PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521800

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521800

Vietnam Business Jets And Helicopters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

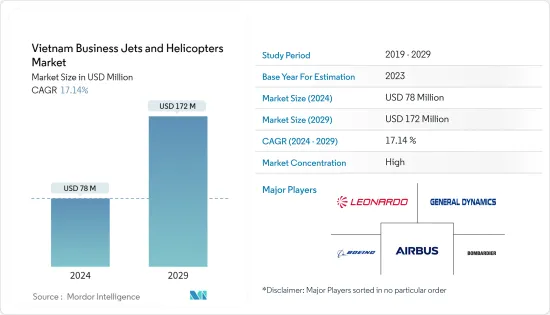

The Vietnam Business Jets And Helicopters Market size is estimated at USD 78 million in 2024, and is expected to reach USD 172 million by 2029, growing at a CAGR of 17.14% during the forecast period (2024-2029).

The Vietnamese business jets and helicopters market is expected to be resilient through the coming decade due to the surge in demand for air travel services and the reduced cost of chartering private jets. The market studied has been witnessing growth in recent years. Southeast Asian countries became some of the major tourist hotspots globally before COVID-19. With the market recovering from the pandemic, new charter and private travel operators are entering the market, and many charter operators are introducing new charter routes in Vietnam. This factor is generating demand for fuel-efficient business jets during the forecast period.

On the other hand, the strict regulations on licenses, permits, and operating standards for business jets and helicopters challenge market growth. Similarly, Vietnam faces challenges related to airport infrastructure, particularly airport capacity, heliports, runway availability, and MRO facilities. For air charter services, congestion at major airports can lead to take-off and landing slot delays. Such factors hinder the market growth.

Vietnam Business Jets And Helicopters Market Trends

Increasing Number of UHNWIs Driving the Demand for Business Jets

Individuals with liquid financial assets over USD 1 million are termed HNWIs, and those with a net worth of at least USD 30 million are termed UHNWIs. The market's growth is driven by the increasing demand for advanced business aircraft among millionaires and a thriving aviation sector. Vietnam's economy has rapidly risen, translating into higher incomes. As the World Bank notes, there was a 170% increase in the ultra-wealthy population, which is expected to reach 540 individuals by the next decade. It has one of the highest growth rates globally. As Vietnam becomes the focal point for international businesses, private jets are critical in facilitating smooth and efficient travel. For instance, Tan Son Nhat Airport has a private and exclusive terminal to cater to the increased demand for global business leaders.

In 2023, Vietnam was expected to lead the world's fastest-recovering domestic aviation sector and be the fifth fastest-growing aviation market. According to the International Air Transport Association, the number of air passengers is expected to reach 150 million by 2035. Thus, the increasing number of HNWIs and the developing economy have been the main drivers for purchasing business jets across the country.

The Business Jets Segment is Expected to Dominate the Market During the Forecast Period

The light business jet segment in Vietnam is an emerging sector with significant potential for growth. The demand for these jets is primarily driven by the country's economic expansion, increasing wealth, and the growing need for quick and efficient travel among the business community. Light business jets are favored for their cost-effectiveness, smaller size, and ability to operate in airports with shorter runways, which are common in Vietnam. In Vietnam, the demand for light business jets is driven by HNWIs and corporate executives who procure or rent them for travel. These jets are typically utilized for their convenience, flexibility, and efficiency, offering a premium travel experience that aligns with the needs of time-sensitive travelers.

Furthermore, large jets are also in high demand due to the high demand for corporate travel, tourism, and personal and leisure travel. This segment includes heavy jets, ultra-long-range, and executive liners/big liners with large cabins that accommodate ten or more passengers. These jets have a flying capacity of up to nine hours nonstop and a range of above 6,000 miles. Thus, increasing demand for business jets for business travel and rising spending on luxury travel are expected to drive the growth of the segment during the forecast period.

Vietnam Business Jets And Helicopters Industry Overview

The Vietnamese business jets and helicopters market is consolidated due to a few players holding significant shares. Some of the key players in the market are The Boeing Company, Airbus SE, General Dynamics Corporation, Leonardo SpA, and Bombardier Inc.

Key OEMs are highly investing in designing and developing luxurious business jets and focusing on business expansion through contracts and partnerships with business jet and helicopter operators. For instance, in March 2024, Airbus announced that it had selected Vietnam as its new civil helicopter market. It plans to focus on technology transfer, pilot training, and maintenance for new helicopter generations. With this expansion, the supply chain in Vietnam will also contribute to the country's economic development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Aircraft Type

- 5.1.1 Business Jets

- 5.1.2 Helicopters

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 General Dynamics Corporation

- 6.2.2 Bombardier Inc.

- 6.2.3 Textron Inc.

- 6.2.4 Embraer SA

- 6.2.5 Dassault Aviation

- 6.2.6 The Boeing Company

- 6.2.7 Airbus SE

- 6.2.8 Honda Aircraft Company

- 6.2.9 Pilatus Aircraft Ltd

- 6.2.10 Cirrus Design Corporation

- 6.2.11 Leonardo SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS