PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521792

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521792

Commercial HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

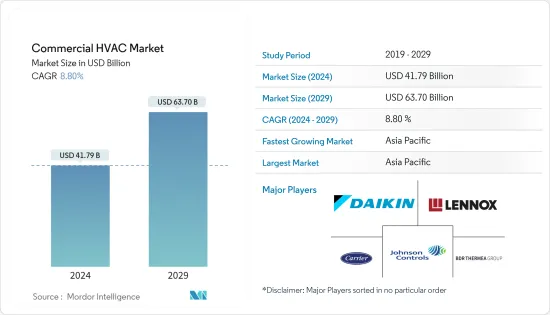

The Commercial HVAC Market size is estimated at USD 41.79 billion in 2024, and is expected to reach USD 63.70 billion by 2029, growing at a CAGR of 8.80% during the forecast period (2024-2029).

Key Highlights

- Any commercial building, including offices, restaurants, hotels, hospitals, and schools, needs heating and cooling systems to give its occupants a comfortable space. These systems are widely used in offices to maintain the right temperature and ventilation, which enhances worker productivity and working conditions while preventing health problems brought on by incorrect humidity levels.

- The increasing government initiatives and investments in the adoption of energy-efficient equipment will drive market growth. For instance, in February 2024, the Indian government's announcement to allocate INR 11.11 lakh crore for infrastructure in the 2024-25 budget created a conducive environment for the HVAC sector's growth. This investment, coupled with the government's focus on self-reliance through initiatives like Atmanirbhar Bharat, is expected to further fuel the industry's expansion.

- In an effort to meet climate change targets, the European Union declared that nations would have to renovate energy-guzzling buildings at a faster pace and adhere to stricter energy-saving targets. The draft proposal would require states to renovate three state-owned and occupied buildings each year to convert them into "near-zero energy buildings." This includes hospitals, government buildings, schools, and social housing, and it will amount to more than 700,000 renovated buildings per year.

- The increase in the construction of offices, rising temperature conditions, and rising adoption of IoT and green technologies are some of the driving factors contributing to the overall growth of the commercial HVAC market. In addition, according to the Office for National Statistics (United Kingdom), in the first quarter of 2023, the gross value added (GVA) of the construction industry in the United Kingdom was over GBP 4 billion higher than in the same period of the previous year.

- The market is witnessing a growing trend toward smart HVAC systems due to increased energy consumption and the need for higher system efficiency. Increasingly, buyers are looking for smart solutions with IoT integration, real-time monitoring, and improved controls. These intelligent systems maximize energy efficiency, improve comfort, and offer more control over interior spaces.

- The increasing energy prices worldwide make energy-efficient HVAC systems attractive for cost savings. Despite the potential benefits, the initial expenses of installing these systems could limit their widespread use and hinder market expansion.

- The commercial HVAC market is highly affected by factors such as government regulations and new initiatives by the governments of various regions to boost the adoption of energy-efficient equipment. For instance, over the past decade, several types of EU legislation have been introduced to minimize energy consumption, stimulate renewable energy use, and reduce CO2 equivalent emissions to decrease the impact of global warming.

Commercial HVAC Market Trends

Air Conditioning /Ventilation Equipment Witnessed Increasing Demand

- The market for air conditioning equipment in the commercial sector is expanding significantly due to factors such as increasing urbanization, infrastructure development, and the growing emphasis on comfort in business environments.

- There are several reasons why air conditioning systems are becoming more and more common in commercial buildings. Air conditioners are essential for preserving a comfortable atmosphere in contemporary commercial buildings. By moving air through water-cooled or refrigerant systems, these units efficiently reduce the temperature while also removing too much moisture from the air.

- Commercial air conditioning systems tend to be larger in size than domestic ones, and they are more complex. These systems are made up of a number of fundamental components that work together to ensure the highest comfort, air quality, and energy efficiency in business settings. This is because properly designed, maintained, and installed air conditioning systems create favorable environments for employees, customers, and operations while also facilitating the efficient utilization and recycling of energy. By regulating temperature levels effectively, air conditioning aids in sustaining productivity levels regardless of the external heat.

- Furthermore, the business landscape is changing due to factors like growing awareness of indoor air quality, sustainability regulations, and the integration of IoT (Internet of Things) and building automation systems. These changes present opportunities for innovation and market expansion.

- Moreover, several companies are constantly investing in introducing various products catering to the demand for these air conditioning systems in the commercial segment. For instance, in April 2024, Haier announced the launch of its latest range of "super heavy-duty" air conditioners. The new range comes with the company's Hexa Inverter and Supersonic cooling technologies.

- Further, in May 2024, Carrier Midea India Pvt. Ltd announced the opening of India's first Midea Cooling Solutions ProShop in Gurugram. This innovative experiential concept is designed to transform the customer buying experience for air-conditioning products. A wide variety of cutting-edge air conditioning solutions are available for exploration at the Midea ProShop; the company offers a comprehensive selection of Midea HVAC solutions for commercial and residential applications. This covers a full range of VRF (Variable Refrigerant Flow) systems to meet the air-conditioning needs of residential, small businesses, offices, large commercial buildings, and project applications. It also includes a variety of split air conditioners, ducted units, cassette units, and tower units.

- Voltas, an Indian manufacturer, reported sales of over 2 million air conditioners in FY 2023-24, the largest-ever annual sales of ACs in India, according to the company. The company's robust offline and online distribution network, creative new launches, and a steady demand for cooling products were all factors leading to an annual volume growth of 35%, which was accelerated by a 72% growth in Q4.

Asia-Pacific is Expected to Witness Significant Growth

- The expansion of offices, malls, hotels, data centers, hospitals, and retail outlets in India and China is a major driver for the region's commercial HVAC market. In Asia-Pacific, the hospitality sector is a significant user of HVAC equipment and services.

- The hotel industry has more needs and considerations compared to virtually any other sector when it comes to HVAC systems. A comprehensive approach is needed to meet the complex needs of commercial hotels for heating and ventilation, from guest comfort and reliability to overall efficiency and energy savings. Thus, the rising hospitality sector in the region is expected to drive the market's growth.

- In January 2024, Indian Hotels Company (IHCL) announced the completion of nine pilot projects in collaboration with IFC's TechEmerge Sustainable Cooling Innovation Program within a span of 18 months. This highlights the firm's unwavering commitment to fostering environmentally responsible practices in order to provide efficient, climate-friendly, and cost-effective cooling solutions for India's hospitality industry.

- Many commercial buildings in the region are also pursuing green certifications like LEED, which mandate the installation of energy-efficient HVAC systems. According to the report published by the International Energy Agency, China is the global leader in new heat pump sales. According to the IEA report, China has a large number of new heat pump installations. Furthermore, China boasts the largest workforce dedicated to installing HVAC systems like heat pumps and holds the largest market share in heat pump manufacturing, accounting for 45%.

- Several players in the market are also supporting the growth of HVAC in the region. For instance, in November 2023, Carrier Corporation announced that it had hosted more than 300 commercial HVAC dealers from across China during its annual conference in the designated National Famous Historical and Cultural City of Changsha. Through this event, the company will provide dealers the opportunity to learn more about its innovative solutions, the company's plan to help customers become carbon neutral, and how it is investing in disruptive technologies to accelerate next-generation sustainable solutions. The event focused on how the HVAC industry can help China achieve its dual carbon strategy with intelligent and green building solutions.

- Furthermore, the growing number of data centers, malls, schools, and universities, among others, in developing countries is driving the demand in the HVAC market. Asia-Pacific is witnessing several investments in the construction of advanced data centers. For instance, in April 2024, ST Telemedia Global Data Centres (STT GDC) announced the groundbreaking for its second data center facility in Tokyo, STT Tokyo 2, to support the demand for critical digital infrastructure in the country. The data center campus will provide up to 70 MW of IT capacity, while the STT Tokyo 2 project is estimated to generate up to 38 MW once it is completed.

Commercial HVAC Industry Overview

The commercial HVAC market is fragmented, favorably competitive, and has several prominent players. The market players are focusing on expanding their consumer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. These enterprises leverage strategic collaborative initiatives to boost their market share and profitability. Companies such as Carrier Corporation, Daikin Industries Ltd, BDR Thermea Group, Lennox International Inc., and Johnson Controls International PLC are significant players in the market.

- May 2024: Lennox International announced the launch of a new HVAC line that reduces global warming potential 'by up to 78%'. The new Lennox heating, ventilation, and air conditioning products will offer a comprehensive range of products and will use the environmentally responsible refrigerant R454B, which reduces global warming potential by as much as 78%.

- March 2024: Panasonic Corporation announced the release of three new models of commercial air-to-water (A2W) heat pumps using environmentally friendly natural refrigerants for multi-dwelling units, stores, offices, and other light commercial properties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Commercial Construction in Major Emerging Economies

- 5.1.2 Increasing Demand For Energy Efficient Devices

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy-efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 HVAC Equipment

- 6.1.1.1 Heating Equipment

- 6.1.1.2 Air Conditioning /Ventillation Equipment

- 6.1.2 HVAC Services

- 6.1.1 HVAC Equipment

- 6.2 By End-user Industry

- 6.2.1 Hospitality

- 6.2.2 Commercial Buildings

- 6.2.3 Public Buildings

- 6.2.4 Other End-user Industries

- 6.3 By Geography ***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Australia

- 6.3.5 New Zealand

- 6.3.6 Latin America

- 6.3.7 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.2 Johnson Controls International PLC

- 7.3 Midea Group Co. Ltd

- 7.4 Daikin Industries Ltd

- 7.5 Robert Bosch GmbH

- 7.6 Carrier Corporation

- 7.7 LG Electronics Inc.

- 7.8 Lennox International Inc.

- 7.9 BDR Thermea Group

- 7.10 Panasonic Corporation

- 7.11 Danfoss A/S

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET