PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521766

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521766

Japan Semiconductor Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

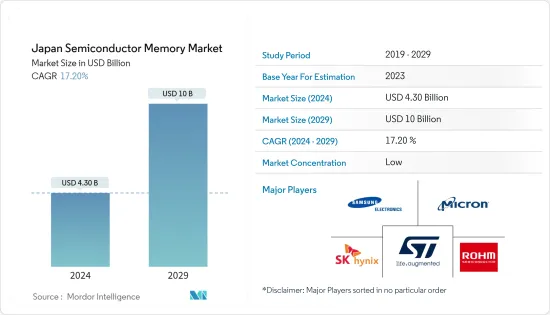

The Japan Semiconductor Memory Market size is estimated at USD 4.30 billion in 2024, and is expected to reach USD 10 billion by 2029, growing at a CAGR of 17.20% during the forecast period (2024-2029).

* Smartphones, tablets, and other consumer electronics are among the largest consumers of semiconductor memory. As these devices become more powerful and feature-rich, they require more memory to function properly. The increasing demand for these devices drives the demand for semiconductor memory in Japan.

* Some of the automotive ADAS manufacturers have already been using memory devices. For Example, Bosch uses the automotive-grade Serial NOR Flash memories from Cypress Semiconductor Corporation, which Infenion now acquires to manufacture its video-based Advanced Driver Assistance Systems (ADAS). The usage is expected to boost the storage of system boot code and algorithms at temperatures up to +125°C.

* As Japan is prone to natural disasters, companies in the region use data centers to secure their business continuity. Japan has not produced a cloud giant, so Chinese and American companies are rushing to sell cloud services to businesses in the world's third-largest economy. The global data center players are building homes for all those cloud servers in Japan's emerging markets. Such factors are expected to significantly boost the country's adoption of semiconductor memory.

* Moreover, researchers from organizations and regional universities are trying to develop high-speed next-generation memory to cater to the increasing applications of AI and IoT devices and their growing amount of data. For instance, in May 2023, Micron Technology announced it would invest up to JPY 500 billion (USD 3.6 billion) in Japan for the next few years, with support from the Japanese government, for next-generation memory chips.

* The pandemic highlighted the importance of having a secure supply of semiconductors. This has led to increased investment in semiconductor manufacturing capacity worldwide, including in Japan. The pandemic also increased the focus on supply chain resilience. Semiconductor manufacturers are now looking to diversify their supply chains and reduce their reliance on a single source of materials or components.

Japan Semiconductor Memory Market Trends

NAND Flash Memory is Expected to Have a Significant Growth

* NAND solution continues to be used over the forecast period, driven by smartphones, targeting emNAND flash memories that are known for their uncomplicated structure, high capacity, and low cost. Their typical features are sequential reading, architecture, and high density. NAND flash memories are becoming more popular due to their usage as Solid-State Drives (SSDs) and USB flash drives, which are called flash storage devices.

* With the rise in demand for PCs and smartphones owing to work from home, NAND flash consumption has dramatically increased, much of which is attributed to the growth of the average capacity of smartphones. This is expected to drive the demand for NAND flash, thus influencing the demand for memory packaging.

* Within smartphones, the use of NAND flash for improved data storage has grown in areas such as multi-chip packages (MCP) and package-on-package (POP), high-density embedded storage, and MCPs/POPs and card slots in handsets.

* Moreover, NAND Flash memory is widely used in the automotive segment to store the software and data that power in-vehicle infotainment systems, such as navigation maps, music, and video files. Additionally, these memories are used to store the software and data that powers ADAS features, such as lane departure warning, collision avoidance, and adaptive cruise control.

* As such, the increasing vehicle sales are also positively impacting the market growth. For instance, according to JAMA, new passenger car registrations in Japan increased from 3.45 million in 2022 to 3.99 million in 2023. The increasing sales of passenger cars and the rising demand for advanced vehicles are expected to drive the market demand in the coming years.

Smartphone/Tablet Segment Is Expected to Register a Significant Growth

* Memory storage has become an essential component in smartphones. The demand has been growing exponentially, primarily driven by the average capacity of smartphones. NAND flash memory in smartphones can significantly enhance the performance of web browsing, email loading, games, and even social network sites, such as Facebook. With the increasing adoption of smartphones, companies are adding extra features and applications to differentiate their products from other manufacturers. For instance, manufacturers are integrating gesture control, fingerprint scanners, and GPS features. This boosts the demand for flash memory, which is used as smartphone code storage media.

* Further, major smartphone vendors are launching their flagship models every year, and the memory capacity keeps increasing with each launch. By improving the scaling limits year after year, smartphone manufacturers sell smartphones at a premium by upgrading the memory capacity to boost performance.

* Additionally, the number of photos and videos users take daily through their smartphone cameras is increasing. The size of smartphone photos has grown exponentially as the number of pixels has increased. The growth in high-capacity smartphone applications, including mobile games, is another reason driving higher storage capacity. This trend would continue with the launch of 5G as high-capacity storage is essential to support high-speed communication, AR/VR, AI technology, and high-definition/4K content.

* According to Sk Hynix, the demand for high-capacity storage devices is booming due to the launch of new high-spec products by major smartphone manufacturers, such as Apple, Huawei, and Xiaomi. Hence, SK Hynix introduced the world's first '128-layer 4D NAND Flash' and put it into mass production before the pandemic arrived.

* With 5G wireless communication rapidly increasing, smartphones are expected to increase multifold, increasing the need for the latest models to raise the bar continuously. According to the Japan Electronics and Information Technology Industries Association (JEITA), the monthly domestic shipment volume of smartphones in Japan amounted to about 490 thousand units in December 2023, increasing from 330 thousand units in the previous month.

Japan Semiconductor Memory Industry Overview

The Japan semiconductor memory market is characterized by a high degree of fragmentation, featuring key players like Samsung Electronics Co. Ltd, Micron Technology Inc., SK Hynix Inc., and STMicroelectronics NV. Market participants strategically leverage partnerships and acquisitions to bolster their product portfolios and establish a sustainable competitive edge.

- In May 2023, Samsung Electronics announced to build a development facility in Yokohama in an initiative to spur collaboration between the chip industries of Japan and South Korea. The new facility will cost over JPY 30 billion (USD 222 million), and operations are expected to begin by 2025.

- In May 2023, SK Hynix Inc. announced that it had started the mass production of its 238-layer 4D NAND Flash memory. SK Hynix has developed solution products for smartphones and client SSDs, which are used as PC storage devices, adopting the 238-layer NAND technology, and has moved into mass production now. The 238-layer product - the smallest NAND in size - has a 34% higher manufacturing efficiency than the previous generation of 176-layer, significantly improving cost competitiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of 5G and IoT Devices

- 5.1.2 Growing Memory Requirement in Data Centers

- 5.1.3 Rising Demand from Consumer Electronics and Automotive Sectors

- 5.2 Market Restraints

- 5.2.1 Short term supply chain challenges due to the pandemic scenario and the US-China Trade war scenario

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 DRAM

- 6.1.2 SRAM

- 6.1.3 NOR Flash

- 6.1.4 NAND Flash

- 6.1.5 ROM & EPROM

- 6.1.6 Others

- 6.2 Application

- 6.2.1 Consumer Products

- 6.2.2 PC/Laptop

- 6.2.3 Smartphone/Tablet

- 6.2.4 Data Center

- 6.2.5 Automotive

- 6.2.6 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 SK Hynix Inc.

- 7.1.4 ROHM Co. Ltd.

- 7.1.5 STMicroelectronics NV

- 7.1.6 Maxim Integrated Products Inc.

- 7.1.7 IBM Corporation

- 7.1.8 Cypress Semiconductor Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Nvidia Corporation

- 7.1.11 Kioxia Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET