PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687727

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687727

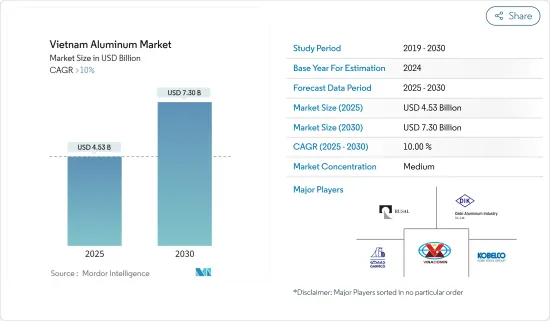

Vietnam Aluminum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Vietnam Aluminum Market size is estimated at USD 4.53 billion in 2025, and is expected to reach USD 7.30 billion by 2030, at a CAGR of greater than 10% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the demand for the aluminum market in Vietnam due to various lockdowns and restrictions imposed by the government. The market, however, has been growing gradually with the restrictions being lifted, and this growth trajectory is likely to continue over the forecast period.

Key Highlights

- Factors such as the rising demand for the construction industry and the expansion of the automotive industry are driving market growth.

- The growing availability of substitutes, along with stringent regulations, are acting as restraints to market growth.

- The increasing awareness of the usage of recycled aluminum is likely to act as an opportunity through the forecast period.

Vietnam Aluminum Market Trends

Growth in Demand from the Building and Construction Industry is Driving the Market

- Aluminum is the second most widely utilized metal in the building and construction industry. Due to its lightweight and corrosion resistance abilities, it is widely used in building windows, curtain walls, roofing and cladding, solar shades, solar panels, railings, shelves, and other temporary structures.

- According to the General Statistics Office of Vietnam, the construction industry has significantly contributed to the country's GDP in recent years.

- According to data released by the Statistics Office of Vietnam, the country's GDP from the construction industry increased to VND 388.199 trillion (USD 15 billion) in the fourth quarter of 2023 compared to VND 263.97 trillion (USD 10 billion) in the third quarter of 2023.

- In its recent publication, the Vietnamese Ministry of Construction also stated that the People's Committee of Ha Long City in Quang Ninh Province had commenced construction of a social housing project for nearly 1,000 apartments in Ha Long City's Hong Hai Ward and Cao Thang Ward in the early November of 2022.

- The overall investment in the project is projected to be around VND 1.3 trillion (USD 52.3 million), with completion scheduled for the first quarter of 2026. After completion, the project aims to house more than 3,880 employees and low-income residents.

- In 2023, TotalEnergies ENEOS signed a long-term agreement with Golden Victory Vietnam Co. Ltd, one of the largest manufacturers of shoes and footwear and a key supplier to globally renowned sportswear brands, for developing a 4.6-megawatt peak (MWp) solar photovoltaic (PV) system at its facility in Nam Dinh Province, Vietnam.

- All these factors are expected to drive the demand for aluminum in the country's construction industry and boost market growth over the forecast period.

Automotive Industry is Projected to Dominate the Market

- As the automobile industry increasingly focuses on fuel efficiency, lowering CO2 emissions, and design flexibility, aluminum plays an increasingly significant role in modern vehicles. The use of aluminum reduces the overall weight of an automobile by several kilograms in various areas.

- Many automobile components, including radiators, wheels, suspension components, bumpers, transmission bodies, engine cylinder blocks, and body components like hoods, doors, and even frames, are constructed of aluminum.

- According to the Vietnam Automobile Manufacturers Association, a total number of 17,314 units of automobiles were produced in the country between January 2022 and 2023, the prominent share being of passenger cars (14,036 units), followed by commercial vehicles (3,174 units) and special purpose vehicles (104 units).

- In September 2023, Czech automobile brand Skoda entered the Vietnamese market as part of its joint venture with TC Motor, while other European manufacturers entered Vietnam very soon after. These included German manufacturers BMW, Mercedes, Volkswagen, and Peugeot, of which Volkswagen still has no factory in the country.

- The Vietnam Automobile Manufacturers Association (VAMA) also suggested that the National Automobile Development Strategy (2021-2050) could promote manufacturing and boost the use of e-vehicles. The number of electric vehicles will, thus, considerably expand between 2030 and 2040, reaching a production capacity of 3.5 million vehicles by that year.

- In addition, aluminum is used in various components, such as engine parts and frames, in two-wheeler manufacturing.

- In Apil 2024, Vietnam's trade ministry reported that Chery had entered a USD 800 million joint venture with a local firm to build a plant. Chery will be the first Chinese EV manufacturer to establish a plant in Vietnam. The plant will be built in partnership between Chery's automotive unit, Omoda & Jaecoo, and Vietnamese firm Geoleximco.

- Therefore, owing to all the factors mentioned above, the development of the automotive industry and its fast-paced growth in Vietnam is likely to help the aluminum market expand during the forecast period.

Vietnam Aluminum Industry Overview

The aluminum market in Vietnam is partially consolidated in nature. Some major players (in no particular order) include Vietnam Coal and Mineral Industries Group, Daiki Aluminium Vietnam (DAVCO), Kobe Steel Ltd, GARMCO, and RusAL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS (Market Size in Value and Volume)

- 4.1 Driver

- 4.1.1 Substitution of Stainless Steel with Aluminum by Automotive Companies

- 4.1.2 Growing Construction and Infrastructure Activities in the Country

- 4.1.3 Other Drivers

- 4.2 Restraint

- 4.2.1 Availability of Substitute Products

- 4.2.2 High Costs and Stringent Environmental Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Processing Type

- 5.1.1 Castings

- 5.1.2 Extrusions

- 5.1.3 Forgings

- 5.1.4 Flat-rolled Products

- 5.1.5 Pigments and Powders

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Industrial

- 5.2.7 Other End-user Industries (Marine, Power, and Others)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Daiki Aluminium Industry Co. Ltd

- 6.4.3 Emirates Global Aluminium PJSC

- 6.4.4 GARMCO

- 6.4.5 KOBE Steel Ltd

- 6.4.6 Norsk Hydro ASA

- 6.4.7 Rusal

- 6.4.8 Vietnam Coal and Mineral Industries Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling of Aluminum for Further Usage

- 7.2 Other Opportunities