PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694035

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694035

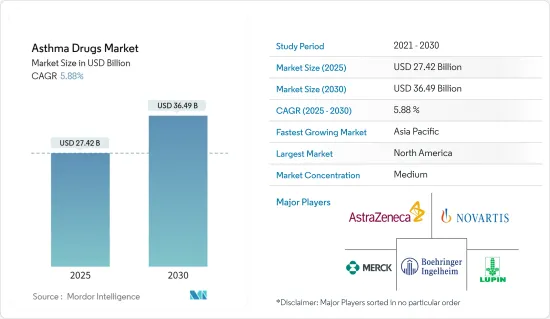

Asthma Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asthma Drugs Market size is estimated at USD 27.42 billion in 2025, and is expected to reach USD 36.49 billion by 2030, at a CAGR of 5.88% during the forecast period (2025-2030).

Factors such as an increase in the incidence and prevalence of asthma, the growing geriatric population, and technological advancements are boosting the growth of the asthma drug market.

The prevalence of asthma is increasing globally due to various reasons, such as air pollution, occupational chemicals and dust, frequent lower respiratory infections during childhood, tobacco smoking, and other environmental factors, which boost the growth of the asthma drug market. World Health Organization (WHO) included asthma in the Global Action Plan for the Prevention and Control of Noncommunicable Diseases (NCDs). As per the latest update on World Asthma Day 2023, the prevalence of asthma is increasing globally, affecting approximately 339 million people. This showed a significantly high burden of asthma globally, likely to boost the demand for asthma drugs and propel the market's growth over the forecast period.

Rising cases of smoking worldwide are increasing the risk of asthma in people. For instance, according to an article published by BMC Pulmonary Medicine in April 2022, smoking was widely recognized as a significant risk factor for various noncommunicable diseases, notably lung cancer and chronic respiratory conditions such as asthma. The harmful chemicals in tobacco smoke can cause inflammation and damage to the respiratory system, increasing the likelihood of developing asthma or exacerbating existing symptoms. Thus, the increasing number of cases of tobacco smoking is raising the demand for asthma drugs for their treatment.

The continuous evolution of technology, particularly in the development of biomarkers, is expected to create significant opportunities for the market. The inherent limitations of conventional treatments, such as delayed therapeutic effects and reduced effectiveness, drive the market toward the innovation of new targeted therapies. This shift is anticipated to fuel market growth. For instance, in January 2023, AstraZeneca's Tezspire (tezepelumab) received a positive opinion from the Committee for Medicinal Products for Human Use (CHMP) for its use in a prefilled pen for self-administration. This approval, which allows patients with severe asthma aged 12 years and older to self-administer the drug, enhances the flexibility and convenience of treatment options.

Therefore, increasing cases of asthma and technological advancements are propelling the growth of the asthma drug market. However, stringent government regulations for product approval and side effects associated with drugs are restraining the market growth.

Asthma Drugs Market Trends

The Short-acting Beta-2 Agonists Segment is Expected to Witness Significant Growth Over the Forecast Period

Short-acting beta-2 agonists are bronchodilators, rapidly relaxing airway smooth muscle cells to relieve bronchoconstriction and improve airflow. They are the first-line treatments for managing acute asthma symptoms such as wheezing, shortness of breath, chest tightness, and exercise-induced bronchoconstriction (EIB). Most used short-acting beta-2 agonists include albuterol (salbutamol) and terbutaline, primarily delivered via metered-dose inhalers (MDIs) or nebulizers.

Reliever therapy plays a critical role in effective medications in managing sudden asthma symptoms and preventing severe asthma attacks. Short-acting beta-agonists (SABAs) are a prominent choice for quick relief due to their rapid onset of action. The portability and user-friendliness of metered-dose inhalers (MDIs) make them an ideal solution for on-the-spot symptom management. This characteristic is especially attractive to patients who struggle to adhere to the regular regimen of daily inhaled corticosteroids (ICS).

According to a report published by the World Allergy Organization Journal in October 2023, the overprescription of short-acting beta-2 agonists among asthma patients suggests a considerable dependency on these medications for immediate symptom relief. This pattern is linked to unfavorable clinical outcomes, with 26.7% of patients receiving at least three canisters of short-acting beta-2 agonists over the past year, correlating with more severe asthma and frequent exacerbations.

The rising number of short-acting beta-2 agonist products used in hospitals, clinical settings, and pharmacies is expected to grow significantly during the forecast period. As more hospitals and clinics adopt these products, the segment will likely experience a considerable growth surge over the coming years. For instance, in January 2024, AstraZeneca launched AIRSUPRA (albuterol/budesonide) in the United States. AIRSUPRA received FDA approval in January 2023 for the as-needed treatment or prevention of asthma symptoms and to help prevent sudden severe breathing problems (asthma attacks) in people aged 18 years and older. Airsupra contains a short-acting beta2-agonist to help relax the smooth muscles of the airways and an inhaled corticosteroid (ICS) to help decrease lung inflammation. Airsupra was approved based on the results from two Phase III trials: MANDALA and DENALI. In MANDALA, AIRSUPRA was superior to albuterol in reducing the risk of severe asthma exacerbations in patients with moderate to severe asthma. In DENALI, AIRSUPRA had a similar onset of bronchodilation compared to albuterol in patients with mild to moderate asthma.

In May 2022, Teva Pharmaceuticals USA Inc., a US affiliate of Teva Pharmaceutical Industries Ltd, published new findings at the 2022 American Thoracic Society (ATS) 2022 Annual Meeting for short-acting beta-2 agonist use established by independent expert consensus to objective patient data from ProAir Digihaler (albuterol sulfate) Inhalation Powder. Expanded savings programs, new medication launches, FDA approvals, and published clinical findings contribute to greater accessibility and adoption of short-acting beta-2 agonists, driving the growth of this market.

The growing market for short-acting beta-2 agonists is driven by factors such as increasing asthma prevalence, over-reliance on these medications, cost-effectiveness, combination therapy trends, and recent product launches and approvals, enhancing accessibility and market adoption.

North America is Expected to Hold Significant Growth and Market Share in the Overall Asthma Drugs Market

The asthma drug market in North America is expected to grow due to the increasing prevalence of asthma and grants of asthma drugs with the increasing number of initiatives for them, such as clinical trials and product approvals. Robust healthcare infrastructure, better reimbursement policies, increased funding, and availability of advanced asthma drugs in the country are boosting the market's growth in North America.

In North America, asthma is spread disproportionately among people with low income, senior adults, and Black, Hispanic, and Alaska Native people. These groups have the highest asthma rates, deaths, and hospitalizations. For instance, as per the data published by the Asthma and Allergy Foundation of America in September 2023, more than 27 million people in the United States had asthma. This corresponded to 1 in 12 people, or more than 22 million people, in the United States. Adults aged 18 and older had asthma; about 4.5 million children under the age of 18 had asthma in 2022. Asthma rates are particularly high among Black and Indigenous American adults in the United States. Additionally, the condition is more prevalent among female adults than male adults; about 10.8% of female adults and 6.5% of male adults were diagnosed with asthma in 2023. The growing prevalence of asthma in the country is expected to drive the market during the forecast period, as the increasing number of individuals with asthma creates a higher demand for effective treatment and management solutions. The market is likely to respond to this trend with a greater focus on developing and delivering targeted asthma treatments to meet the needs of these high-risk groups.

The strategies employed by market players, such as product approvals and launches, are contributing to increased product availability, which is expected to drive the market's growth in the region. For instance, in February 2023, Pulmatrix initiated a Phase 2b trial, with the first patient dosed with PUR1900, targeting Allergic Bronchopulmonary Aspergillosis (ABPA) and asthma. This global trial was intended to evaluate the safety, tolerability, and efficacy of the drug over a 16-week period, forming part of Pulmatrix's partnership with Cipla to deliver innovative therapies for asthma patients. The proof-of-concept data from this study is anticipated by mid-2024.

In October 2022, AstraZeneca and Amgen announced the Canadian availability of Tezspire (tezepelumab injection), which was indicated as an add-on maintenance treatment for adults and adolescents aged 12 and older with severe asthma. The approval of Tezspire was based on the PATHWAY Phase IIb and NAVIGATOR Phase III trials, which showed significant improvements in primary and key secondary endpoints in patients with severe asthma, compared to a placebo, when used alongside standard therapy. Due to Tezspire's proven efficacy in treating severe asthma, the demand for asthma treatments is expected to increase, driving the market's growth over the forecast period.

Factors such as the rising burden and prevalence of asthma, manufacturers focusing on launches, clinical trials, and investments in asthma drugs are expected to boost the growth of the asthma drug market in North America during the forecast period.

Asthma Drugs Industry Overview

The asthma drugs market is moderately fragmented. Due to the growth opportunities, many new players are emerging in the asthma drug market. Forthcoming patent expiries of major drugs are expected to increase competition, further driving the market, especially in the generic sector. The market is expected to grow significantly, with several generic players controlling significant market shares in the developing regions. Some of the market players include AstraZeneca PLC, Boehringer Ingelheim GmbH, Novartis AG, Sanofi SA, and Merck & Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Incidence and Prevalence of Asthma

- 4.2.2 Technological Advancements

- 4.2.3 Growing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Stringent Government Regulations for the Product Approval

- 4.3.2 Side Effects Associated with Drugs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Drug Class

- 5.1.1 Bronchodilators

- 5.1.1.1 Short-acting Beta-2 Agonists

- 5.1.1.2 Long-acting Beta-2 Agonists

- 5.1.1.3 Anticholinergic Agents

- 5.1.2 Anti-inflammatory Drugs

- 5.1.2.1 Oral and Inhaled Corticosteroids

- 5.1.2.2 Anti-leukotrienes

- 5.1.2.3 Phosphodiesterase Type-4 Inhibitors

- 5.1.2.4 Other Anti-inflammatory Drugs

- 5.1.3 Monoclonal Antibodies

- 5.1.4 Combination Drugs

- 5.1.1 Bronchodilators

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AstraZeneca

- 6.1.2 Boehringer Ingelheim International GmbH

- 6.1.3 Lupin Ltd

- 6.1.4 Covis Pharma GmbH

- 6.1.5 GSK Plc

- 6.1.6 Merck & Co. Inc.

- 6.1.7 Viatris Inc. (Mylan NV)

- 6.1.8 Novartis AG

- 6.1.9 Pfizer Inc.

- 6.1.10 Sanofi

- 6.1.11 Sumitomo Dainippon Pharma Co. Ltd

- 6.1.12 Teva Pharmaceutical Industries Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS