PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521797

Europe Medical Gloves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

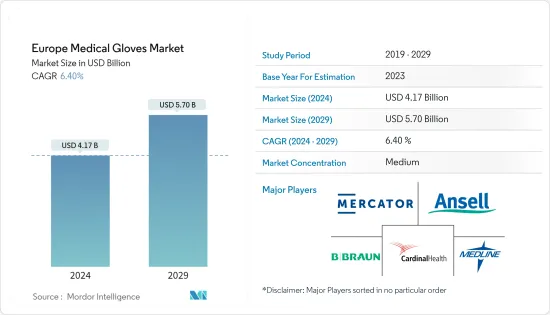

The Europe Medical Gloves Market size is estimated at USD 4.17 billion in 2024, and is expected to reach USD 5.70 billion by 2029, growing at a CAGR of 6.40% during the forecast period (2024-2029).

The major factors driving the market growth in Europe are the rising number of hospital visits and surgeries and the increasing incidence of infections. For instance, according to the report published by Eurostat in July 2022, the two most common surgical operations and procedures performed in European hospitals were cataract surgery and cesarean sections. Similarly, as per the data reported by the Organisation for Economic Co-operation and Development (OECD) in April 2024, in Ireland, 24,826 cesarean sections and 30,055 cataract surgeries were conducted in 2022. This shows the significant number of surgical cases that raise the demand for medical gloves to avoid infections during surgical procedures, which likely boosts the market growth in the region.

Moreover, various infections increase the usage of medical gloves in the region. For instance, according to data provided by the European Centre for Disease Prevention and Control in April 2024, 359 cases of diphtheria due to toxigenic Corynebacterium diphtheriae, 2,623 cases of pertussis, and 2,593 mumps cases were reported in EU/EEA countries in 2022. Hence, medical gloves can be used to reduce the spread of these infections, which is expected to boost the market growth in the region.

Furthermore, market players' new product launches are expected to propel regional market growth. For instance, in May 2022, Unigloves, a company registered in England, launched a new nitrile disposable glove, BioTouch, combining chemical resistance, comfort, and grip with environmentally friendly, biodegradable technology. It is manufactured to medical-grade standards. These new launches are expected to increase the widespread distribution of medical gloves in Europe, which is likely to boost the market's growth during the study period.

However, the presence of counterfeit and sub-standard gloves in the market and the potential risk of contamination due to inappropriate disposal of gloves are the major factors anticipated to hinder the market's growth between 2024 and 2029.

Europe Medical Gloves Market Trends

The Surgery Segment is Expected to Have Significant Growth in the Market Between 2024 and 2029

The medical gloves used during surgical procedures are called surgical gloves. The primary purpose of surgical gloves is to act as a protective barrier to prevent the possible transmission of diseases between healthcare professionals and patients during surgical procedures.

Due to the growing number of surgeries in Europe and the mandatory use of gloves during surgeries, the use of gloves is expected to increase significantly in the segment. For instance, according to the British Association of Aesthetic Plastic Surgeons (BAAPS) report published in March 2023, 31,057 cosmetic procedures took place in 2022 in the United Kingdom, up by 102% from the previous year. The five most popular procedures were breast augmentation, breast reduction, abdominoplasty, liposuction, and eyelid surgery. The number of procedures men and women undergo has increased in the United Kingdom. This shows that the increasing number of surgeries is expected to raise the demand for surgical gloves, thereby propelling the segment's growth over the study period.

For instance, according to a study by researchers at the University of Birmingham published in November 2022, routinely changing surgical gloves and equipment just before closing wounds can significantly reduce the chances of the most common postoperative infections. This increases the usage of surgical gloves, which is anticipated to boost the segment's growth between 2024 and 2029.

Germany is Expected to Hold a Significant Share in the Market Between 2024 and 2029

Germany is expected to have a significant share in the market between 2024 and 2029 owing to the increased usage of medical gloves due to the risk of infections in hospitals and the number of surgical and non-surgical procedures like injections and intubations in the country. In addition, the market players' strategies, like agreements and new factory establishments, increase the availability of gloves in the market, which is likely to boost the market growth from 2024 to 2029.

The usage of medical gloves in the country is increasing. For instance, according to the report published by University Hospital Leipzig (UKL) in May 2023, the university hospital's examination gloves consumption was 97,000 packs in 2022. From a hospital hygiene perspective, 94,000 packs yearly are considered too high. This shows the higher usage of medical gloves in the country, which is expected to cause significant growth in the market over the study period.

Furthermore, according to the data published by the Association of German Aesthetic-Plastic Surgeons in May 2023, aesthetic plastic surgery recorded an increase in all aesthetic procedures of around 5% in 2023 in Germany. This shows the significant increase in the percentage of surgeries that need surgical gloves, which likely boosts the country's market growth over the study period.

Europe Medical Gloves Industry Overview

The European medical gloves market is highly competitive due to the presence of a large number of local players. Factors contributing to the competition include rising initiatives from key market players, such as launches, exhibitions, and expansions. Some of the key players in the market are Ansell Ltd, Cardinal Health, Mercator Medical SA, Medline Industries LP, and B. Braun SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Number of Hospital Visits and Surgeries

- 4.2.2 Increasing Incidence of Infections

- 4.3 Market Restraints

- 4.3.1 Presence of Counterfeit and Sub-standard Gloves in the Market

- 4.3.2 Potential Risk of Contamination Due to Inappropriate Disposal of Gloves

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Powdered

- 5.1.2 Non-Powdered

- 5.2 By Material

- 5.2.1 Natural Rubber Gloves

- 5.2.2 Nitrile Gloves

- 5.2.3 Vinyl Gloves

- 5.2.4 Other Materials

- 5.3 By Application

- 5.3.1 Medical Examination

- 5.3.2 Surgery

- 5.3.3 Chemotherapy

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cardinal Health

- 6.1.2 Mercator Medical SA

- 6.1.3 B. Braun SE

- 6.1.4 Medline Industries LP

- 6.1.5 HuskMedical

- 6.1.6 SHIELD Scientific

- 6.1.7 Global Gloves SRL

- 6.1.8 Dispotech SRL

- 6.1.9 Unigloves (UK) Limited

- 6.1.10 ANSELL LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS