PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690767

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690767

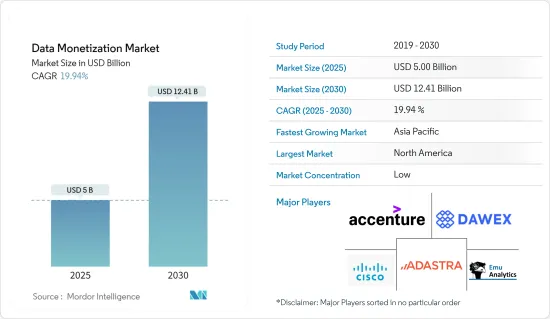

Data Monetization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Data Monetization Market size is estimated at USD 5.00 billion in 2025, and is expected to reach USD 12.41 billion by 2030, at a CAGR of 19.94% during the forecast period (2025-2030).

The increasing importance of data in business decisions and strategy development in the B2B environment is driving the demand for the market. This is also supported by the integration of digital devices and systems in the business environment to generate data, the growth of internet usage to increase consumer data volume, and the emergence of data analytics tools in the market, creating an opportunity for the market's growth and to monetize the generated data worldwide.

Key Highlights

- Data monetization strategies relied on more traditional analytical techniques and struggled to deal effectively with unstructured data. However, easier access to significant computing resources via cloud platforms and the commoditization of some AI/machine learning-powered analysis engines are creating more affordable opportunities to extract both values and return on investment, which would drive the market's future growth. Independent software vendors have turned to self-service business intelligence to increase application revenue and differentiate their offerings in line with technological advancement.

- Similarly, self-service BI can contribute to application ROI for enterprises developing applications by increasing adoption and improving operational efficiencies. This shows the potential of the market's growth in data monetization solutions.

- The broad and emerging applications of data monetization strategies enable businesses to generate new revenue streams. This can be achieved through selling data directly to third parties, creating data-driven products or services, or using data to enhance existing offerings. This is expected to fuel the adoption of data monetization solutions across all end-user segments in the future.

- As online businesses expand, including expanding online banking and e-commerce companies, they may implement data monetization solutions to analyze customer purchasing patterns and preferences and personalize product recommendations. This is expected to increase sales and customer satisfaction, driving the market's growth during the forecast period.

- The increasing number of internet users worldwide, in line with the growth of connected devices and software-based solutions in businesses, is supporting the generation of customer data in various end-user segments, creating an opportunity for the market's growth. For instance, in November 2023, the International Telecommunication Union reported that internet users reached 5,400 million worldwide. This growth may support online data generation and fuel the market's growth during the forecast period.

- The privacy and legal implications of releasing data to outside entities are the primary concerns with data monetization projects. Therefore, users must carefully review their rights and ownership of the data they may have acquired from their customers. Depending on the geography, the industry, and the specific customer contracts signed at the moment of data acquisition, these regulatory policies may require considerable resources and expertise. This presents challenges for organizations seeking to monetize their datasets.

Data Monetization Market Trends

Large Enterprises to Hold Major Market Share

- The growing trends of digital transformation are shaping the business landscape. Large enterprises are ramping up their plans for cloud migration and confronting new challenges, including higher customer expectations, business volume growth, and service delivery model changes.

- Thus, many large enterprises are adopting Data as a Service (DaaS) solutions from high-speed cloud service providers. Most are engaged in revenue generation from DaaS. Data-based monetization tasks are set to become automated and offer higher productivity.

- In the United States, companies like Amazon, Facebook, and Google have monetized and used their data to fuel the growth of their business. As a result, organizations across all industries increasingly look at their data to uncover opportunities to create value for their business growth.

- According to the Bank of America Corporation, digital advertising is expected to reach 74% of US ad spending in 2024, up from 69% in 2023. Tech giants like Google, Meta, and Amazon will continue to have a significant share of the US online advertising industry. In recent years, companies in the United States, such as Expedia, Booking, eBay, and Airbnb, have allocated significant revenues to their sales and marketing. They are anticipated to continue doing so during the forecast period.

- Large enterprises are expected to design reconfigurable architectures that support extensive data reuse to enhance the embedded value of data monetization solutions. This helps them meet aggressive technical demands such as high-performance processing, advanced data integration, and scalability.

North America Holds Significant Market Share

- The North American data monetization market has been experiencing significant growth, driven by increasing volumes of data generated by businesses and consumers. Companies are finding new ways to extract value from this data, leading to the development of innovative data monetization strategies and technologies. Adopting advanced analytics and artificial intelligence has enabled organizations to derive actionable insights from their data, further fueling the market's growth.

- Furthermore, the region is an early adopter and host to innovative initiatives for advanced analytics solutions and practices, such as big data, machine learning, information science, and high-performance computing. It has a strong foothold of vendors, contributing to the market's growth. Some include Google Inc., Cisco Systems Inc., Adastra Corporation (Canada), Domo, and Sisense Inc.

- In June 2023, Cisco announced the Cisco Observability Platform, an open and extensible, API-driven Full-Stack Observability (FSO) platform built on OpenTelemetry and anchored on metrics, events, logs, and traces (MELT). Advancing Cisco's Full-Stack Observability strategy, it provides AI/ML-driven analytics and a new observability ecosystem, delivering relevant and impactful business insights. Observability can become the primary way to reduce team friction by unifying data, analysis, actions, and practices.

- The proliferation of digital devices and technologies has led to a massive increase in the volume of data generated by businesses and consumers, creating more monetization opportunities. According to Cisco Systems, the average number of devices and connections per person in North America was 13.4 in FY 2023, significantly higher than in other regions.

- Furthermore, businesses increasingly recognize the value of their data as a strategic asset. They are exploring ways to monetize it through various means, such as selling data, offering data-driven services, or leveraging it for targeted advertising. Regulatory frameworks such as the GDPR in Europe and the CCPA in California also have heightened awareness around data privacy and security, prompting companies to find compliant ways to monetize their data assets.

Data Monetization Industry Overview

The data monetization market is competitive due to the presence of small and medium-sized enterprises and global players. Data monetization is used in various industries to provide vendors with growth opportunities, attracting new players into the market and driving competition among vendors. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage. Some key market players include Accenture PLC, Adastra Corporation, Cisco Systems Inc., Dawex Systems SAS, and Emu Analytics Ltd., among others.

- In May 2024, Accenture and Oracle joined forces to invest in state-of-the-art generative AI solutions, tools, and training resources. These strategic investments aim to enable organizations to unlock the full potential of their data, propelling them toward unprecedented growth and fostering a culture of continuous innovation. By combining their expertise, Accenture and Oracle are dedicated to helping clients across diverse industries reinvent their businesses through the adoption of generative AI at scale.

- In February 2024, Dawex, Schneider Electric, Valeo, CEA, and Prosyst collaborated to establish Data4Industry-X, the Reliable Data Exchange Solution for the Industrial Sector. Primarily focusing on the automotive and power generation industries, Data4Industry-X strives to enhance competitiveness and minimize the environmental impact of prominent multinational industrial corporations operating in various countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Data Monetization Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Advanced Analytics and Visualization

- 5.1.2 Increasing Volume and Variety of Business Data

- 5.2 Market Restraints

- 5.2.1 Interoperability With Existing Systems

- 5.2.2 Varying Structure of Regulatory Policies

- 5.3 Market Challenge

- 5.3.1 Increasing Complexities in Data Structures and Availability of Consistent Data

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium-sized Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 Telecom and IT

- 6.2.3 Manufacturing

- 6.2.4 Healthcare

- 6.2.5 Retail

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Accenture PLC

- 7.1.2 Adastra Corporation

- 7.1.3 Cisco Systems Inc.

- 7.1.4 Dawex Systems SAS

- 7.1.5 Emu Analytics Ltd

- 7.1.6 Thales Group

- 7.1.7 Google LLC (Alphabet Inc.)

- 7.1.8 IBM Corporation

- 7.1.9 Infosys Limited

- 7.1.10 Ness Technologies Inc.

- 7.1.11 NetScout Systems Inc.

- 7.1.12 Openwave Mobility Inc. (ENEA)

- 7.1.13 SAP SE

- 7.1.14 SAS Institute Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS