PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1524098

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1524098

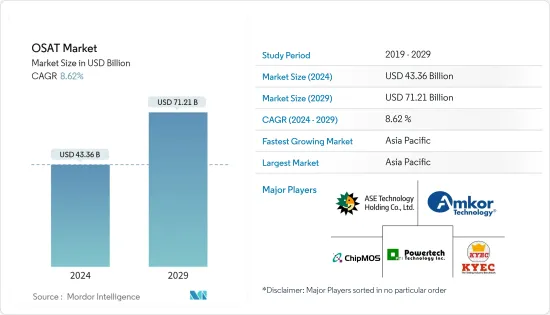

OSAT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The OSAT Market size is estimated at USD 43.36 billion in 2024, and is expected to reach USD 71.21 billion by 2029, growing at a CAGR of 8.62% during the forecast period (2024-2029).

The semiconductor industry has been growing, focusing on miniaturization and efficiency. Semiconductors are emerging as building blocks of all modern technology. The advancements and innovations in this field directly impact all downstream technologies. The rapid development of electronics technology, including artificial intelligence (AI) and cloud computing, is complemented by a high demand for integrated circuits (ICs) with high speed, low power consumption, and high integration, leading to its significant sales.

Key Highlights

- Outsourcing is also a significant factor in the semiconductor industry. More than just design, the manufacturing aspect of semiconductor product development is dependent on the services provided by third-party vendors. Fabs (Pure-Play Foundries) and OSATs are two prominent examples of semiconductor outsourcing.

- OSAT semiconductor firms provide third-party IC packaging and testing services package and test semiconductor devices made by foundries before shipping them to the market. Such companies in the market provide innovative and cost-effective solutions that deliver faster processing speeds, higher performance, and functionality while taking up less space in an electronic device.

- Semiconductor design companies, such as Intel, AMD, and Nvidia, contract OSAT companies to execute the companies' designs. For instance, Intel is a chip designer and a foundry (wafer provider) because they own and operate their fabs or foundries. Before shipping the chips to customers, Intel outsources its chip packaging to different OSATs for assembly and test services.

- Vertical integration of key semiconductor manufacturers into packaging operations is a significant threat to the global OSAT market. Various factors, such as the US-China trade war, have caused a supply chain gap in the semiconductor industry.

- The suppliers of as OSAT are third parties that provide the assembly, packaging and testing services for a semiconductor integrated circuit. Post COVID, semiconductor industry has been witnessing the growth due to chipmakers are focused on producing smaller, faster and more efficient semiconductors and where which increased the growth of OSAT as its has playes an essential part in the by filling the gap between IC design and availability.

OSAT Market Trends

Communication to be the Largest Application Segment

- The semiconductor market's growth directly influences the OSAT market's development because the packaging is still at an early stage in the telecommunications value chain. The foundries can either handle the packaging themselves or contract it out. For instance, Qualcomm, a manufacturer of semiconductors and telecom equipment, contracts OSATs to handle its packaging needs.

- The communication applications primarily consist of communication chips in the telecommunication industry. Equipment such as power amplifiers (PAs), front-end modules (FEMs), and other RF and connectivity devices are major sources of demand for OSATs and OEMs. According to the Semiconductor Industry Association, about 31% of all semiconductors manufactured are used for communications, including networking equipment and smartphone radios.

- Communication applications require highly reliable packaging solutions as they are often deployed in harsh environmental conditions. In many cases, a system in package (SiP) is preferred for a large variety of communication equipment, especially in large-scale telecommunication applications.

- The smartphone market has grown significantly in hardware and software over the past few years. Despite declining global smartphone unit shipments during COVID-19, there was high penetration in many markets, including China. Sales of new smartphones are expected to regain momentum, driven by trends like biosensors, 5G smartphones, and AI features.

- The smartphone adoption rate in Asia-Pacific is expected to rise to 83% by 2025, according to GSMA. Concurrently, the mobile subscriber penetration rate is expected to reach 62% by the same year. The proliferation of 5G smartphones is also expected to significantly improve connected device density, wireless data communication bandwidth, and latency.

- Many semiconductor producers anticipate that 5G smartphones with higher silicon contents will be widely adopted worldwide. The use of semiconductor components per device will rise due to the need for 5G smartphones to have higher power efficiency, faster speeds, and more complex functionalities. In turn, the consumer electronics industry is anticipated to experience a significant increase in demand for semiconductor packaging solutions.

- According to the GSMA Report, around one-third of the global population is estimated to have access to 5G networks by 2025. The report also states that there will be more than 400 million 5G connections at that time, accounting for approximately 14% of all mobile connections.

- The adoption of 5G was projected to reach 17% by the end of 2023 and increase to 54% (equivalent to 5.3 billion connections) by 2030. This technological advancement is anticipated to contribute nearly USD 1 trillion to the global economy. As a result, the demand for semiconductors will enhance the market's growth.

South Korea Expected to Register Significant Growth in the Market

- South Korea is one of the promising markets for global OSAT vendors. The country is also home to some prominent chip makers for the consumer electronics segment, such as Samsung and SK Hynix, making it a lucrative hub for innovation in semiconductor devices.

- The South Korean government focuses on smart manufacturing and plans to have 30,000 fully automated manufacturing companies by 2025. The government aims to achieve this by incorporating the latest automation, data exchange, and IoT technologies, which are expected to be significant drivers for OSAT services in the country.

- The country's semiconductor testing sector has grown significantly with the growth of Samsung Electronics' system semiconductor business. The semiconductor testing companies in the country, such as NEPES Ark, LB Semicon, Tesna, and Hana Micron, have been dealing with increased supplies of system semiconductors by making significant investments in necessary facilities and equipment.

- SK Hynix is constructing a base for manufacturing next-generation memory in the Wonsam town region of Yongin by investing KRW 120 trillion ( USD 90 billion). The chipmaker anticipates breaking construction on the memory manufacturing facility in 2025. SK Hynix is also the manufacturer of HBM3. The company plans to install TSV packaging production lines at its Icheon DRAM manufacturing facility. To improve its HBM competitiveness, Samsung and SK Hynix are considering adding more packaging production lines.

- Samsung has been working on replacing the 2.5D interposer integration service offered by TSMC. It seeks to lower the cost of manufacturing the through-silicon via (TSV) packaging method. Compared to SK Hynix, Samsung is a latecomer to the HBM (high bandwidth memory) market. Still, the business claims it is increasing investments in its HBM capacity and declared intentions to introduce new HBM products by 2023, opening possibilities for expanding HBMs' packaging capacity.

- The developments in the 5G space have also led to the growth of advanced packaging of chips. According to the Ministry of Science and ICT, as of February 2023, the country had 29.13 million 5G Subscribers, an increase of 113% compared to 13.66 million 5G subscribers in February 2021.

OSAT Industry Overview

The outsourced semiconductor assembly and test services (OSAT) market is fragmented, with the presence of major players like ASE Technology Holding Co. Ltd, Amkor Technology Inc., Powertech Technology Inc., ChipMOS Technologies Inc., and King Yuan Electronics Co. Ltd. Players in the market are adopting strategies such as innovations, partnerships, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

* December 2023 - In a recent announcement, Powertech Technology (PTI) Inc. revealed its partnership with Winbond Electronics Corporation by signing a letter of intent. This collaboration aims to jointly advance the business of 2.5D (Chip on Wafer on Substrate)/3D advanced packaging. PTI will guide its customers to leverage WEC's silicon Interposer, DRAM, and Flash to enable heterogeneous integration and cater to the market's demand for high-bandwidth and high-performance computing services.

* October 2023 - ASE Technology Holding Co. Ltd launched its Integrated Design Ecosystem (IDE), a collaborative design toolset. This toolset is designed to enhance advanced package architecture across the VIPack platform systematically. This innovative approach enables a seamless transition from single-die SoC to multi-die disaggregated IP blocks, including chiplets and memory. It can be achieved by integrating them using 2.5D or advanced fanout structures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Semiconductor Industry Outlook

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Applications of Semiconductors in Automotive

- 5.1.2 Advancement in Semiconductor Packaging Due to Trends like 5G

- 5.2 Market Restraints

- 5.2.1 Vertical Integration is One of the Significant Concerns of OSAT Players

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Packaging

- 6.1.2 Testing

- 6.2 By Type of Packaging

- 6.2.1 Ball Grid Array (BGA) Packaging

- 6.2.2 Chip Scale Packaging (CSP)

- 6.2.3 Stacked Die Packaging

- 6.2.4 Multi Chip Packaging

- 6.2.5 Quad Flat and Dual-inline Packaging

- 6.3 By Application

- 6.3.1 Communication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Computing and Networking

- 6.3.5 Industrial

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 China

- 6.4.3 Taiwan

- 6.4.4 South Korea

- 6.4.5 Malaysia

- 6.4.6 Singapore

- 6.4.7 Japan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 ASE Technology Holding Co. Ltd

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Powertech Technology Inc.

- 7.1.4 ChipMOS Technologies Inc.

- 7.1.5 King Yuan Electronics Co. Ltd

- 7.1.6 Formosa Advanced Technologies Co. Ltd

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.8 UTAC Holdings Ltd

- 7.1.9 Lingsen Precision Industries Ltd

- 7.1.10 Tongfu Microelectronics Co.

- 7.1.11 Chipbond Technology Corporation

- 7.1.12 Hana Micron Inc.

- 7.1.13 Integrated Micro-electronics Inc.

- 7.1.14 Tianshui Huatian Technology Co. Ltd

- 7.2 Vendor Share Analysis

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS