PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523385

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523385

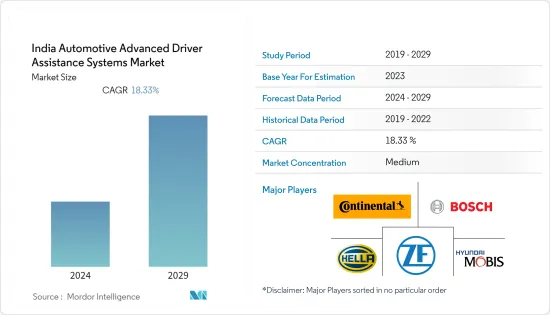

India Automotive Advanced Driver Assistance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The India Automotive Advanced Driver Assistance Systems Market size is estimated at USD 2.51 billion in 2024, and is expected to reach USD 5.96 billion by 2029, growing at a CAGR of 18.33% during the forecast period (2024-2029).

Growing production of vehicles with integrated ADAS features in the wake of rising awareness toward the comfort and safety of passengers and government regulations mandating safety features are expected to drive demand in the market. Also, the rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market. Automobile manufacturers and governments focus on developing and promoting safe driving technologies, especially in passenger vehicles. Most of those technologies are expected to become essential.

Besides safety, advanced driver assistance systems can provide other benefits, such as traffic awareness, decreased insurance premiums, low repair and maintenance costs, and increased fuel efficiency. Due to the above factors and developments, the adoption of ADAS features is growing in the market, and such positive trends are expected to enhance the market's growth during the forecast period.

Due to supply chain disruptions, global vehicle production halts, lockdowns, and trade restrictions, the COVID-19 pandemic significantly affected the market. To generate momentum in the market during the forecast period, players began concentrating on reducing such risks and developments as restrictions loosened.

India Automotive Advanced Driver Assistance Systems Market Trends

Growing Demand For ADAS Features In Vehicles

Autonomous cars and connected vehicles are gaining consumers' interest and are anticipated to gain wider acceptance during the forecast period. The advanced driver assistance systems (ADAS) featured are expected to diminish the penetration gap between traditional and modern cars. Moreover, with the rising technological advancements in the automotive industry, end users are ready to spend more on the latest technologies, which enhance the driving experience and increase the safety of drivers and riders. ADAS features, such as collision warning, lane assistance, and blind spot detection, significantly impact consumer behavior and are expected to enhance vehicles' performance by reducing vehicle downtime by alerting the owner of any faults in the car.

ADAS has advanced considerably. However, there is a long way to go with connected vehicle technology. V2V communication has the potential to upgrade it further, as vehicles may communicate with each other directly and share information on relative speeds, positions, directions of travel, and even control inputs, such as sudden braking, accelerations, or changes in direction. Using this data with the vehicle's sensor inputs makes it possible to create a more detailed picture of the surrounding area and provide more accurate warnings or even corrective actions to avoid collisions.

However, the number of ADAS components may keep growing as these previously available systems in high-end models are being used in entry-level vehicles. These systems bring added safety and security to daily driving. Many of these systems allow the car to make driving adjustments according to the condition. The vehicle can perform functions such as steering, braking, and accelerating in certain situations. For instance,

- The Automotive Research Association of India (ARAI) has developed a cost-effective indigenous technology solution for adaptive front lighting systems (AFLS) for mid-segment automobiles and SUV/MPVs. The algorithm is intended to address the requirements of Indian road and traffic situations. AFS changes the headlight beam pattern to the vehicle's driving conditions.

- The AFLS has three modes of operation: motorway, country, and town. To achieve these modes, the prototype AFLS ECU was linked with a Utility Vehicle's Electrical & Electronic architecture via a CAN network.

- These AFLS modes are achieved with fewer sensor inputs than comparable market solutions on existing mid-segment utility vehicle architecture. The vehicle speed thresholds have been optimized to fit the requirements of Indian traffic.

Supportive Government Policies And Initiatives To Augment Demand

India has a steadily growing number of companies that have successfully capitalized on local advantages like higher return on investment and talent availability to create alluring business and delivery models that enable the development and deployment of ADAS/AD software for major international automakers. These businesses can do demanding tasks like virtual validation and simulation, continuous integrations essential to ADAS/AD software development, and virtual validation and simulation thanks to India's technological and networking infrastructure, meeting international standards. The increasing demand for vehicles with integrated ADAS features, driven by rising awareness of passenger comfort and safety and government regulations mandating safety features, is expected to drive growth in the market. Moreover, the rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market.

Autonomous cars and connected vehicles are gaining consumers' interest and are anticipated to gain wider acceptance during the forecast period. The advanced driver assistance systems (ADAS) featured are expected to diminish the penetration gap between traditional cars and modern cars.

Also, improved road networks with lane markings, government efforts to make safety features like forward collision warning (FCW), advanced emergency braking (AEB), and lane keep assist (LKA) mandatory, at least in the commercial vehicle segment, growing interest in technology among young consumers, and advancements in ADAS technology with each new generation are all factors that are expected to accelerate ADAS adoption in India.

India Automotive Advanced Driver Assistance Systems Industry Overview

Some of the key players in the automotive ADAS market include Robert Bosch, Continental AG, ZF Friedrichshafen, Hyundai Mobis, and Autoliv. They are partnering and planning to invest in the latest ADAS features. For instance,

- In May 2023, Tata Technologies announced a partnership with TiHAN IIT Hyderabad to collaborate in the areas of software-defined vehicles (SDV) and advanced driver assistance systems (ADAS) that incorporate the latest technologies.

- In March 2022, Hyundai Mobis India Ltd and IIT Hyderabad formed a partnership. To address difficulties unique to India in advanced driving assistance systems (ADAS) and hardware resource optimization approaches for Chassis Software, IIT Hyderabad will draw on its expertise in mathematical modeling, machine learning, and hardware prototypes for ADAS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Concerns About Road Safety and Government Initiatives To Enhance Demand In The Market?

- 4.1.2 Growing Adoption of New Technologies?

- 4.2 Market Restraints

- 4.2.1 High Cost and Limited Penetration Rate?

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 Type

- 5.1.1 Parking Assist System

- 5.1.1.1 Night Vision System

- 5.1.1.2 Blind Spot Detection

- 5.1.1.3 Advanced Automatic Emergency Braking System

- 5.1.1.4 Collision Warning

- 5.1.1.5 Driver Drowsiness Alert

- 5.1.1.6 Traffic Sign Recognition

- 5.1.1.7 Lane Departure Warning

- 5.1.1.8 Adaptive Cruise Control

- 5.1.2 Technology

- 5.1.2.1 Radar

- 5.1.2.2 LiDAR

- 5.1.2.3 Camera

- 5.1.3 Vehicle Type

- 5.1.3.1 Passenger Cars

- 5.1.3.2 Commercial Vehicles

- 5.1.1 Parking Assist System

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aisin Seiki Co. Ltd

- 6.2.2 Delphi Automotive

- 6.2.3 DENSO Corporation

- 6.2.4 Infineon Technologies

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Continental AG

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Mobileye

- 6.2.10 Hella KGAA Hueck & Co

- 6.2.11 Robert Bosch GmbH

- 6.2.12 Hyundai Mobis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Emphasis On Multi-Functional ADAS Components

8 Supplier Information