PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690697

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690697

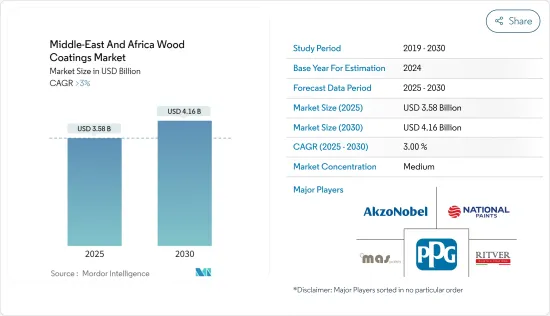

Middle-East And Africa Wood Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle-East And Africa Wood Coatings Market size is estimated at USD 3.58 billion in 2025, and is expected to reach USD 4.16 billion by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the wood coatings market in the Middle East and Africa (MEA). Due to restrictions associated with the pandemic, there was a slowdown in the construction and furniture industries, leading to a decrease in demand for wood coatings. However, as situations improve, the industries are expected to grow and reach pre-pandemic levels, witnessing a sharp increase in the future.

Key Highlights

- Over the long term, factors such as the growing construction industry in the Middle Eastern region and growing furniture production are expected to drive market demand.

- However, factors such as rising concerns regarding volatile material emissions are expected to restrain the growth of the market.

- Increasing demand for UV-cured coatings and a shift toward water-borne coatings are expected to offer growth opportunities for the market.

- In the region, Saudi Arabia is expected to dominate the market during the forecast period.

Middle-East And Africa Wood Coatings Market Trends

The Demand from the Furniture and Fixtures Segment is Growing

- Wood coatings, owing to their properties such as excellent adhesion, anti-corrosiveness, increased durability on woods, and esthetic appearance, are becoming an integral part of various wood-based products in commercial sectors.

- Wood coatings mainly find applications in furniture and fixtures. Wood surfaces coated with these coatings remained protected from termites and fungal infections.

- In addition, the wood surfaces are also protected from moisture and mold formation by these coatings. These coatings are UV-curable and powder technology-based, enhancing the furniture's appearance and prolonging its life.

- The increasing level of income for the middle-income group and the growing demand for furniture and home decor are expected to boost the demand for furniture such as wooden chairs, tables, beds, sofas, shelves, cupboards, and others, driving market demand.

- Most countries in the Middle East and Africa are majorly dependent on imports for their wooden furniture demand.

- The furniture industry is essential in the United Arab Emirates; more than 600 furniture factories are in operation, accounting for 13% of the total number of industries in the UAE.

- The furniture industry in the UAE is expected to grow further due to the rapidly increasing establishment of multinational corporations (MNCs) and increasing employment possibilities, which are driving up demand for office spaces and furniture.

- The Egyptian furniture industry accounts for 2.2% of the GDP, and it consists of 15,800 manufacturers who provide 69,000 jobs. In November 2023, The Micro, Small, and Medium Enterprise Development Agency (MSMEDA) planned to allocate approximately EGP 50 million (USD 1.06 million) to fund over 100 furniture projects, with an average of EGP 400 thousand (USD 8.45 thousand) per project.

- The above-mentioned factors are expected to affect the demand for wood coatings in the furniture and fixtures segment.

Saudi Arabia is Expected to Dominate the Market

- In Saudi Arabia, the demand for wood-based furniture, doors, windows, decks, cabinets, or other components is likely to increase over the forecast period as a result of increasing investment in infrastructure and commercial constructions in developing economies, along with the implementation of Building Information Models.

- According to the General Authority for Statistics, Saudi Arabia, in Q3 2023, the GDP from construction in the country was SAR 32,872 million (USD 8,763.68 million), about 4.22% more than the same period in 2022.

- The Saudi Arabian furniture industry is driven by increasing residential property demand, real estate development, and government measures to improve economic infrastructure.

- The Saudi economic strategy, which attempts to wean the country's economy off of oil dependency, promises to deliver home ownership to more than 70% of families by 2030. Further, international investors are expected to invest USD 1 trillion in Saudi Vision 2030.

- As many furniture industry retailers entered online retailing, the demand for home and office furniture through online portals increased, owing to increasing internet penetration and urbanization, a growing younger population, and expanding government initiatives.

- Also, many companies, including IKEA and Midas, have moved into online furniture shopping in order to attract more customers.

- Hence, the above-mentioned factors are expected to affect the growth of the wood coatings market in Saudi Arabia.

Middle-East And Africa Wood Coatings Industry Overview

The Middle East and African wood coatings market is partially consolidated in nature. The key players in the market include NATIONAL PAINTS FACTORIES CO. LTD, Ritver, Akzo Nobel NV, MAS Paints, and PPG Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Activities in the Middle East and Africa

- 4.1.2 Growing Furniture Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Concern Toward Volatile Material Emission

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Nitrocellulose

- 5.1.3 Polyurethane

- 5.1.4 Polyester

- 5.1.5 Other Resin Types (Alkyd, Vinyl Resins, Epoxy, etc.)

- 5.2 Technology

- 5.2.1 Waterborne

- 5.2.2 Solvent-borne

- 5.2.3 UV-cured

- 5.2.4 Powder

- 5.3 Application

- 5.3.1 Furniture and Fixtures

- 5.3.2 Doors and Windows

- 5.3.3 Decks and Cabinets

- 5.3.4 Other Applications (including Floors and Molding Products)

- 5.4 Country

- 5.4.1 Saudi Arabia

- 5.4.2 Egypt

- 5.4.3 Morocco

- 5.4.4 Nigeria

- 5.4.5 Algeria

- 5.4.6 Kenya

- 5.4.7 Saudi Arabia

- 5.4.8 United Arab Emirates

- 5.4.9 Iran

- 5.4.10 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Crown Paints Kenya PLC

- 6.4.3 IVM Chemicals srl

- 6.4.4 Jotun

- 6.4.5 Kansai Paint Co. Ltd

- 6.4.6 KAPCI Coating

- 6.4.7 Nippon Paint Holdings Co. Ltd

- 6.4.8 PPG Industries Inc.

- 6.4.9 RPM International Inc.

- 6.4.10 The Sherwin-Williams Company

- 6.4.11 NATIONAL PAINTS FACTORIES CO. LTD

- 6.4.12 Ritver

- 6.4.13 MAS Paints

- 6.4.14 Sipes Egypt

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift toward Water-borne Coatings

- 7.2 Supportive Government Policies