PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686578

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686578

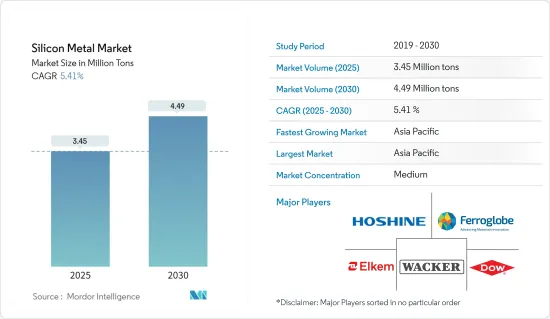

Silicon Metal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Silicon Metal Market size is estimated at 3.45 million tons in 2025, and is expected to reach 4.49 million tons by 2030, at a CAGR of 5.41% during the forecast period (2025-2030).

The COVID-19 hampered the silicone metal market. Many industries that utilize silicone metal, such as automotive, construction, and electronics, experienced decreased demand during the pandemic due to economic downturns, reduced consumer spending, and disruptions in production and supply chains. However, as lockdowns and restrictions eased, industries that utilize silicone metal recovered, and there was increased demand for silicone from infrastructure projects, automotive production, semiconductor manufacturing, and renewable energy installations, which boosted the demand for silicone metals.

Key Highlights

- Surging demand for silicone from the automotive industry, increasing use in the solar industry, and increasing demand for silicones from various other end users are expected to increase the market for silicone metal globally.

- However, volatility in energy costs is hindering the growth of the silicon metal market.

- Several measures to reduce production costs by improving current technologies and increasing demand from the renewable energy sector are expected to create growth opportunities for the market players in the upcoming period.

- The Asia-Pacific holds the highest market share and is likely to dominate the silicon metal market during the forecast period.

Silicon Metal Market Trends

Solar Panels Segment to Dominate the Market

- Silicon, which accounts for about 95% of the modules sold today, is the most extensively used semiconductor material in photovoltaics. In the process of purification, metallurgical silicon can be transformed into high-purity silicon that is used to make semiconductors and solar cells. Therefore, it is suitable for the manufacture of photovoltaic cells.

- Solar energy is one of the largest and fastest-growing sectors worldwide. The sector is responsible for nearly two-thirds of global net energy capacity, according to the International Energy Agency.

- According to the data published by the International Energy Agency (IEA), in 2022, solar PV production increased by a record 270 TWh, which increased by 26%, reaching almost 1300 TWh. It demonstrated the most considerable absolute generation growth of all renewable technologies in 2022, surpassing wind for the first time in history.

- The United States included generous new funding for solar PV in the Inflation Reduction Act (IRA) introduced in 2022. Investment and production tax credits will likely significantly boost the growth of PV capacity and supply chains.

- According to the data published by the International Energy Agency (IEA), in 2022, Brazil added almost 11 gigawatts of solar PV capacity, doubling its growth rate for 2021. In view of the continued demand for renewable energy from industry and power retailers, deployment is projected to be maintained at this level over the medium term.

- According to the data published by the Ministry of New and Renewable Energy (MNRE), India held the fourth position in solar PV deployment worldwide as of the end of 2022. The Cumulative installed capacity of solar power reached around 7.2 GW as of November 2022. Today, India's solar tariffs are very competitive, and grid parity has been achieved.

- The developments mentioned above are expected to drive the market for silicone metal in the solar industry through the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific, particularly China, is the largest producer of silicone metal globally. The region benefits from abundant reserves of raw materials like quartz and coal, as well as access to low-cost labor, which supports the establishment of large-scale silicon metal production facilities.

- The most critical applications of silicon metal are silicone adhesives, sealants, lubricants, chemicals, and other substances, as well as aluminum alloys. The automotive, building and construction, industrial, and other end-user sectors are the primary uses of these products.

- The production and sales of new energy vehicles increased significantly in China, with the number of units sold reaching 7.22 million by 2022, representing 64 % of all EV sales worldwide.

- The market is projected to be driven by the government's promotion of EVs, hybrids, and fuel-cell vehicles in the forecast period. The rising demand for electric vehicles in this country increases the need for semiconductors, aluminum alloys, and silicon adhesives.

- According to the report released by the China Association of Automobile Manufacturers (CAAM), in 2022, China exported 3.11 million vehicles, including 2.53 million passenger cars and 580,000 commercial vehicles, an increase of 54.4 % compared to 2021.

- The top global solar PV manufacturing companies, such as JinkoSolar, Trina Solar, and JA Solar, are headquartered in China. Solar cell manufacturing in China has been increasing significantly in the past two years. According to the data published by the International Energy Agency (IEA), with 100 GW capacity of solar PV added in 2022, almost 60% more than in 2021, China continues to lead in terms of solar PV capacity additions.

- Investment in the manufacture of mobile phones, laptops, and other electrical appliances is a significant area for investment in China. In order to meet the upcoming increase in demand, large manufacturers from around the world have invested substantial capital into China's market.

- Due to these factors, Asia-Pacific region China is expected to dominate the silicon metal market.

Silicon Metal Industry Overview

The silicon metal market is partially consolidated. The major players (not in any particular order) include Hoshine Silicon Industry Co., Ltd, Ferroglobe, Elkem ASA, Dow, and Wacker Chemie AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Automotive Industry

- 4.1.2 Increasing Use in the Solar Industry

- 4.1.3 Increasing Demand for Silicones from Different End Users

- 4.2 Restraints

- 4.2.1 Volatility in Energy Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Metallurgy Grade

- 5.1.2 Chemical Grade

- 5.2 Application

- 5.2.1 Aluminum Alloys

- 5.2.2 Semiconductors

- 5.2.3 Solar Panels

- 5.2.4 Silicone Derivatives

- 5.2.5 Other Applications (Construction and Infrastructure)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Indonesia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 France

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anyang Huatuo Metallurgy Co., Ltd.

- 6.4.2 Dow

- 6.4.3 Elkem ASA

- 6.4.4 Ferroglobe

- 6.4.5 Hoshine Silicon Industry Co., Ltd.

- 6.4.6 Liasa

- 6.4.7 Minasligas

- 6.4.8 Mississipi Silicon

- 6.4.9 PCC SE

- 6.4.10 RIMA INDUSTRIAL

- 6.4.11 RusAL

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Wacker Chemie AG

- 6.4.14 Zhejiang kaihua yuantong silicon industry co. LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Efforts to Reduce the Cost of Production by Innovating the Existing Technology

- 7.2 Increasing Demand from Renewable Energy Sector