PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1522875

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1522875

CNG LPG Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

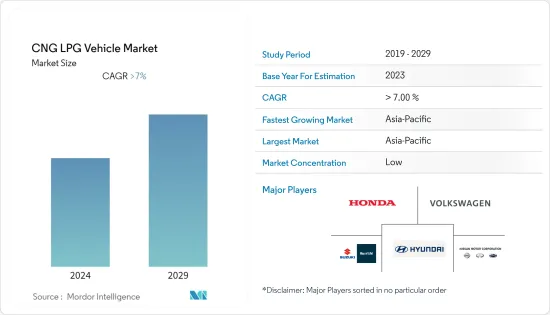

The CNG LPG Vehicle Market size is estimated at USD 6.73 billion in 2024, and is expected to reach USD 10.13 billion by 2029, growing at a CAGR of 7% during the forecast period (2024-2029).

The global market for CNG and LPG vehicles has been growing, driven by increasing environmental concerns, rising fuel prices, and the push for energy diversification. In recent years, significant improvements have been made in CNG and LPG vehicle technologies, including fuel storage, engine efficiency, and safety features. These advancements have made CNG and LPG vehicles more competitive in terms of performance and reliability.

Lower operational costs due to cheaper CNG and LPG compared to petrol and diesel are significant drivers. This aspect is particularly appealing for commercial and high-mileage vehicles. Stricter emission regulations worldwide are boosting the adoption of CNG and LPG vehicles, as they emit fewer pollutants compared to conventional fuels.

With the global shift toward sustainable energy, CNG and LPG vehicles are likely to maintain their relevance, especially in regions where electric vehicle infrastructure is lagging. Continuous improvements in vehicle technology and fuel infrastructure may also enhance the market appeal of CNG and LPG vehicles.

Asia-Pacific is the largest market for automobiles in the world. The region, despite the sluggish growth in the Chinese market, the largest automobile market in the world, is expected to lead the growth in the CNG and LPG vehicles market during the forecast period.

Thus, the confluence of the aforementioned factors is expected to produce significant growth in the market in the coming years.

CNG LPG Vehicle Market Trends

Commercial Vehicles Fueling the Demand for CNG and LPG Vehicle

CNG and LPG are often cheaper than traditional petrol and diesel fuels. For commercial vehicle operators, fuel cost is a significant portion of operating expenses. The lower cost of CNG and LPG can translate into substantial savings over the lifetime of the vehicle, making these options financially attractive. Compared to the more volatile oil market, CNG and LPG prices are generally more stable. This stability allows businesses to better forecast and manage their operating costs, which is crucial for commercial operations.

Increasingly stringent emission regulations worldwide are a significant driver. CNG and LPG vehicles emit fewer pollutants such as nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2) compared to diesel and petrol vehicles. In urban areas, especially where air quality is a major concern, CNG and LPG vehicles are more compliant with environmental standards.

The expansion of CNG and LPG fueling stations has made these fuels more accessible. This infrastructure development is often a result of either government initiatives or partnerships between private entities and government bodies. Modern CNG and LPG vehicles have seen significant improvements in terms of performance, reliability, and fuel efficiency. This makes them more competitive with traditional fuel vehicles.

In regions where natural gas or LPG is readily available and less expensive due to domestic production, there is a natural inclination to utilize these resources. Many cities worldwide are introducing low-emission zones where vehicles that do not meet certain emission standards are either banned or subject to a fee. CNG and LPG vehicles often meet these standards, making them a viable option for businesses operating within urban areas.

However, the cost advantage offered by natural gas vehicles and supportive government policies to encourage the adoption of alternative fuel-powered vehicles is driving the global CNG and LPG vehicle market. For instance,

- In November 2022, 1 kg of CNG was priced at INR 78.61 (94 cents) compared to petrol, which cost INR 96.72 (USD 1.16) per liter, and diesel, which was priced at INR 96.67 (USD 1.16) per liter in New Delhi, India. This substantial difference in CNG and petrol/diesel pricing and the higher mileage of CNG vehicles than petrol/diesel vehicles has almost doubled the sales of CNG vehicles in India over the past few years.

Thus, the combination of all the above factors is anticipated to propel the market for CNG and LPG vehicles worldwide over the next five years.

Asia-Pacific Region is Expected to be the Largest Market During the Forecast Period

Asia-Pacific is forecasted to be the largest market for CNG and LPG vehicles in the world, led by the growth in India.

Cities in Asia-Pacific are among the most polluted globally. CNG and LPG vehicles emit fewer pollutants compared to diesel and petrol vehicles, making them attractive options for improving urban air quality. Therefore, many countries are aligned with global trends in emission standards. CNG and LPG vehicles are seen as practical steps toward meeting these stricter environmental regulations.

Moreover, regulatory policies across the region reinforce this trend. Stringent emission control policies, such as India's Bharat Stage VI emission standards, have expedited the adoption of cleaner fuel vehicles, including CNG and LPG. Furthermore, countries like China and India have specific policies promoting alternative fuel vehicles, situating CNG and LPG vehicles within broader carbon reduction strategies.

Technological advancements significantly contribute to the attractiveness of CNG and LPG vehicles. Improvements in vehicle technology have not only enhanced performance and reliability but also increased efficiency. The range and refueling times of these vehicles have seen marked improvements. Complementing these technological strides is the expansion of refueling infrastructure, which is critical for the practicality of CNG and LPG vehicles. This expansion, notably in India and China, has been instrumental in making these fuels more accessible for both personal and commercial use. The market dynamics of the Asia-Pacific region are characterized by a vast and growing vehicle population that further fuels the demand for CNG and LPG vehicles.

Following Asia-Pacific, Europe and North America are predicted to be the next biggest markets due to lower prices of natural gas and the adoption of stringent emission norms.

CNG LPG Vehicle Industry Overview

The CNG and LPG vehicle market is highly fragmented and dominated by several global and local players. Some of the major players are Hyundai Motor Company, Suzuki Motor Corporation, Nissan Motor Co. Ltd, Volkswagen AG, and Honda Motor Company. The major companies are launching new products and forming joint ventures to cement their market position. For instance,

- In August 2022, Scania, a brand of Traton SE, the Volkswagen Group commercial vehicle division, delivered the country's first dedicated natural gas truck to BridCam Distributors in Gauteng, South Africa.

- In January 2022, Iveco Bus partnered with SOTRA in Ivory Coast, Africa, to start the local assembly of CNG-powered Iveco Daily Minibus.

- In January 2022, Eicher (VECV) showcased CNG variants of its 4.9 and 5.9-metric-ton trucks, typically used in last-mile delivery operations by fleet owners. While these are the lightest payload trucks VECV offers, the automaker plans to bring in CNG trucks with higher payloads as the footprint of CNG stations is likely to increase in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Demand for Clean Energy Driving the Market

- 4.3 Market Restraints

- 4.3.1 Rising Safety Concerns is Antcipated to Restrain the Market

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Fuel Type

- 5.1.1 Compressed Natural Gas (CNG)

- 5.1.2 Liquefied Petroleum Gas (LPG)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 Retrofitting

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Hyundai Motor Company

- 6.3.2 Suzuki Motor Corporation

- 6.3.3 Nissan Motor Co. Ltd

- 6.3.4 Volkswagen AG

- 6.3.5 Honda Motor Company

- 6.3.6 IVECO SpA

- 6.3.7 AB VOLVO

- 6.3.8 Ford Motor Company

- 6.3.9 Tata Motors Limited

- 6.3.10 Traton SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 CUSTOMIZATION

- 8.1 Market Volume In Units