PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521872

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521872

Vietnam Bike-Sharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

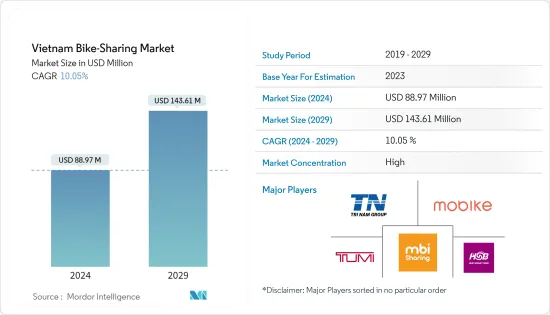

The Vietnam Bike-Sharing Market size is estimated at USD 88.97 million in 2024, and is expected to reach USD 143.61 million by 2029, growing at a CAGR of 10.05% during the forecast period (2024-2029).

Over the long term, the increasing traffic congestion and consumers' growing preference for sustainable transportation are expected to act as significant determinants for the growth of the bike-sharing market in Vietnam. Due to the lack of an efficient traffic management system and the growing urban population, consumers face immense difficulties in traveling between places for a shorter duration. Therefore, to reduce traffic congestion and complement the government's efforts to promote the decarbonization of the transport sector, there exists a massive demand for bike-sharing services across the country.

Key Highlights

- According to the General Statistics Office of Vietnam, the urban population in Vietnam stood at 38.23 million in 2023 compared to 37.35 million in 2022, representing a Y-o-Y growth of 2.35% between 2022 and 2023.

- The government's aggressive focus on investing hefty sums in enhancing the country's bicycling infrastructure also facilitates the creation of an efficient ecosystem for bicycle riders, thereby positively impacting the demand for bike-sharing services.

- Consumers prefer using bike-sharing services rather than purchasing a new bicycle owing to their cost-effectiveness, which allows them to use bicycles at a lower price. Various organizations, such as the United Nations Development Programme and Transport Authorities of cities in Vietnam, are organizing events to enable the construction of optimal bicycling infrastructure, which is expected to contribute to the surging growth of the bike-sharing market.

- One of the major challenges that the market faces is the growing incidents of bike damage and theft. Since these bicycles are lightweight and are deployed in open public spaces, the incidents of thefts can increase. Moreover, the lack of accountability of customers in returning the bicycles in a proper condition poses a significant threat to the industry since these companies charge a lower deposit and usage cost. To mitigate such adverse effects, companies are actively pursuing the integration of technologies, such as advanced lock systems, ID verifications, etc., into their fleet. In the coming years, various players are expected to integrate into the market as there remain low barriers to entry.

Vietnam Bike-Sharing Market Trends

E-bikes Segment to Gain Traction during the Forecast Period

The government's aggressive push to promote the reduction of carbon emissions from the transport sector fosters the demand for sustainable transportation, consequently leading to increasing demand for e-bicycles in the sharing ecosystem, among other electric transportation mediums. This is further facilitated by the increasing traffic congestion in the country, owing to the higher two-wheeler usage. Therefore, to reduce carbon emissions, the government is actively encouraging citizens to use sustainable transportation mediums, which not only assists in reducing carbon emissions but also helps curb traffic congestion, thereby positively impacting the growth of the e-bike market segment.

- According to the General Statistics Office of Vietnam, the road passenger traffic in Vietnam stood at 123.52 billion person-kilometers in 2022 compared to 78.03 billion person-kilometers in 2021, recording a Y-o-Y growth of 58.2% between 2021 and 2022.

- According to a survey conducted in 2023, private motorcycles were the leading mode of transportation in Vietnam, with 86.84% of the 1,140 respondents stating that they use motorcycles for daily commutes, while bicycles were only preferred by 3.51% of consumers.

Companies such as G-Bike, TriNam, and TUMI are actively strategizing to expand their e-bike fleets in their sharing service model to complement the government's effort to reduce carbon emissions. These companies also cater to the growing need of consumers for sustainable transportation. E-bikes also enhance consumers' convenience when traveling as they offer a higher range and lower pedaling efforts compared to traditional bicycles. With the integration of e-bikes in sharing fleets in the coming years, the demand for this segment is projected to increase.

- In August 2023, TriNam Group announced its plan to deploy at least 500 electric bikes of the 1,000 bikes deployed in Hanoi as a bike-sharing model. To ensure that consumers can easily access these e-bikes, they are placed at certain tourist sports, buses, and parks across 79 rental stations within the city.

Assessing the lucrative opportunity, various domestic and international players, especially those of Chinese origin, are expected to integrate the e-bike sharing market in Vietnam to increase their profitability prospects, which, in turn, will contribute to the surging demand for this market segment. Moreover, with the development of dedicated bicycling paths for e-bikes, a massive demand for utilizing the new energy transportation medium will exist, thereby contributing to the market's growth during the forecast period.

Tourism Segment to Witness Surging Demand during the Forecast Period

The growing number of tourists arriving in Vietnam and the increasing preference of these consumers for lower-cost traveling services within the country are leading to excessive demand for bike-sharing services. Traditionally, tourists preferred car rental services or services provided by their tourism agency. However, with more tourists preferring to travel at their desired time, the demand for bicycle-sharing services has witnessed rapid growth in recent years. Cycling and walking within the city are the preferred choice for international travelers as it helps them to visit places based on their preferences and time.

- According to the Vietnam National Administration of Tourism, the annual revenue of the tourism sector in Vietnam touched VND 678.3 trillion (USD 26.9 billion) in 2023 compared to VND 495 trillion (USD 19.6 billion) in 2022, representing a Y-o-Y growth of 37.0% between 2022 and 2023.

Various companies operating in the ecosystem are actively strategizing to develop bike-sharing rental stations near tourist hubs and spots to cater to the increasing need. Companies like TriNam, Mobike, and Hue Smart Bike are spending hefty sums to expand their rental station network across these tourist sports. With the growing tourist arrivals from different countries, the demand for bike-sharing services is expected to record surging demand during the forecast period.

- According to the General Statistics Office of Vietnam, the number of international arrivals in Vietnam touched 12.6 million in 2023 compared to 3.66 million in 2022, representing a Y-o-Y growth of 244.2% between 2022 and 2023.

Apart from the demand by tourists, consumers prefer availing this service for daily commutes and leisure purposes, owing to the inclination toward a healthy lifestyle. Furthermore, the growing young population in the country also enjoys these services as they help them explore places at a lower cost compared to other transportation mediums. With the incorporation of subscription plan models and aggressive marketing strategies, the bike-sharing service model is projected to witness significant growth during the forecast period.

Vietnam Bike-Sharing Industry Overview

The Vietnam bike-sharing market is highly consolidated and competitive due to the presence of a few players capturing the majority share of the market. Some prominent players in the market include Trinam Group JSC, Meituan (Mobike), Lemonc Vietnam Company Limited (MBI Sharing), TUMI, and Hue Smart Bike. These players actively strategize to expand their fleet size and enhance their digital platforms to cater to increasing consumer needs. Active partnerships with local governments and municipalities also assist these players in setting up dedicated docks in a locality, enhancing their brand presence.

- In August 2023, TriNam Group JSC launched a public bicycle-sharing service in Hanoi, operating at least 90 stations with a fleet of 1,000 bikes. Consumers need to register using the company's mobile app. The cost of availing this service is VND 5,000 (USD 0.22) per 30 minutes.

- In March 2023, Da Nang's Transport Department announced the launch of the one-year pilot bicycle-sharing service program in the city to curb environmental pollution and reduce traffic congestion. The transport department has planned to operate 61 rental stations with 600 bikes available to consumers in five districts across the city. Consumers willing to rent a bike from the platform need to pay VND 5,000 (USD 0.21) per 30 minutes of use, and for trips that extend 7.5 hours of the journey in a day, the price is charged at VND 50,000 per day (USD 1.96).

The market is anticipated to witness the integration of electric bikes deployed as sharing services, complementing the government's efforts to raise awareness of sustainable transportation mediums and lessen traffic congestion on roads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Shifting Consumer Preference toward Eco-friendly Medium of Transportation

- 4.2 Market Restraints

- 4.2.1 Growing Incidents of Bike Damage and Theft

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Bike Type

- 5.1.1 Traditional/Conventional Bikes

- 5.1.2 E-bikes

- 5.2 By Sharing System

- 5.2.1 Docked/Station-based

- 5.2.2 Dock Less

- 5.2.3 Hybrid

- 5.3 By Sharing Duration

- 5.3.1 Short Term

- 5.3.2 Long Term

- 5.4 By Application

- 5.4.1 Regular Commutes and Recreation

- 5.4.2 Tourism

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 TriNam Group JSC

- 6.2.2 Meituan (Mobike)

- 6.2.3 Lemonc Vietnam Company Limited (MBI Sharing)

- 6.2.4 TUMI

- 6.2.5 Hue Smart Bike

- 6.2.6 Hyosung Group

- 6.2.7 G-Bike (GCOO)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Government Investments to Improve the Cycling Infrastructure to Fuel the Market Demand