-center rollouts show a similar pattern, replacing wired units with DECT or Bluetooth headsets that boost mobility and call-clarity. Procurement cycles shorten whenever AI-powered live translation or background-noise removal becomes available, guiding steady refresh revenue for vendors active in the earphones and headphones market.

Proliferation of Counterfeit Earbuds Depressing ASPs in South America

The surge in counterfeit wireless earbuds is significantly impacting legitimate manufacturers' pricing strategies and profit margins, particularly in South American markets where enforcement of intellectual property rights remains challenging. These counterfeits have evolved beyond simple visual imitations to include sophisticated clones that replicate connectivity features and even mimic authentic firmware update processes, making them increasingly difficult for consumers to distinguish from genuine products. The problem is exacerbated by online marketplaces that inadvertently facilitate the distribution of these products through third-party sellers. The economic impact extends beyond lost sales to include brand erosion and customer support burdens when users seek assistance for non-authentic products. This dynamic is forcing legitimate manufacturers to compete on price points that may be unsustainable for their business models, potentially limiting investment in innovation for these markets.

Other drivers and restraints analyzed in the detailed report include:

- Gen-Z Fitness Boom Boosting Open-Ear/Bone-Conduction Sales in Europe

- AI-Enabled Adaptive Noise-Cancellation Differentiating Flagship Models Globally

- Battery-Waste Regulations Increasing Compliance Costs in EU

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earphones controlled 62.6% of revenue in 2024, driven by pocket-sized TWS models that pair instantly and hide in charging cases. This usage profile matches commuters and gym-goers who value weight savings. In contrast, headphones contribute fewer units but carry higher gross margins because over-ear cushions, larger drivers, and extended battery modules justify premium pricing. Market visibility rises further as remote workers pick circum-aural designs for day-long comfort, lifting the category's 8.4% forecast CAGR.

The headphones revival encourages hybrid designs with detachable ear-cups or modular headbands that morph between on-ear and in-ear roles. Such flexibility responds to consumers owning multiple devices and attending multiple contexts during a single day. Suppliers extract cross-selling revenue by offering color-matched mics and ear-pads. These developments broaden addressable demand inside the earphones and headphones market, rather than cannibalize earphones outright.

Wireless solutions captured a commanding 86% share in 2024, illustrating the near-universal preference for untethered audio. The earphones and headphones market size for True Wireless Stereo is forecast to expand at a 10.2% CAGR as chipsets prolong battery life well past six hours per charge. Multipoint pairing and LC3-plus codecs reduce latency, enabling earbuds to serve both entertainment and video-calling without audio-video drift. Wired SKUs survive in professional mastering studios where zero-latency monitoring remains critical.

Neckband and clip-on designs occupy an intermediate niche for users who fear losing individual buds but still crave freedom of movement. RF and infrared hold micro-shares inside classroom and cinema assistive-listening systems, although Bluetooth LE Audio plus Auracast broadcast mode threatens to displace these legacy links. This progression cements wireless as the default technology stack across the earphones and headphones market.

Passive isolation earned 60% revenue in 2024 by combining ear-tip seals and over-ear cushions that block mid-frequency noise without electronics. Nevertheless, active noise-cancelling units should log a robust 12.37% CAGR. Adaptive filters now target locomotive drones, office chatter, and aircraft cabins with tailored profiles. Brands differentiate further through transparency modes that re-inject selected frequencies, letting users hold conversations or hear traffic signals while music continues.

Integration of machine learning accelerates ANC personalization. Devices store environmental samples and user feedback to tune equalizers automatically. This enhanced utility allows vendors to command higher prices even inside crowded channels. Within the earphones and headphones market, open-ear models with wide-band noise control demonstrate the technology's next frontier, extending premium functionality to form factors that previously sacrificed isolation for awareness.

The Earphones and Headphones Market Report is Segmented by Product Type (Headphones, and Earphones/Earbuds), Form Factor (Over-Ear, On-Ear, and More), Connectivity (Wired, and Wireless), Noise-Control Technology (Active Noise-Cancelling (ANC), and More), Price Band (Sub-USD 50, USD 51-150, and More), Application (Consumer Entertainment and Music, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 30.5% of global revenue in 2024 and continues to benefit from high disposable income, employer headset stipends, and a culture of early technology adoption. Premium flagship launches routinely debut in this region, giving retailers predictable upgrade cycles while extended warranties drive after-sales revenue. Robust esports leagues attract sponsorship that popularizes branded gaming headsets, reinforcing a virtuous demand loop inside the earphones and headphones market.

Asia Pacific is the fastest growing territory, forecast to post a 10.7% CAGR to 2030. Rising middle-class populations in China, India, and Southeast Asia fuel upgrades from wired buds to TWS. Domestic champions price aggressively yet integrate features such as adaptive ANC and app-based EQ profiles, undercutting imports and spreading innovation across mass segments. Cross-border e-commerce platforms allow rural consumers to access brand catalogs once limited to metro areas, enlarging the earphones and headphones market size in the region.

Europe maintains strong appetite for sustainable design and reparability, influenced by policy moves that mandate USB-C charging and recycled content. Shoppers prioritize durable hinges, replaceable pads, and eco-friendly packaging. Open-ear solutions register notable traction in fitness-centric demographics, while premium over-ear ANC models sell well to business travelers seeking quiet rail commutes. Southern European economies, previously more conventional, indicate rising TWS penetration as 5G smartphones bundle promotional earbuds, diversifying revenue sources across the earphones and headphones market.

- Apple Inc.

- Sony Group Corporation

- Samsung Electronics Co. Ltd. (incl. Harman/JBL/AKG)

- Bose Corporation

- Shenzhen Imagine Marketing Ltd. (boAt)

- Skullcandy Inc.

- Sennheiser Electronic GmbH and Co. KG

- Shokz Holding Ltd.

- Logitech International S.A. (Astro)

- Razer Inc.

- Logitech G/Blue

- Panasonic Corp.

- Audio-Technica Corp.

- Corsair Gaming Inc. (Elgato)

- Plantronics (Poly, an HP Company)

- Pioneer Corp.

- Beyerdynamic GmbH

- Yamaha Corp.

- Grado Labs

- Lenovo Group Ltd. (ThinkPlus)

- Anker Innovations Ltd. (Soundcore)

- Xiaomi Corp. (Redmi, Mi)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 In-App Spatial-Audio Ecosystems Accelerating Premium-TWS Adoption in Asia

- 4.2.2 Enterprise Hybrid-Work Policies Fueling Demand for Boom-Mic Headsets in North America

- 4.2.3 Gen-Z Fitness Boom Boosting Open-Ear/Bone-Conduction Sales in Europe

- 4.2.4 AI-Enabled Adaptive Noise-Cancellation Differentiating Flagship Models Globally

- 4.2.5 Esports Sponsorships Driving High-Fidelity Gaming Headphones in Middle East

- 4.2.6 Subscription-Bundled Hardware Models (e.g., Apple, Samsung) Lifting Upgrade Cycles

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit Earbuds Depressing ASPs in South America

- 4.3.2 Battery-Waste Regulations Increasing Compliance Costs in EU

- 4.3.3 Spectrum-Interference Issues Limiting Ultra-Low-Latency Bluetooth LE Audio in Dense Cities

- 4.3.4 Health-Related Concerns on Prolonged SPL Exposure Curbing Volume Limits

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Headphones

- 5.1.2 Earphones/Earbuds

- 5.2 By Form Factor

- 5.2.1 Over-Ear

- 5.2.2 On-Ear

- 5.2.3 In-Ear/Canal

- 5.2.4 Open-Ear/Bone-Conduction

- 5.3 By Connectivity

- 5.3.1 Wired

- 5.3.2 Wireless

- 5.3.2.1 True Wireless Stereo (TWS)

- 5.3.2.2 Neckband

- 5.3.2.3 RF/Infra-red

- 5.4 By Noise-Control Technology

- 5.4.1 Active Noise-Cancelling (ANC)

- 5.4.2 Passive Noise-Isolation

- 5.4.3 Open-Transparency/Ambient Mode

- 5.5 By Price Band

- 5.5.1 Sub-USD 50 (Value)

- 5.5.2 USD 51-150

- 5.5.3 USD 151-300

- 5.5.4 Above USD 300

- 5.6 By Application

- 5.6.1 Consumer Entertainment and Music

- 5.6.2 Gaming and Esports

- 5.6.3 Sports and Fitness

- 5.6.4 Professional Studio and Broadcast

- 5.6.5 Enterprise/Call-Center/UC&C

- 5.7 By Distribution Channel

- 5.7.1 Online

- 5.7.1.1 E-commerce Marketplaces

- 5.7.1.2 Brand Webstores

- 5.7.2 Offline

- 5.7.2.1 Consumer Electronics Chains

- 5.7.2.2 Specialty Audio Stores

- 5.7.2.3 Hypermarkets/Supermarkets

- 5.7.1 Online

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Nordics

- 5.8.2.7 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 South Korea

- 5.8.3.4 India

- 5.8.3.5 South East Asia

- 5.8.3.6 Australia

- 5.8.3.7 Rest of Asia-Pacific

- 5.8.4 South America

- 5.8.4.1 Brazil

- 5.8.4.2 Rest of South America

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 United Arab Emirates

- 5.8.5.1.2 Saudi Arabia

- 5.8.5.1.3 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Apple Inc.

- 6.4.2 Sony Group Corporation

- 6.4.3 Samsung Electronics Co. Ltd. (incl. Harman/JBL/AKG)

- 6.4.4 Bose Corporation

- 6.4.5 Shenzhen Imagine Marketing Ltd. (boAt)

- 6.4.6 Skullcandy Inc.

- 6.4.7 Sennheiser Electronic GmbH and Co. KG

- 6.4.8 Shokz Holding Ltd.

- 6.4.9 Logitech International S.A. (Astro)

- 6.4.10 Razer Inc.

- 6.4.11 Logitech G/Blue

- 6.4.12 Panasonic Corp.

- 6.4.13 Audio-Technica Corp.

- 6.4.14 Corsair Gaming Inc. (Elgato)

- 6.4.15 Plantronics (Poly, an HP Company)

- 6.4.16 Pioneer Corp.

- 6.4.17 Beyerdynamic GmbH

- 6.4.18 Yamaha Corp.

- 6.4.19 Grado Labs

- 6.4.20 Lenovo Group Ltd. (ThinkPlus)

- 6.4.21 Anker Innovations Ltd. (Soundcore)

- 6.4.22 Xiaomi Corp. (Redmi, Mi)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment