Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523369

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523369

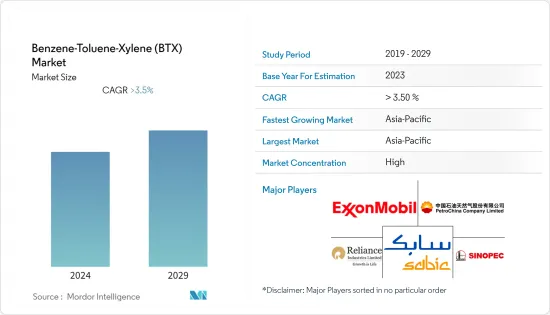

Benzene-Toluene-Xylene (BTX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Benzene-Toluene-Xylene Market size is estimated at 137.61 Million tons in 2024, and is expected to reach 165.65 Million tons by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 outbreak across the world severely impacted market growth in various sectors. Stoppage or slowdown of projects, movement restrictions, production halts, and labor shortages to contain the COVID-19 outbreak have led to a decline in the BTX market growth. However, it recovered significantly in 2021, owing to rising consumption from various applications, including paints and coating, adhesive and sealants, and the chemical industry.

- The increasing demand for toluene from paints, coatings, and adhesives is expected to drive the BTX market. Moreover, increasing investments in capacity expansions drive the growth of paraxylene, xylene, and benzene.

- The harmful effects of benzene-toluene-xylene (BTX) are expected to hinder the market's growth.

- Moreover, emerging sustainable technologies to develop Benzene-Toluene-Xylene (BTX) are expected to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market between 2024 and 2029, owing to its growing development in major countries such as India, China, and Japan.

Benzene-Toluene-Xylene (BTX) Market Trends

Ethylbenzene is Expected to Dominate the Benzene by Application Segment

- Ethylbenzene is commercially produced from benzene and ethylene in industrial plants, and a minor amount is isolated by purifying petroleum by-product streams. It is also present naturally in crude oil, some natural gas streams, and coal tar. Ethylbenzene appears as a clear, colorless liquid with an aromatic odor.

- Belgium is the world's leading exporter country of ethylbenzene. In 2022, Belgium exported USD 342.53 million of ethylbenzene. Ranking second was the Czech Republic, which exported some USD 136.27 million of ethylbenzene. That year, the Netherlands was the top country importing ethylbenzene worldwide, with an import value of USD 353.67 million.

- Minor ethylbenzene applications include the production of chemicals other than styrene or as a solvent, as well as some agricultural and home insecticide sprays, dyes, household degreasers, rubber adhesives, and rust preventives.

- Over 98% of synthetic ethylbenzene is used as a raw material to manufacture styrene monomer. Ethylbenzene is used primarily in the production of styrene, which is produced by the catalytic dehydrogenation of ethylbenzene, which gives hydrogen and styrene.

- Styrene is used mainly in polymer production for polystyrene, acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers and latexes, and unsaturated polyester resins. Production capacity of styrene across countries are;

- In 2022, around 2.45 million metric tons of styrene monomer were produced in South Korea. This represents a decrease from about 2.91 million metric tons in the previous year.

- The volume of styrene production in Russia has fluctuated during the observed period. In 2022, production of the product fell to 715 thousand metric tons, having decreased slightly from the year earlier.

- The major styrene industry markets include packaging, electrical and electronic appliances, construction, automotive, and consumer products.

- Ethylbenzene is added to gasoline as an anti-knock agent to reduce engine knocking and increase the octane rating. It is a component of automotive and aviation fuels. It also makes other chemicals, including acetophenone, cellulose acetate, diethyl-benzene, ethyl anthraquinone, ethylbenzene sulfonic acids, propylene oxide, and alpha-methylbenzyl alcohol.

- Ethylbenzene is also used as a solvent, a constituent of asphalt and naphtha, and in synthetic rubber, fuels, paints, inks, carpet glues, varnishes, tobacco products, and insecticides.

- Therefore, the demand for ethylbenzene will likely increase with the increasing usage in styrene production between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the market studied, with the largest share of the total market volume, and is estimated to be the fastest-growing region between 2024 and 2029.

- In Asia-Pacific, the growing significance of benzene and toluene in various chemical applications and the growing usage of xylene as solvents and monomers are driving the growth of the market studied.

- The region has several companies that manufacture benzene, toluene, and xylene and have various production capacities. For instance,

- In April 2023, Tangshan Risun Chemicals Limited, a subsidiary of China Risun Group Limited, successfully commenced production at the newly built Phase II crude benzene hydrogenation refinery plant, which has an annual capacity of 360,000 tonnes, and Phase I natural benzene hydrogenation refinery plant transformation project with a yearly capacity of 200,000 tonnes.

- Similarly, the crude benzene processing capacity of Tangshan Risun is likely to be boosted to 560,000 tonnes per year, making it the largest crude benzene hydrogenation refinery unit project in China. Thus, enhancing the benzene market.

- In August 2023, Mangalore Refinery and Petrochemicals Ltd (MRPL) announced they would set up a world-scale isobutylbenzene production facility in the coming days. The production of Isobutylbenzene involves toluene. Thus, the new facility will likely increase the demand for toluene between 2024 and 2029.

- Kashima Aromatics Co. Ltd, a joint venture among Japan Energy Corporation, Mitsubishi Chemical Corporation (current Mitsubishi Chemical Holdings Corporation), and Mitsubishi Corporation, has one of the largest production capacities in Japan, of approximately 520,000 tons of paraxylene and 230,000 tons of benzene a year.

- Similarly, Mitsui Chemicals has a benzene production facility in Chiba, Japan, with an annual production capacity of 145 thousand tons.

- SK Incheon Petrochem Co. Ltd's aromatics business produces and sells commodity products used as raw materials for everyday supplies, construction, home electronics, and textiles. The constant investment by the company is anticipated to expand the BTX production capacity to 3 million tons per year, the most enormous scale in the area.

- Moreover, according to Statistics Korea, in 2022, around 7.61 million metric tons of paraxylene were produced in South Korea. This represents a decrease from 8.69 million metric tons in the previous year. Paraxylene is commonly used as a building block to make other chemicals and acids, especially those used in plastic manufacturing.

- Owing to all the factors above, the market for BTX in the region is projected to grow significantly between 2024 and 2029.

Benzene-Toluene-Xylene (BTX) Industry Overview

The global benzene toluene xylene (BTX) market is partially consolidated in nature, with competition among the major players to increase their share in the studied market. Some of the major players in the market are China Petrochemical Corporation (SINOPEC), Exxon Mobil Corporation, SABIC, Reliance Industries Limited, and PetroChina Company Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72458

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Investments in Capacity Expansions is Driving the Growth of Paraxylene, Xylene, and Benzene

- 4.1.2 Increasing Demand for Toluene from Paints, Coatings, and Adhesives

- 4.2 Restraints

- 4.2.1 Hazards Associated with Benzene-toluene-xylene (BTX)

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Benzene

- 5.1.2 Toluene

- 5.1.3 Xylene

- 5.1.3.1 Ortho-xylene

- 5.1.3.2 Meta-xylene

- 5.1.3.3 Para-xylene

- 5.2 Product By Application

- 5.2.1 Benzene By Application

- 5.2.1.1 Ethylbenzene

- 5.2.1.2 Cyclohexane

- 5.2.1.3 Alkylbenzene

- 5.2.1.4 Cumene

- 5.2.1.5 Nitrobenzene

- 5.2.1.6 Other Applications

- 5.2.2 Toluene By Application

- 5.2.2.1 Paints and Coatings

- 5.2.2.2 Adhesives and Inks

- 5.2.2.3 Explosives

- 5.2.2.4 Chemical Industry

- 5.2.2.5 Other Applications

- 5.2.3 Xylene By Application

- 5.2.3.1 Solvent

- 5.2.3.2 Monomer

- 5.2.3.3 Other Applications

- 5.2.1 Benzene By Application

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 BP PLC

- 6.3.3 Chevron Phillips Chemical Company LLC

- 6.3.4 China National Offshore Oil Corporation (CNOOC)

- 6.3.5 Dow

- 6.3.6 Exxon Mobil Corporation

- 6.3.7 Formosa Plastics Group

- 6.3.8 GS Caltex Corporation

- 6.3.9 INEOS

- 6.3.10 IRPC Public Company Limited

- 6.3.11 JFE Chemical Corporation

- 6.3.12 JX Nippon Oil & Gas Exploration Corporation (Eneos)

- 6.3.13 MITSUBISHI GAS CHEMICAL COMPANY INC.

- 6.3.14 OCI LTD

- 6.3.15 China National Petroleum Corporation

- 6.3.16 Reliance Industries Limited

- 6.3.17 Shell PLC

- 6.3.18 China Petroleum & Chemical Corporation Limited (SINOPEC)

- 6.3.19 SABIC

- 6.3.20 S-OIL Corporation

- 6.3.21 SK Innovation Co. Ltd

- 6.3.22 Totalenergies

- 6.3.23 YEOCHUN NCC CO. LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Sustainable Technologies to Develop BTX

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.