Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686615

Smart Railways - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

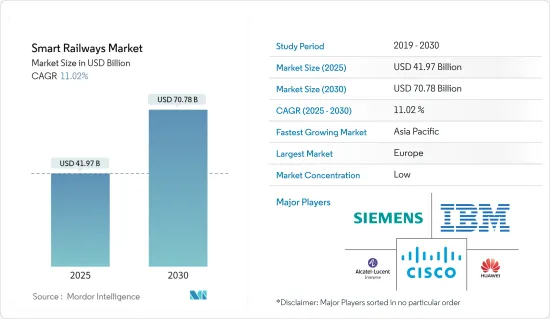

The Smart Railways Market size is estimated at USD 41.97 billion in 2025, and is expected to reach USD 70.78 billion by 2030, at a CAGR of 11.02% during the forecast period (2025-2030).

Key Highlights

- The adoption of new technology-based solutions to enhance the operation of train services by leveraging real-time data is driving market growth, creating demand for smart solutions such as analytics systems for various applications. For instance, Indian Railways opted for the Internet of Things (IoT) to enhance the operation of train services. The Real-Time Train Information System (RTIS), which uses GPS sensors mounted on locomotives to monitor the exact location of trains in real time, is implemented.

- The initiatives taken by several country governments for the modernization of stations and adoption of technology are further adding growth to the market. These initiatives are driving the need for solutions such as passenger information systems, smart ticketing systems, energy management systems, analytics platforms, and others that help enhance overall passenger experience and convenience, increasing overall efficiency.

- Moreover, the adoption of artificial intelligence (AI) and the Internet of Things (IoT) for various applications is expected to encourage vendors to launch solutions based on these technologies, as railway authorities in multiple countries are emphasizing the adoption of advanced technology.

- One of the major obstacles faced by the legacy railway systems is their aging infrastructure. A broad array of railway networks have been in operation for decades, and their outdated design, as well as the technology involved within it, hinder their energy efficiency. Upgrading these systems requires a significant investment of time and resources, posing a challenge to the market studied.

- In the post-pandemic scenario, the market outlook was positively impacted by rising demand for biometric, integrated, contactless, and mobile payment adoption systems, sensor-based technology, and ticketing technologies at railway stations with increased modernization activities.

Smart Railways Market Trends

Railway Communication and Networking System to Register Major Growth

- Due to several key factors, the railway communication and networking systems demand is expected to grow in the global smart rail market, including the adoption of advanced communication technologies to be able to monitor and coordinate trains, tracks, or infrastructure continuously is driven by a need for enhanced safety and efficiency. Robust networking systems are required to meet the increasing expectations of passengers for smooth connectivity and onboard comfort.

- Furthermore, the need for reliable communication networks to support data exchange and control systems is reinforced by a trend toward digitization and automation in railway operations.

- Additionally, governments' investments in railway modernization projects and the growing emphasis on sustainable transportation solutions propel communication and networking infrastructure deployment to optimize operations and enhance passenger experience.

- Based on region, Asia-Pacific is expected to grow due to the growing investments in railways across Asian countries for technology upgradation and efficiency. According to China State Railway Group Co. Ltd, in the first 11 months of 2023, national investment in railway fixed assets amounted to JPY 640.7 billion, a Y-O-Y increase of 7.4%. The number of miles the National Railway carries has exceeded 155,500 kilometers since November 30, 2023, with 4.37% being high-speed railways.

- The demand for innovative communication and networking systems worldwide is expected to be driven by China's railway infrastructure expansion, with increased capital investment based on increasing operational miles along its rail network and higher-speed trains. To ensure efficient and safe operations, as China further develops its railway network, it is expected to become more important that reliable communication technologies are used to affect similar investments and upgrades in rail systems across the world. Further developments by market players are expected to drive the segment.

Asia-Pacific to Witness Significant Growth

- The smart railways market in the Asia-Pacific region is experiencing significant expansion, driven by advancements in technologies such as smart ticketing and advanced security monitoring systems. These innovations streamline operations, enhance passenger experiences, and improve safety and security across the rail network. The region's growing population, urbanization, and infrastructure investments further fuel this growth, making it a promising market for smart railway solutions.

- In terms of passenger traffic, Shanghai Hongqiao railway station is one of the busiest in Asia. China Mobile Shanghai, in collaboration with Huawei, deployed a 5G network at the station, which includes a 5G digital indoor system. This is intended to allow passengers to log into a system-supported network and download 2 GB of high-definition video in less than 20 seconds.

- In May 2023, Kyushu Railway Company (JR Kyushu), as part of Japan's rail network, the Japan Railway Group introduced that it would issue NFTs on Astar Network, the multichain smart contract platform, in partnership with PRO Co. Ltd. As part of the Japanese railway operator infrastructure, it is also engaged in bus transportation, freight services, hospitality, and other related services.

- By solution, the passenger information system holds a substantial market share. The passenger information system (PIS) is crucial in enhancing the efficiency and passenger experience in smart railways across the Asia-Pacific region. It provides real-time information about train schedules, arrivals, departures, delays, and other relevant updates to passengers, improving their overall journey experience. With the growing demand for efficient and reliable public transportation systems in densely populated Asian cities, the adoption of advanced technologies like PIS is driving growth in the smart railways market.

- According to the India Brand Equity Foundation, the government announced 5,000 km of metro rail network by 2047 in 100 cities. Foreign Direct Investment (FDI) inflows in railway-related components stood at USD 1.23 billion from April 2000 to March 2023. Such huge investment in the development of railways would further boost the demand for smart railway solutions in the region.

Smart Railways Market Overview

The smart railways market is highly fragmented, with major players like Cisco Systems Inc., IBM Corporation, ALE International, Huawei Technologies Co. Ltd, and Siemens AG. Players in the Market are adopting techniques such as partnerships, collaborations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Siemens Mobility introduced its latest stock product with its first electric Mireo Smart train at the rail technology company's factory in Krefeld, Germany. The new train, mainly built for regional and commuter rail operators, is crucial to the company's attempts to capitalize on demand for more sustainable rolling stock solutions.

- June 2023 - Huawei Technologies launched four Intelligent OptiX innovative practices of F5.5G in scenarios of smart homes, small and micro enterprises, smart manufacturing, and metro networks. Using the company's Alps-WDM, China Unicom Chongqing has built metro networks with the optimal TCO. Huawei's Alps-WDM increased the single-wavelength rate from 10G to 100G at the integrated access site.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 53233

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Market

- 4.4 Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Importance of Smart Cities

- 5.1.2 Increasing Population Growth of Hyper-urbanization

- 5.2 Market Restraints

- 5.2.1 Issues with Integration and Connectivity into Legacy Systems and High Initial Infrastructure and Related Investments

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Rail Analytics System

- 6.1.2 Railway Communication and Networking System

- 6.1.3 Freight Information System

- 6.1.4 Smart Ticketing System

- 6.1.5 Advanced Security Monitoring System

- 6.1.6 Passenger Information System

- 6.1.7 Other Solutions

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 IBM Corporation

- 7.1.3 ALE International

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Siemens AG

- 7.1.6 Hitachi Ltd

- 7.1.7 Tata Consultancy Services Limited

- 7.1.8 Moxa Inc.

- 7.1.9 Thales Group

- 7.1.10 Televic Group

- 7.1.11 Cyient Limited

- 7.1.12 Toshiba Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.