PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523396

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523396

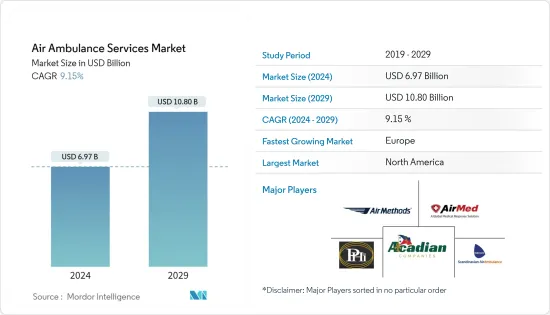

Air Ambulance Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Air Ambulance Services Market size is estimated at USD 6.97 billion in 2024, and is expected to reach USD 10.80 billion by 2029, growing at a CAGR of 9.15% during the forecast period (2024-2029).

Air ambulances are now being increasingly used for the transportation of patients suffering from health issues. An increase in the number of accidents and other threats such as heart attacks, strokes, and other medical emergencies creates demand for air ambulance services. Increasing partnerships between governments and helicopter emergency medical services (HEMS) providers boost the market's growth. There have been increasing advancements in terms of technology for air ambulance services. For instance, air ambulance helicopters are equipped with the required medical equipment and accessories, along with skilled medical crew trained in providing initial emergency medical care to patients.

In addition, air ambulance provides advantages over conventional road ambulance services, as the former helps mitigate the issue of prolonged travel durations and limited access to remote areas. New technologies such as advanced ventilator systems and heart monitoring systems increase the chances of patients' survival until they are safely transported to the nearest hospital. Additionally, advanced technology in terms of communication systems leads to the transfer of real-time data of patients to the hospitals so that the doctors are aware of the necessary steps to be taken to save the patient.

However, factors like operational constraints, high costs, and air ambulance accident incidences are projected to restrain the growth of the segment. Despite this factor, the need for maximizing the use of air ambulance assets to offer better emergency care and the generation of more profitable returns is anticipated to propel the revenues of the segment during the forecast period.

Air Ambulance Services Market Trends

The Rotary-Wing Aircraft Segment Dominates the Market During the Forecast Period

The market for air ambulance services is on the rise owing to several benefits, such as increased survival rates, swift and comfortable transportation, and a vast coverage range in a shorter time. These advantages make rotary-wing helicopters a compelling choice for emergency medical transportation. For instance, during 2019-2023, a total of 268 helicopters were in operation performing various emergency and medical services globally. Helicopters for carrying out air ambulance services have been made lightweight by original equipment manufacturers (OEMs). The introduction of carbon fiber while designing such helicopters has provided many benefits by making the craft lighter in weight and thus adding the benefit of quick landings and take-offs during emergencies. Making use of a carbon fiber structure for the helicopter model has also led to increasing the life of the helicopter so that it can be used in service for many years. It has also made the helicopters more durable towards damages occurring during flight transportation. Such advancements are compelling various countries, militaries, and other air ambulance service-providing companies to procure new and advanced helicopters to provide air ambulance services.

For instance, in November 2023, the Norwegian Air Ambulance awarded a contract to Airbus to deliver three H135s and two five-bladed H145s to carry out helicopter emergency medical service missions in Denmark. Similarly, in December 2023, Gama Aviation launched its Helicopter Emergency Medical Services (HEMS) for the Wales Air Ambulance Charity. Under a USD 70 million contract, a fleet of four Airbus H145 helicopters will be operated and maintained, with their base of operations being the charity's existing sites. Thus, such technological advancements being made by the original equipment manufacturers or OEMs will lead to the rotor-craft segment showing impressive growth during the forecast period.

North America to Exhibit the Largest Market Share During the Forecast Period

Currently, North America holds the highest shares in the air ambulance market. The dominance is due to the presence of a large number of air ambulance service providers and rising spending in the healthcare sector. For instance, in August 2023, the Association of Air Medical Services published that more than 550,000 patients in the U.S. use air ambulance services every year. The presence of key players such as Air Methods Corporation, Acadian Companies, PHI Inc., and others drives the growth of the market across the region. In addition, the demand for air ambulance services in the region is driven by the presence of the U.S. For instance, in January 2024, the American Heart Association published that every year, there are about 605,000 new heart attacks and 200,000 recurrent attacks in the U.S. And the past 10 years, the age-adjusted death rate from high blood pressure increased by 65.6%, and the actual number of deaths rose by 91.2%. High blood pressure is a leading risk factor for heart disease and stroke. Such factors are driving the demand for air ambulance services across the country. Hence, various air ambulance service providers are procuring newer helicopter models to provide emergency air ambulance services.

For instance, in February 2023, Bell Textron Inc. was awarded a contract by Global Medical Response (GMR) to deliver three additional Bell 407GXi aircraft. The delivery happened at the end of 2023, and the three Bell 407GXis have joined GMR's exclusive 220 Bell helicopter fleet used for emergency medical operations throughout North America. Similarly, in May 2023, Ascent Helicopters, a Canadian company based in Parksville, was awarded a contract by the provincial government to provide the B.C. Emergency Health Services (BCEHS) with six new air ambulances for USD 544.4 million. By 2025, six new air ambulances are expected to be added to the fleet for B.C. Emergency Health Services. Growing investments by various original equipment manufacturers as well as companies in the North American region to better develop air ambulance services at times of medical requirements are expected to fuel the market growth in the region.

Air Ambulance Services Industry Overview

The market of air ambulance services is fragmented in nature and is characterized by several operators who provide various types of emergency medical services. Some of the prominent market players include Air Methods Corporation, Acadian Companies, PHI Group, Inc., Babcock Scandinavian Air Ambulance (Babcock International Group), and AirMed International (Global Medical Response, Inc.). The market growth is anticipated to receive a boost with the incorporation of sophisticated medical equipment in helicopters that enable emergency treatment and transportation. In addition, various advances to the design of air ambulances by making use of composite materials such as carbon fiber to increase the life of the air ambulance in service, as well as offer better protection during heavy impact, may provide additional protection to the patient being transported by the air ambulance and this is likely to lead to the growth of the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Operator

- 5.1.1 Hospital-based

- 5.1.2 Independent

- 5.1.3 Government

- 5.2 Aircraft Type

- 5.2.1 Fixed-Wing

- 5.2.2 Rotary-Wing

- 5.3 Service Type

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Egypt

- 5.4.5.3 Israel

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Air Methods Corporation

- 6.2.2 AirMed International (Global Medical Response, Inc.)

- 6.2.3 Acadian Companies

- 6.2.4 PHI Group, Inc.

- 6.2.5 REVA Inc.

- 6.2.6 European Air Ambulance

- 6.2.7 Babcock Scandinavian Air Ambulance (Babcock International Group)

- 6.2.8 Air Charter Services Group

- 6.2.9 Gulf Helicopters

- 6.2.10 CareFlight

7 MARKET OPPORTUNITIES AND FUTURE TRENDS