PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523357

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1523357

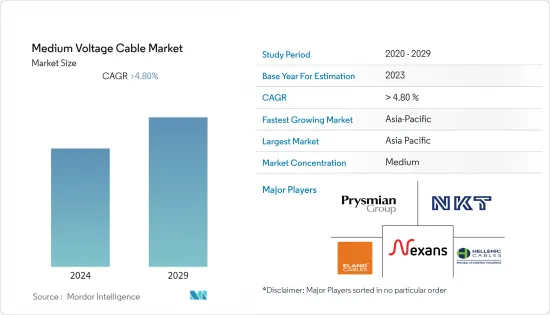

Medium Voltage Cable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Medium Voltage Cable Market size is estimated at USD 48.71 billion in 2024, and is expected to reach USD 63.36 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

Increasing urbanization and industrialization, as well as aging power infrastructure in power transmission and distribution networks, are likely to drive the medium-voltage cable market.

On the downside, the dearth of investments to revamp the transmission and distribution lines is likely to hinder market growth in the near future.

With rising electrification projects in regions such as Africa, medium-voltage cables are used for power distribution from substations to the customer. The increasing rural electrification in African and Asian countries is expected to offer tremendous opportunities for medium-voltage cable market players in the future.

Asia-Pacific is expected to be the largest and the fastest-growing region during the forecast period, supported by a high urbanization growth rate and growing electricity demand, mainly from China and India.

Medium Voltage Cable Market Trends

The Underground Segment to Witness Significant Growth

- In urban areas, underground cables are more favored as above-ground space constraints. Owing to growth in urbanization and renewable energy projects across various economies worldwide, the installation of underground cables has gained traction, where overhead cables or underwater cables may endanger lives and pose economic constraints.

- Underground cables are a safe and reliable source of electricity transfer. Their capacity ranges from low to medium voltage levels. Owing to their robust manufacturing and materials, underground cables are less prone to faults than their counterparts. Moreover, they can be repaired quickly.

- Countries such as Germany are increasingly installing underground power cables to serve the power demands of large and small consumers. For instance, in November 2023, construction of a 300 km underground HVDC transmission cable commenced in South Germany. The transmission route known as an A-Nord is expected to facilitate 2000 MW of wind energy to Osterath from the North Sea Port. Such developments highlight the expanding underground cable market in Europe.

- The rise in electricity generation owing to electricity demand from end-consumers and the increase in an alternative source of energy is likely to lead to the growth of the medium-voltage cable market in future years. As per the Statistical Review of World Energy, electricity generation in 2022 stood at over 29,165 terawatt-hours, an increase of roughly 2% from the previous year.

- Therefore, based on the above-mentioned factors, the underground segment in the market studied is likely to witness significant growth during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific has emerged as one of the major medium-voltage cable markets in recent years. The rise in energy demand associated with urbanization, economic modernization, and better living standards across the region has resulted in the growth of sustainable power systems, which, in turn, has increased the demand for the medium-voltage cable market in this region.

- Many countries in Asia-Pacific require more transmission and distribution (T&D) networks, and electricity is not available in some remote and rural areas. The region is investing heavily in building a transmission line network to bring electricity to these areas. Vietnam is also replacing the power cables from overhead to underground in two of its major cities, Ho Chi Minh City and Hanoi. Besides deploying underground cables on major roads, the exercise has also been extended to passages within the cities. The overhead cable replacements are expected to take place between 2020 and 2025, driving the market for underground cables.

- In addition, many countries, such as India, have felt the need to have a dedicated transmission corridor to evacuate growing intermittent renewable energy electricity to end-consumers. This has driven the deployment of medium-voltage cables in Asia-Pacific. According to the International Renewable Energy Agency, the installed capacity of clean energy sources in the region in 2023 stood at 1,961,099 MW, an increase from the previous year's 1,633,347 MW.

- In countries such as India, the power transmission and distribution grid has been experiencing significant gradations and modifications to make it capable of transmitting to the agriculture sector (and other sectors as well). For instance, in May 2023, the Gidderwindi region in Punjab witnessed the installation of a 66 kV transmission line and substation to ensure uninterrupted power supply to farmers during the paddy sowing season. Similar projects are likely to be rolled out in the future to eradicate power supply issues in India.

- Therefore, factors like expansions and upgrades, especially in Asia-Pacific, are expected to have a positive impact on the medium-voltage cables market during the forecast period.

Medium Voltage Cable Industry Overview

The medium voltage cable market is moderately fragmented. The key players in the market include (in no particular order) Cablel Hellenic Cables Group, Nexans SA, Eland Cables Ltd, NKT AS, and Prysmian SpA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Electricity Propelled by Growing Industrialization and Urbanization

- 4.5.1.2 Aging Power Sector Infrastructure

- 4.5.2 Restraints

- 4.5.2.1 Limited Investments to Support Medium-voltage Transmission Network

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Voltage Level

- 5.1.1 Less than 35 kV

- 5.1.2 Greater than 35 kV

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial (C&I)

- 5.2.3 Utility

- 5.3 Insulation

- 5.3.1 Cross-linked Polyethylene (XLPE)

- 5.3.2 Ethylene Propylene Rubber (EPR)

- 5.3.3 Other Insulations

- 5.4 Location of Deployment

- 5.4.1 Overhead

- 5.4.2 Underground

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Spain

- 5.5.2.3 NORDIC

- 5.5.2.4 Russia

- 5.5.2.5 Turkey

- 5.5.2.6 Germany

- 5.5.2.7 Italy

- 5.5.2.8 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Malaysia

- 5.5.3.5 Thailand

- 5.5.3.6 Indonesia

- 5.5.3.7 Vietnam

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Qatar

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cablel Hellenic Cables Group

- 6.3.2 Nexans SA

- 6.3.3 Eland Cables Ltd

- 6.3.4 NKT AS

- 6.3.5 Prysmian SpA

- 6.3.6 Siemens AG

- 6.3.7 Southwire Company LLC

- 6.3.8 Riyadh Cables Group

- 6.3.9 The Okonite Company

- 6.3.10 General Cables Corporation

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS